What Type Of Business Expense Is Software - While your expenses are definitely becoming increasingly common, the irs doesn't have a special category listed on schedule c. Software can be a capital expense if it's expected to be used in the business for more than one year and its cost exceeds a certain. The ability to deduct software as a business expense can significantly impact a company’s financial health and tax liability.

While your expenses are definitely becoming increasingly common, the irs doesn't have a special category listed on schedule c. Software can be a capital expense if it's expected to be used in the business for more than one year and its cost exceeds a certain. The ability to deduct software as a business expense can significantly impact a company’s financial health and tax liability.

While your expenses are definitely becoming increasingly common, the irs doesn't have a special category listed on schedule c. The ability to deduct software as a business expense can significantly impact a company’s financial health and tax liability. Software can be a capital expense if it's expected to be used in the business for more than one year and its cost exceeds a certain.

5 Different Types of Accounts in Accounting

The ability to deduct software as a business expense can significantly impact a company’s financial health and tax liability. While your expenses are definitely becoming increasingly common, the irs doesn't have a special category listed on schedule c. Software can be a capital expense if it's expected to be used in the business for more than one year and its.

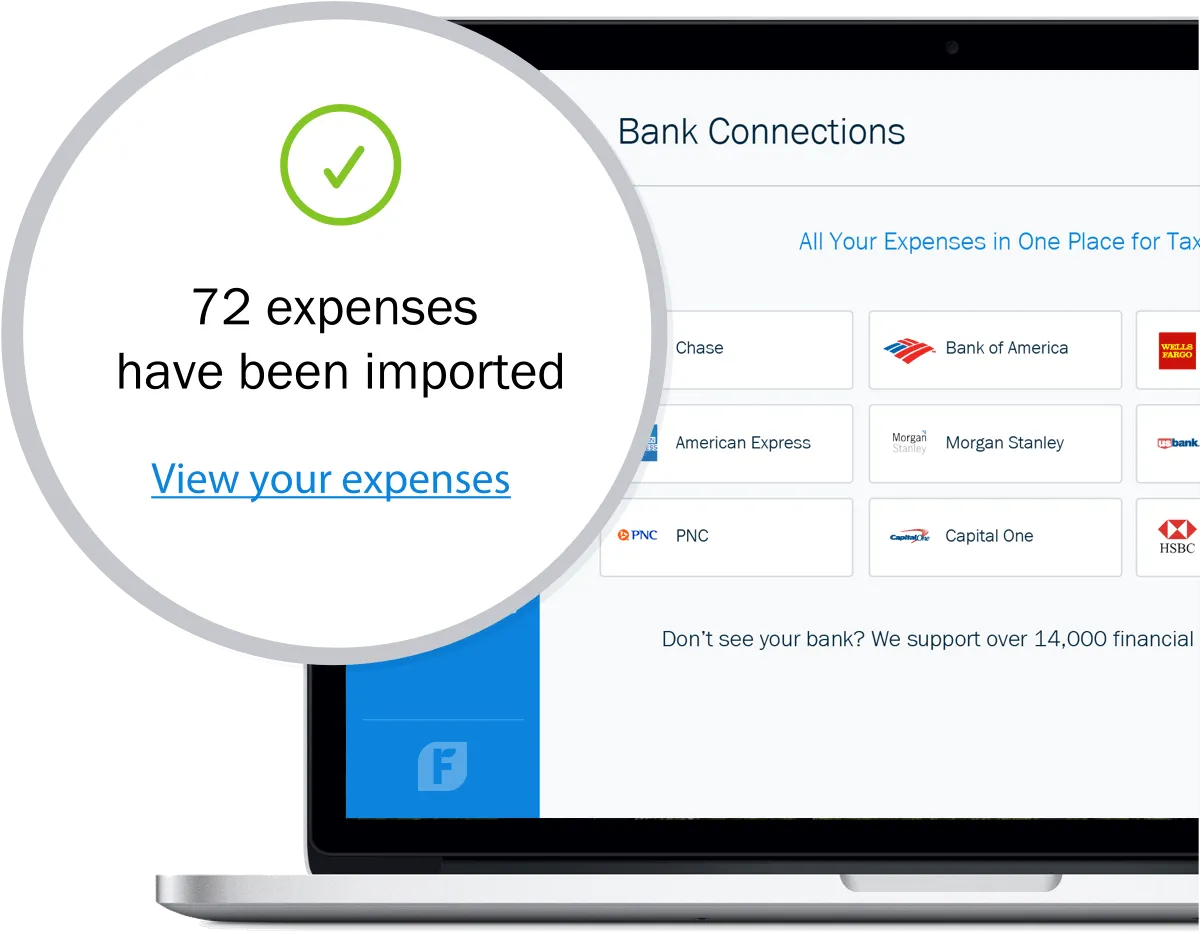

Expense tracking software All you need to know

While your expenses are definitely becoming increasingly common, the irs doesn't have a special category listed on schedule c. The ability to deduct software as a business expense can significantly impact a company’s financial health and tax liability. Software can be a capital expense if it's expected to be used in the business for more than one year and its.

How Does Expense Management Software Help Your Business?

Software can be a capital expense if it's expected to be used in the business for more than one year and its cost exceeds a certain. The ability to deduct software as a business expense can significantly impact a company’s financial health and tax liability. While your expenses are definitely becoming increasingly common, the irs doesn't have a special category.

CloudBased Expense Tracking Software Web & Desktop App

Software can be a capital expense if it's expected to be used in the business for more than one year and its cost exceeds a certain. The ability to deduct software as a business expense can significantly impact a company’s financial health and tax liability. While your expenses are definitely becoming increasingly common, the irs doesn't have a special category.

The Evolution of Expense Management Software A Comprehensive Overview

While your expenses are definitely becoming increasingly common, the irs doesn't have a special category listed on schedule c. Software can be a capital expense if it's expected to be used in the business for more than one year and its cost exceeds a certain. The ability to deduct software as a business expense can significantly impact a company’s financial.

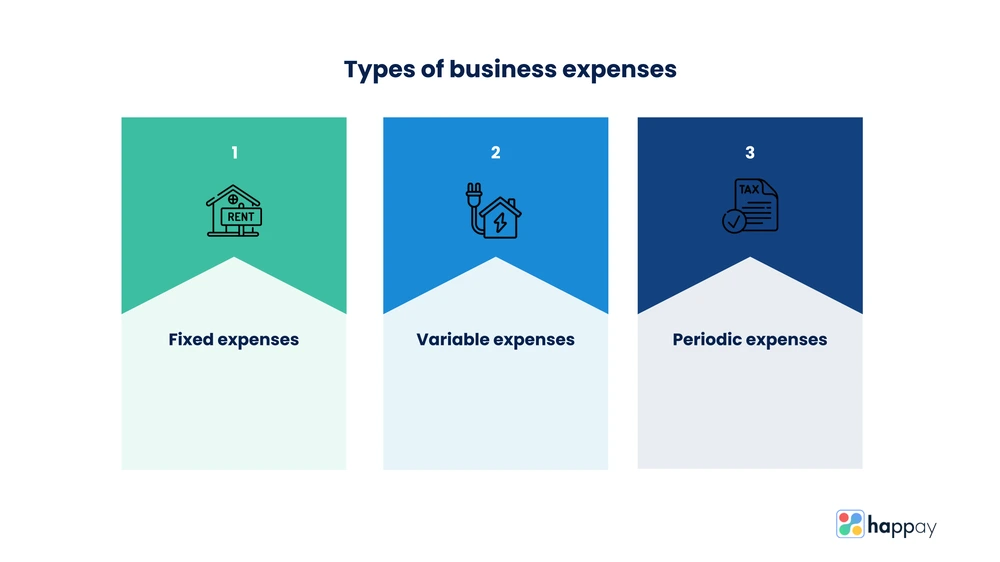

Expense Reports How to Create, Process and Types Happay

Software can be a capital expense if it's expected to be used in the business for more than one year and its cost exceeds a certain. The ability to deduct software as a business expense can significantly impact a company’s financial health and tax liability. While your expenses are definitely becoming increasingly common, the irs doesn't have a special category.

Expense tracking software All you need to know

The ability to deduct software as a business expense can significantly impact a company’s financial health and tax liability. Software can be a capital expense if it's expected to be used in the business for more than one year and its cost exceeds a certain. While your expenses are definitely becoming increasingly common, the irs doesn't have a special category.

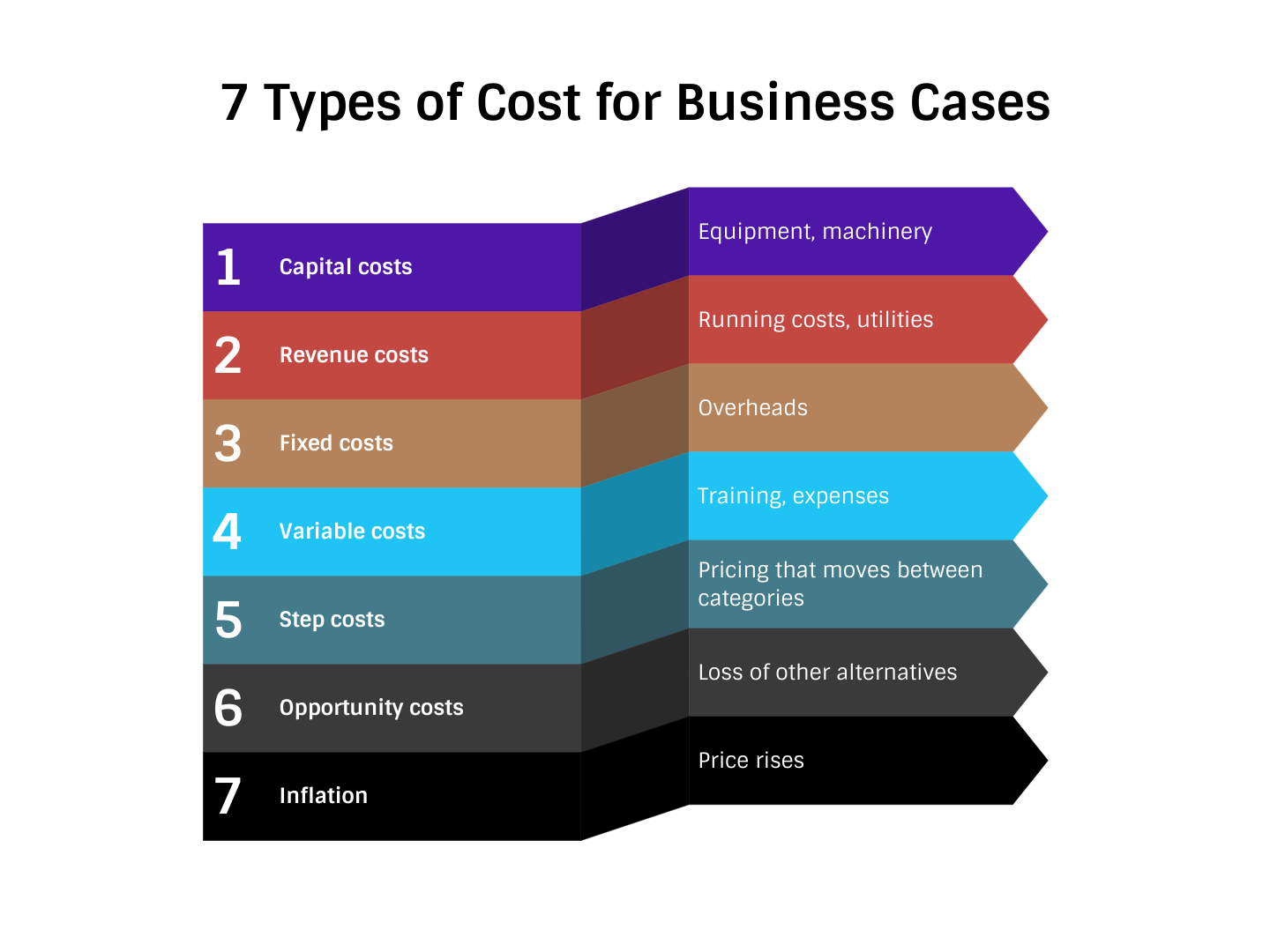

7 Types of cost for your business case

The ability to deduct software as a business expense can significantly impact a company’s financial health and tax liability. Software can be a capital expense if it's expected to be used in the business for more than one year and its cost exceeds a certain. While your expenses are definitely becoming increasingly common, the irs doesn't have a special category.

How to Choose the Best Expense Software ITILITE

Software can be a capital expense if it's expected to be used in the business for more than one year and its cost exceeds a certain. While your expenses are definitely becoming increasingly common, the irs doesn't have a special category listed on schedule c. The ability to deduct software as a business expense can significantly impact a company’s financial.

20 Business Expense Categories List to Consider for Your Business

The ability to deduct software as a business expense can significantly impact a company’s financial health and tax liability. Software can be a capital expense if it's expected to be used in the business for more than one year and its cost exceeds a certain. While your expenses are definitely becoming increasingly common, the irs doesn't have a special category.

Software Can Be A Capital Expense If It's Expected To Be Used In The Business For More Than One Year And Its Cost Exceeds A Certain.

The ability to deduct software as a business expense can significantly impact a company’s financial health and tax liability. While your expenses are definitely becoming increasingly common, the irs doesn't have a special category listed on schedule c.