Uae Vat Tax Law - Vat is a consumption tax (not a sales tax) that applies to most transactions in the uae. Article 1 of uae vat law defines tax group as ‘two or more persons registered with the authority for tax purposes as a single taxable. His highness sheikh khalifa bin zayed al nahyan, president of the united arab emirates, has issued the following decree law: (8) of 2017, outlining its key components, legal.

His highness sheikh khalifa bin zayed al nahyan, president of the united arab emirates, has issued the following decree law: (8) of 2017, outlining its key components, legal. Article 1 of uae vat law defines tax group as ‘two or more persons registered with the authority for tax purposes as a single taxable. Vat is a consumption tax (not a sales tax) that applies to most transactions in the uae.

Article 1 of uae vat law defines tax group as ‘two or more persons registered with the authority for tax purposes as a single taxable. (8) of 2017, outlining its key components, legal. His highness sheikh khalifa bin zayed al nahyan, president of the united arab emirates, has issued the following decree law: Vat is a consumption tax (not a sales tax) that applies to most transactions in the uae.

UAE announces changes to VAT provisions (Updated) BMS

Article 1 of uae vat law defines tax group as ‘two or more persons registered with the authority for tax purposes as a single taxable. Vat is a consumption tax (not a sales tax) that applies to most transactions in the uae. (8) of 2017, outlining its key components, legal. His highness sheikh khalifa bin zayed al nahyan, president of.

UAE VAT Law Key Updates and Expert Advice 2023

His highness sheikh khalifa bin zayed al nahyan, president of the united arab emirates, has issued the following decree law: (8) of 2017, outlining its key components, legal. Vat is a consumption tax (not a sales tax) that applies to most transactions in the uae. Article 1 of uae vat law defines tax group as ‘two or more persons registered.

Statute of Limitations Under the Amended UAE VAT Law

Article 1 of uae vat law defines tax group as ‘two or more persons registered with the authority for tax purposes as a single taxable. His highness sheikh khalifa bin zayed al nahyan, president of the united arab emirates, has issued the following decree law: (8) of 2017, outlining its key components, legal. Vat is a consumption tax (not a.

Derecho Constitucional Suaed UNAM, 42 OFF

His highness sheikh khalifa bin zayed al nahyan, president of the united arab emirates, has issued the following decree law: (8) of 2017, outlining its key components, legal. Article 1 of uae vat law defines tax group as ‘two or more persons registered with the authority for tax purposes as a single taxable. Vat is a consumption tax (not a.

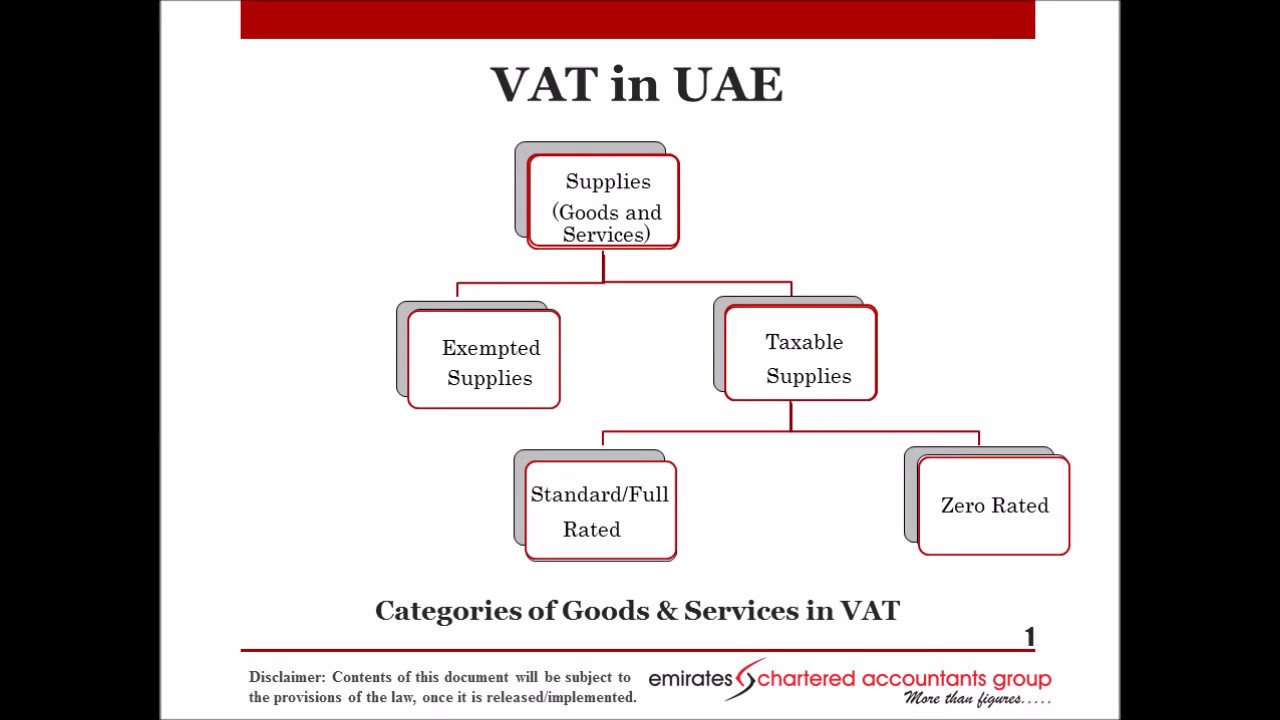

A COMPREHENSIVE GUIDE ON UAE VALUE ADDED TAX UAE VAT SIMPLIFIED by CA

His highness sheikh khalifa bin zayed al nahyan, president of the united arab emirates, has issued the following decree law: Vat is a consumption tax (not a sales tax) that applies to most transactions in the uae. (8) of 2017, outlining its key components, legal. Article 1 of uae vat law defines tax group as ‘two or more persons registered.

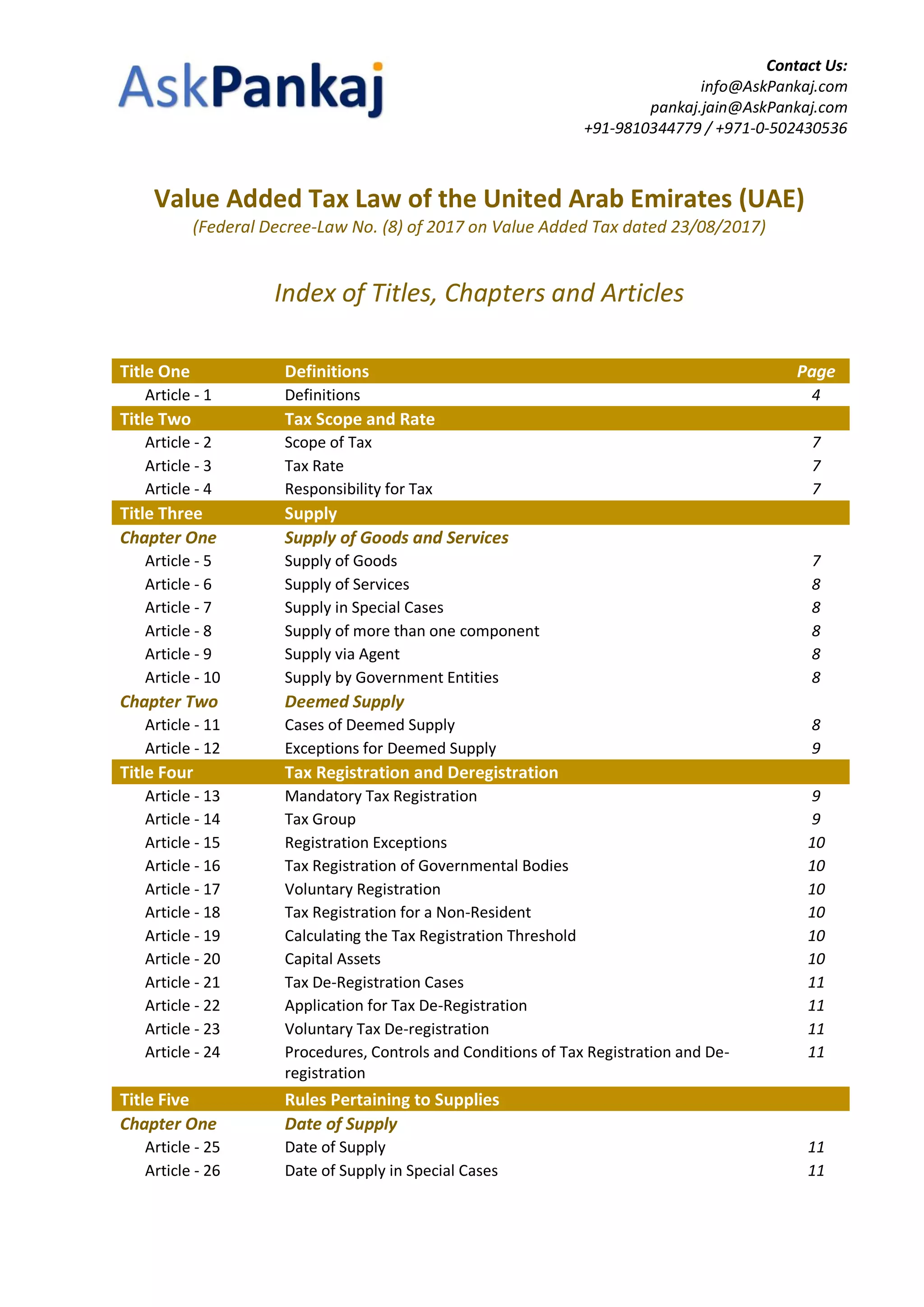

AskPankaj Value Added Tax (VAT) law of the United Arab Emirates (UAE

(8) of 2017, outlining its key components, legal. Vat is a consumption tax (not a sales tax) that applies to most transactions in the uae. Article 1 of uae vat law defines tax group as ‘two or more persons registered with the authority for tax purposes as a single taxable. His highness sheikh khalifa bin zayed al nahyan, president of.

UAE VAT Implementation Key Insights Businesses Need to Know

Article 1 of uae vat law defines tax group as ‘two or more persons registered with the authority for tax purposes as a single taxable. Vat is a consumption tax (not a sales tax) that applies to most transactions in the uae. His highness sheikh khalifa bin zayed al nahyan, president of the united arab emirates, has issued the following.

A Guide to New Amendments to UAE VAT Decree Law

Article 1 of uae vat law defines tax group as ‘two or more persons registered with the authority for tax purposes as a single taxable. Vat is a consumption tax (not a sales tax) that applies to most transactions in the uae. (8) of 2017, outlining its key components, legal. His highness sheikh khalifa bin zayed al nahyan, president of.

UAE Tax Laws for Businesses VAT and Corporate tax

(8) of 2017, outlining its key components, legal. His highness sheikh khalifa bin zayed al nahyan, president of the united arab emirates, has issued the following decree law: Vat is a consumption tax (not a sales tax) that applies to most transactions in the uae. Article 1 of uae vat law defines tax group as ‘two or more persons registered.

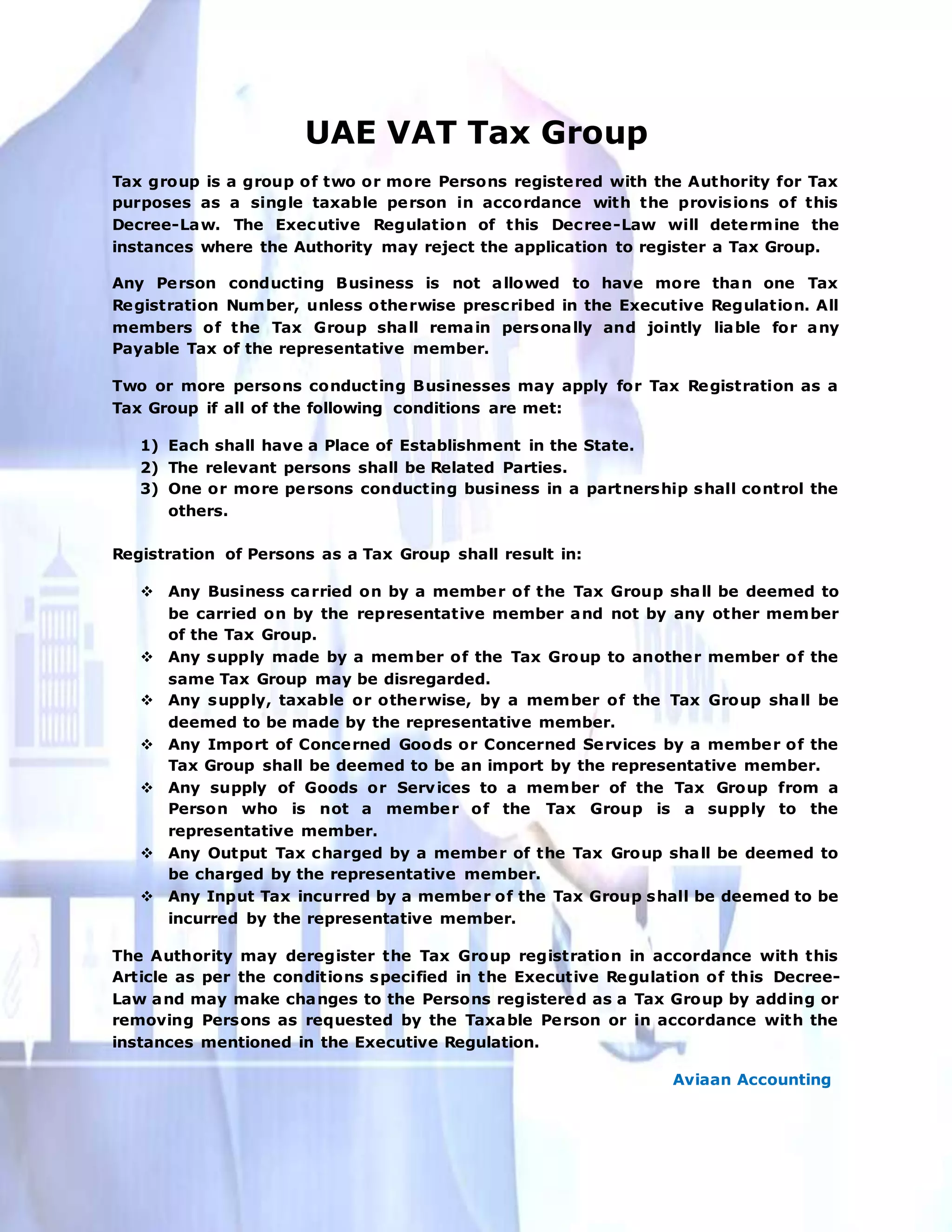

UAE VAT Tax Group PDF

Article 1 of uae vat law defines tax group as ‘two or more persons registered with the authority for tax purposes as a single taxable. (8) of 2017, outlining its key components, legal. His highness sheikh khalifa bin zayed al nahyan, president of the united arab emirates, has issued the following decree law: Vat is a consumption tax (not a.

Vat Is A Consumption Tax (Not A Sales Tax) That Applies To Most Transactions In The Uae.

(8) of 2017, outlining its key components, legal. Article 1 of uae vat law defines tax group as ‘two or more persons registered with the authority for tax purposes as a single taxable. His highness sheikh khalifa bin zayed al nahyan, president of the united arab emirates, has issued the following decree law: