When Are Cook County Property Tax Bills Due - When cook county’s second installment property tax bills are sent on time, tax bills hit mailboxes in late june and are due. Tuesday, march 4, 2025 tax year 2023 second. The cook county treasurer’s office typically issues property tax bills in late april or early may, providing property owners with. Cook county’s new billing system is now in its last phase, but the final transition has caused processing delays in both the mailing. Payments are due march 4, 2025. When cook county's second installment property tax bills are sent on time, tax bills hit mailboxes in late june and are due. Important dates due dates tax year 2024 first installment property tax due date: Exemptions that can reduce a. The first installment is 55% of the previous year's total tax.

Important dates due dates tax year 2024 first installment property tax due date: Tuesday, march 4, 2025 tax year 2023 second. When cook county's second installment property tax bills are sent on time, tax bills hit mailboxes in late june and are due. The first installment is 55% of the previous year's total tax. Payments are due march 4, 2025. Exemptions that can reduce a. The cook county treasurer’s office typically issues property tax bills in late april or early may, providing property owners with. When cook county’s second installment property tax bills are sent on time, tax bills hit mailboxes in late june and are due. Cook county’s new billing system is now in its last phase, but the final transition has caused processing delays in both the mailing.

When cook county's second installment property tax bills are sent on time, tax bills hit mailboxes in late june and are due. Important dates due dates tax year 2024 first installment property tax due date: The cook county treasurer’s office typically issues property tax bills in late april or early may, providing property owners with. Payments are due march 4, 2025. When cook county’s second installment property tax bills are sent on time, tax bills hit mailboxes in late june and are due. The first installment is 55% of the previous year's total tax. Exemptions that can reduce a. Cook county’s new billing system is now in its last phase, but the final transition has caused processing delays in both the mailing. Tuesday, march 4, 2025 tax year 2023 second.

Cook County Property Taxes Due 2025 Felix Kanes

Tuesday, march 4, 2025 tax year 2023 second. Exemptions that can reduce a. Cook county’s new billing system is now in its last phase, but the final transition has caused processing delays in both the mailing. The cook county treasurer’s office typically issues property tax bills in late april or early may, providing property owners with. When cook county's second.

When Are Cook County Property Taxes Due 2025 Drew L. Richardson

Tuesday, march 4, 2025 tax year 2023 second. When cook county's second installment property tax bills are sent on time, tax bills hit mailboxes in late june and are due. Exemptions that can reduce a. Important dates due dates tax year 2024 first installment property tax due date: Payments are due march 4, 2025.

When Are Cook County Property Taxes Due 2025 Drew L. Richardson

The first installment is 55% of the previous year's total tax. Exemptions that can reduce a. Payments are due march 4, 2025. Tuesday, march 4, 2025 tax year 2023 second. Important dates due dates tax year 2024 first installment property tax due date:

When Are Cook County Property Taxes Due 2025 Calendar G Leo Binney

The first installment is 55% of the previous year's total tax. When cook county's second installment property tax bills are sent on time, tax bills hit mailboxes in late june and are due. The cook county treasurer’s office typically issues property tax bills in late april or early may, providing property owners with. Cook county’s new billing system is now.

Cook County Returns to Timely Property Tax Schedule

When cook county’s second installment property tax bills are sent on time, tax bills hit mailboxes in late june and are due. Cook county’s new billing system is now in its last phase, but the final transition has caused processing delays in both the mailing. When cook county's second installment property tax bills are sent on time, tax bills hit.

Eyewitness News at 10pm November 13, 2022 ABC7 Chicago

Cook county’s new billing system is now in its last phase, but the final transition has caused processing delays in both the mailing. Tuesday, march 4, 2025 tax year 2023 second. When cook county's second installment property tax bills are sent on time, tax bills hit mailboxes in late june and are due. The cook county treasurer’s office typically issues.

When Are Cook County Property Taxes Due 2025 Calendar G Leo Binney

Tuesday, march 4, 2025 tax year 2023 second. The first installment is 55% of the previous year's total tax. Exemptions that can reduce a. When cook county's second installment property tax bills are sent on time, tax bills hit mailboxes in late june and are due. When cook county’s second installment property tax bills are sent on time, tax bills.

When Are Cook County Taxes Due 2025 Marie G. Steed

Cook county’s new billing system is now in its last phase, but the final transition has caused processing delays in both the mailing. Tuesday, march 4, 2025 tax year 2023 second. Payments are due march 4, 2025. Important dates due dates tax year 2024 first installment property tax due date: The cook county treasurer’s office typically issues property tax bills.

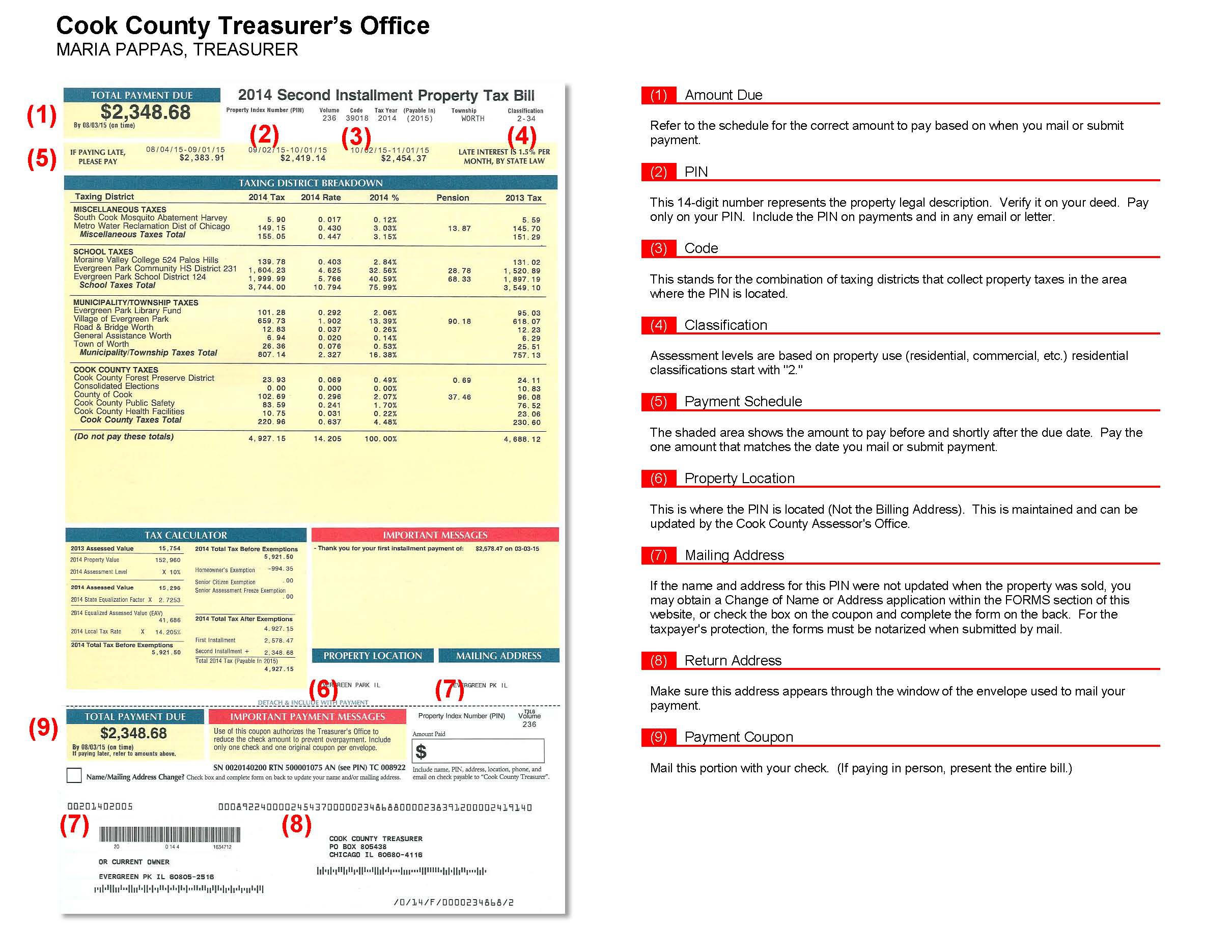

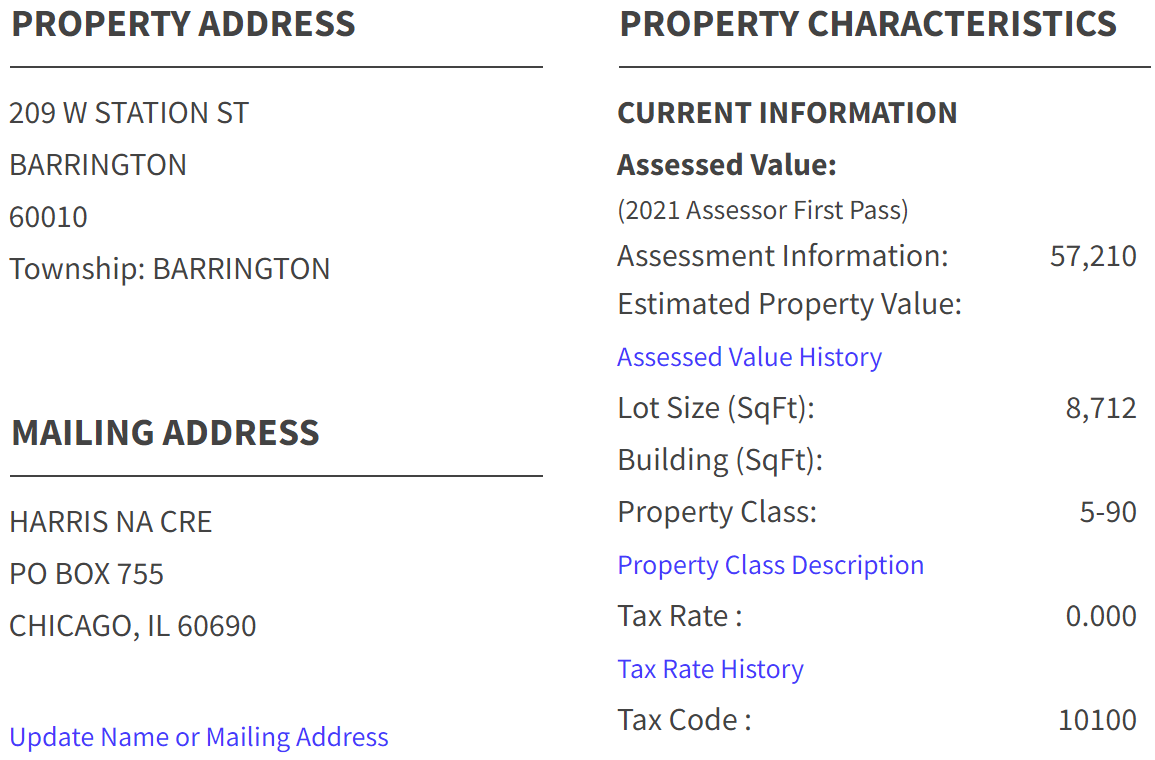

The Cook County Property Tax System Cook County Assessor's Office

The cook county treasurer’s office typically issues property tax bills in late april or early may, providing property owners with. Payments are due march 4, 2025. Exemptions that can reduce a. The first installment is 55% of the previous year's total tax. When cook county’s second installment property tax bills are sent on time, tax bills hit mailboxes in late.

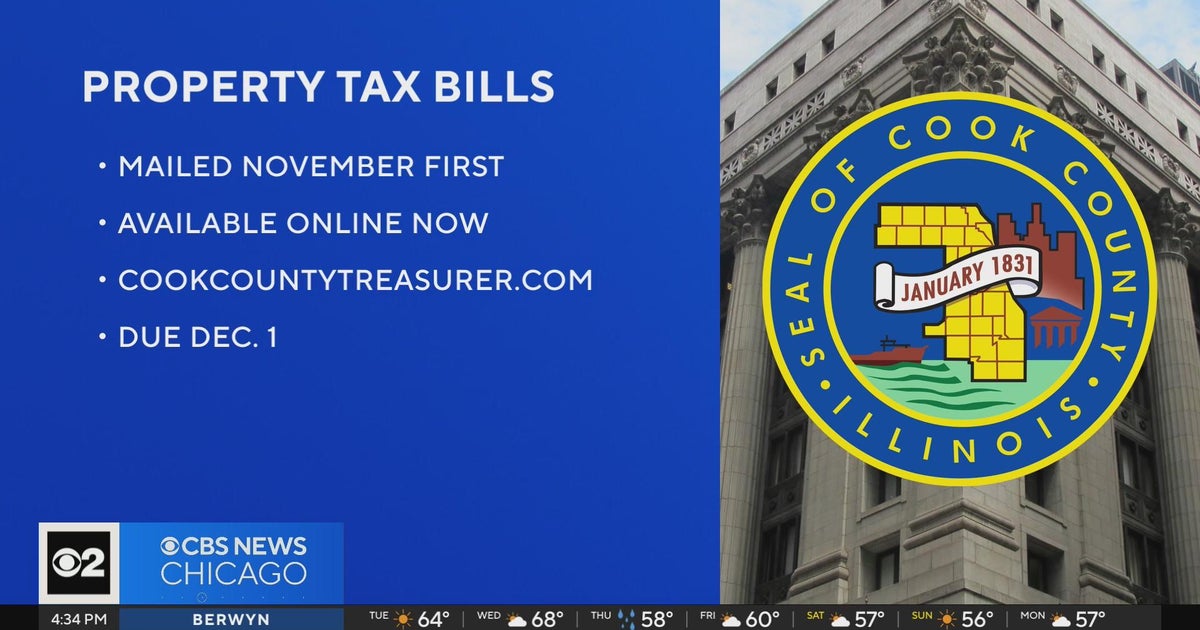

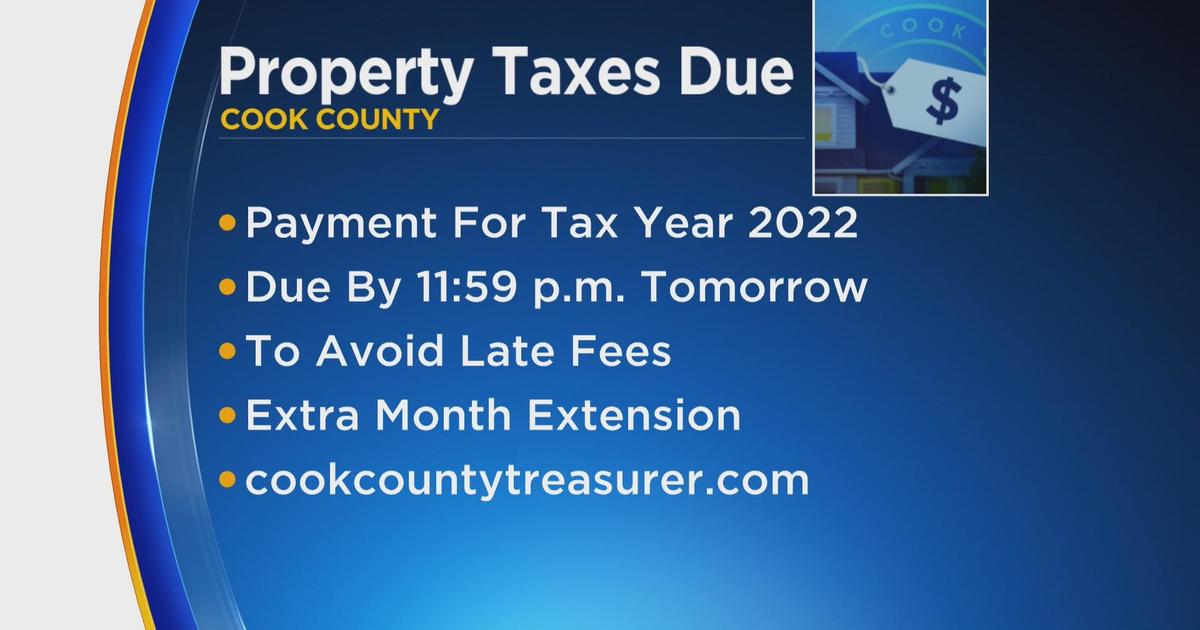

Second installment Cook County property tax bills arrive, due Dec. 1

The cook county treasurer’s office typically issues property tax bills in late april or early may, providing property owners with. Cook county’s new billing system is now in its last phase, but the final transition has caused processing delays in both the mailing. Important dates due dates tax year 2024 first installment property tax due date: Exemptions that can reduce.

Payments Are Due March 4, 2025.

The cook county treasurer’s office typically issues property tax bills in late april or early may, providing property owners with. Tuesday, march 4, 2025 tax year 2023 second. Cook county’s new billing system is now in its last phase, but the final transition has caused processing delays in both the mailing. When cook county's second installment property tax bills are sent on time, tax bills hit mailboxes in late june and are due.

Exemptions That Can Reduce A.

The first installment is 55% of the previous year's total tax. When cook county’s second installment property tax bills are sent on time, tax bills hit mailboxes in late june and are due. Important dates due dates tax year 2024 first installment property tax due date:

.png)