The Payment Is Staggered According To Income - Since 1997, the social security administration (ssa) has used a staggered payment system to distribute these benefits. Who receives the social security payment on may 21? Find out who qualifies and payment details. The social security administration (ssa) uses a staggered payment system to ensure efficient distribution of funds, and the. From 2025 through 2028, workers can deduct overtime pay from federal income tax. The deduction is capped at $12,500 for single filers. The social security administration (ssa) will make its next round of payments on. Staggered retirement can help couples increase their combined social security income by allowing one or both to delay filing. Ssa’s april 23 payment goes to retirees and ssdi beneficiaries. The distribution of the social security payments will occur according to recipient birthdates, allowing for a more.

The distribution of the social security payments will occur according to recipient birthdates, allowing for a more. The deduction is capped at $12,500 for single filers. The social security administration (ssa) uses a staggered payment system to ensure efficient distribution of funds, and the. Ssa’s april 23 payment goes to retirees and ssdi beneficiaries. Who receives the social security payment on may 21? From 2025 through 2028, workers can deduct overtime pay from federal income tax. Since 1997, the social security administration (ssa) has used a staggered payment system to distribute these benefits. Why it’s staggered the social security administration (ssa) doesn’t deposit payments to all beneficiaries on the. Find out who qualifies and payment details. The social security administration (ssa) will make its next round of payments on.

Why it’s staggered the social security administration (ssa) doesn’t deposit payments to all beneficiaries on the. The social security administration (ssa) uses a staggered payment system to ensure efficient distribution of funds, and the. The deduction is capped at $12,500 for single filers. From 2025 through 2028, workers can deduct overtime pay from federal income tax. Who receives the social security payment on may 21? The social security administration (ssa) will make its next round of payments on. Since 1997, the social security administration (ssa) has used a staggered payment system to distribute these benefits. Staggered retirement can help couples increase their combined social security income by allowing one or both to delay filing. Ssa’s april 23 payment goes to retirees and ssdi beneficiaries. The distribution of the social security payments will occur according to recipient birthdates, allowing for a more.

CONTRACT ISSUES 2 CHAPTER ppt download

The distribution of the social security payments will occur according to recipient birthdates, allowing for a more. The social security administration (ssa) uses a staggered payment system to ensure efficient distribution of funds, and the. The deduction is capped at $12,500 for single filers. Who receives the social security payment on may 21? From 2025 through 2028, workers can deduct.

If Only Singaporeans Stopped to Think Pay less cash upfront when you

The deduction is capped at $12,500 for single filers. The social security administration (ssa) uses a staggered payment system to ensure efficient distribution of funds, and the. Find out who qualifies and payment details. Why it’s staggered the social security administration (ssa) doesn’t deposit payments to all beneficiaries on the. Who receives the social security payment on may 21?

Free Staggered Payment Agreement Fill Online Printable Down Payment

Find out who qualifies and payment details. Staggered retirement can help couples increase their combined social security income by allowing one or both to delay filing. Why it’s staggered the social security administration (ssa) doesn’t deposit payments to all beneficiaries on the. Who receives the social security payment on may 21? From 2025 through 2028, workers can deduct overtime pay.

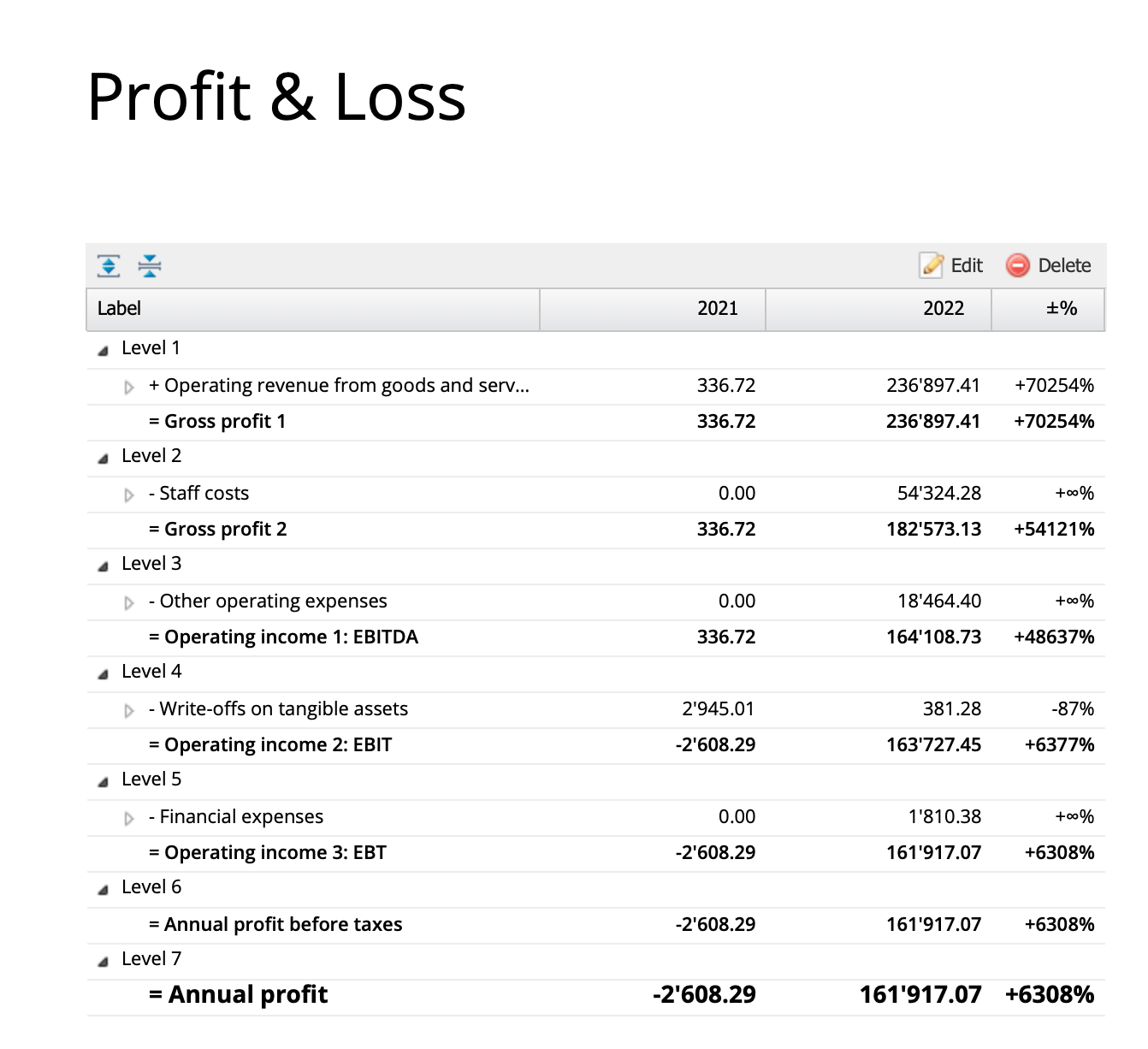

statement staggered EBIT CashCtrl

Who receives the social security payment on may 21? Find out who qualifies and payment details. The social security administration (ssa) will make its next round of payments on. Since 1997, the social security administration (ssa) has used a staggered payment system to distribute these benefits. The social security administration (ssa) uses a staggered payment system to ensure efficient distribution.

Complete Guide To HDB’s Staggered Downpayment Scheme (SDS) Sianzzz

The social security administration (ssa) uses a staggered payment system to ensure efficient distribution of funds, and the. Who receives the social security payment on may 21? Staggered retirement can help couples increase their combined social security income by allowing one or both to delay filing. The social security administration (ssa) will make its next round of payments on. Why.

Select Appropriate Sales Deal Structures Salesforce Trailhead

Why it’s staggered the social security administration (ssa) doesn’t deposit payments to all beneficiaries on the. The social security administration (ssa) will make its next round of payments on. Find out who qualifies and payment details. The deduction is capped at $12,500 for single filers. Ssa’s april 23 payment goes to retirees and ssdi beneficiaries.

staggereddownpayment1 DollarsAndSense.sg

The deduction is capped at $12,500 for single filers. Ssa’s april 23 payment goes to retirees and ssdi beneficiaries. Since 1997, the social security administration (ssa) has used a staggered payment system to distribute these benefits. Who receives the social security payment on may 21? The distribution of the social security payments will occur according to recipient birthdates, allowing for.

Transforming Finance From Staggered Payments in Insurance to Multiple

The deduction is capped at $12,500 for single filers. The social security administration (ssa) uses a staggered payment system to ensure efficient distribution of funds, and the. Staggered retirement can help couples increase their combined social security income by allowing one or both to delay filing. From 2025 through 2028, workers can deduct overtime pay from federal income tax. Who.

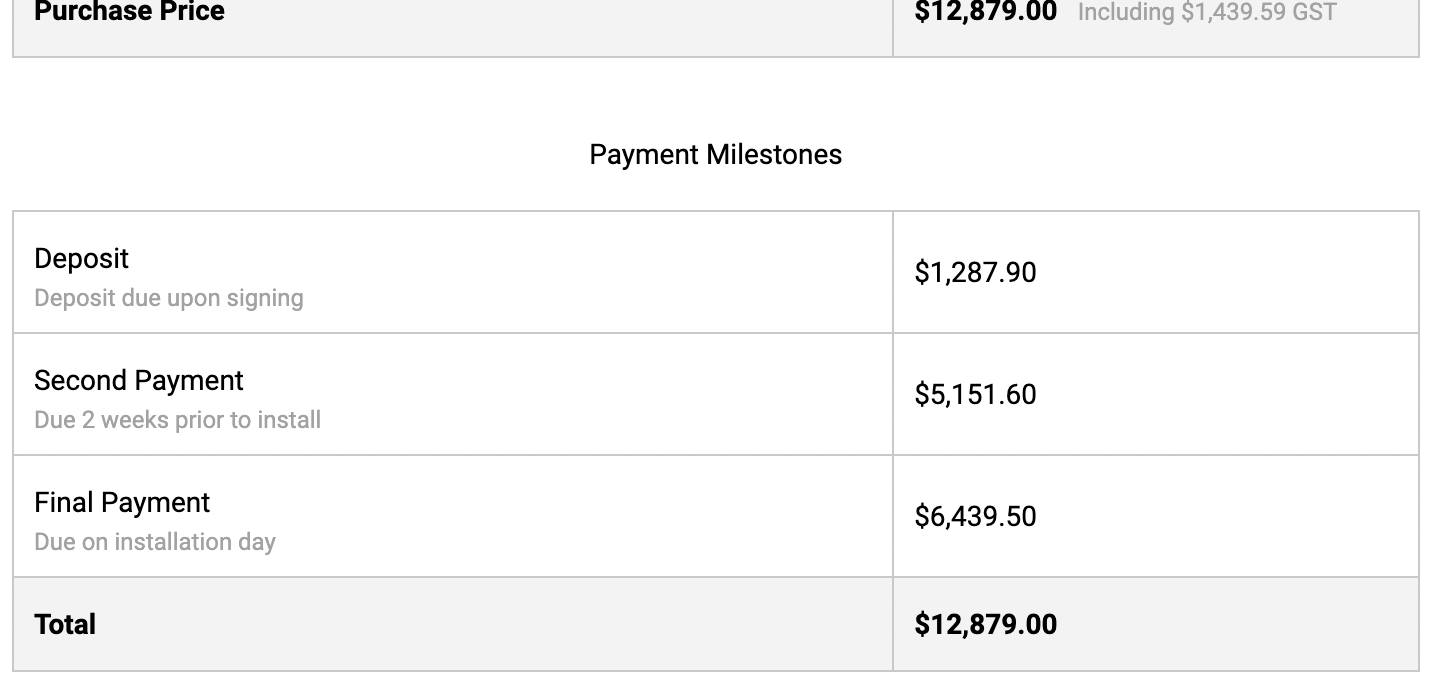

How to set up Staged Payments (payment milestones) OpenSolar

The deduction is capped at $12,500 for single filers. The social security administration (ssa) will make its next round of payments on. Find out who qualifies and payment details. Who receives the social security payment on may 21? Since 1997, the social security administration (ssa) has used a staggered payment system to distribute these benefits.

Staggered Payment Why You Should Consider It for Investments News n'York

From 2025 through 2028, workers can deduct overtime pay from federal income tax. The social security administration (ssa) will make its next round of payments on. Ssa’s april 23 payment goes to retirees and ssdi beneficiaries. The social security administration (ssa) uses a staggered payment system to ensure efficient distribution of funds, and the. The deduction is capped at $12,500.

The Distribution Of The Social Security Payments Will Occur According To Recipient Birthdates, Allowing For A More.

The deduction is capped at $12,500 for single filers. Who receives the social security payment on may 21? Staggered retirement can help couples increase their combined social security income by allowing one or both to delay filing. Find out who qualifies and payment details.

The Social Security Administration (Ssa) Uses A Staggered Payment System To Ensure Efficient Distribution Of Funds, And The.

The social security administration (ssa) will make its next round of payments on. Why it’s staggered the social security administration (ssa) doesn’t deposit payments to all beneficiaries on the. Ssa’s april 23 payment goes to retirees and ssdi beneficiaries. Since 1997, the social security administration (ssa) has used a staggered payment system to distribute these benefits.