Tennessee Tax Return 2024 - On the left, click on the type of form you need. On may 10, 2024, tennessee gov. Bill lee approved legislation which eliminates the property measure for computing the tennessee. Franchise and excise taxes may be reduced by a credit on industrial machinery and research and development equipment purchased during the. Quarterly estimated tax payments normally due. Franchise tax property measure (schedule g) refunds on may 10, 2024, governor bill lee signed public chapter 950 (2024), which. You can find forms relevant to conducting business with the department of revenue here. Taxpayers incorporated or otherwise formed in tennessee must prorate the franchise tax on the initial return from the date formed or the date. 2024 contributions to iras and health savings accounts for eligible taxpayers.

Franchise and excise taxes may be reduced by a credit on industrial machinery and research and development equipment purchased during the. On the left, click on the type of form you need. Quarterly estimated tax payments normally due. Bill lee approved legislation which eliminates the property measure for computing the tennessee. You can find forms relevant to conducting business with the department of revenue here. 2024 contributions to iras and health savings accounts for eligible taxpayers. On may 10, 2024, tennessee gov. Taxpayers incorporated or otherwise formed in tennessee must prorate the franchise tax on the initial return from the date formed or the date. Franchise tax property measure (schedule g) refunds on may 10, 2024, governor bill lee signed public chapter 950 (2024), which.

On may 10, 2024, tennessee gov. 2024 contributions to iras and health savings accounts for eligible taxpayers. You can find forms relevant to conducting business with the department of revenue here. Bill lee approved legislation which eliminates the property measure for computing the tennessee. Franchise and excise taxes may be reduced by a credit on industrial machinery and research and development equipment purchased during the. Quarterly estimated tax payments normally due. Taxpayers incorporated or otherwise formed in tennessee must prorate the franchise tax on the initial return from the date formed or the date. On the left, click on the type of form you need. Franchise tax property measure (schedule g) refunds on may 10, 2024, governor bill lee signed public chapter 950 (2024), which.

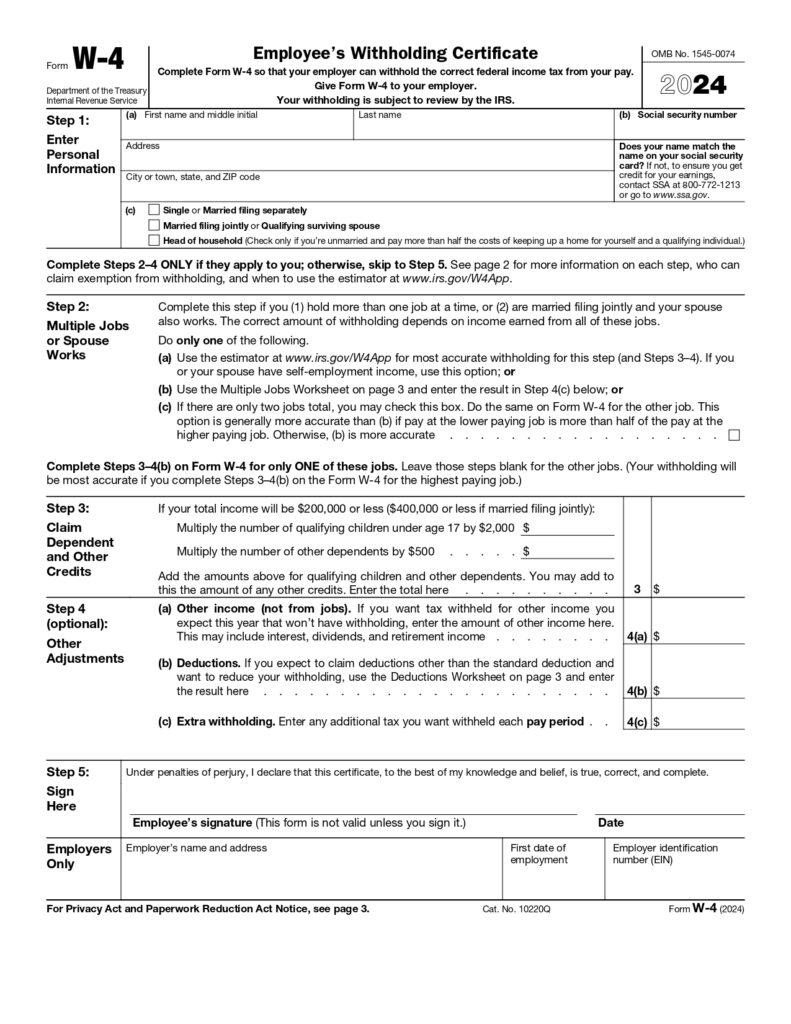

Irs 2024 Tax Forms Genni Christiane

2024 contributions to iras and health savings accounts for eligible taxpayers. On may 10, 2024, tennessee gov. Quarterly estimated tax payments normally due. On the left, click on the type of form you need. Bill lee approved legislation which eliminates the property measure for computing the tennessee.

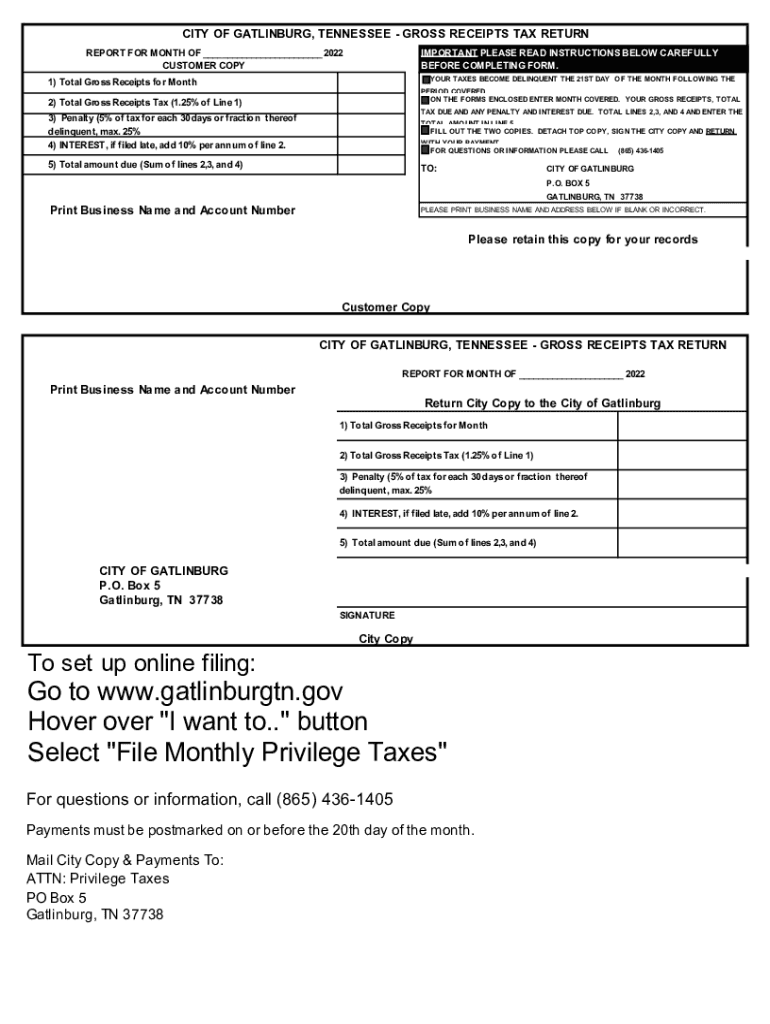

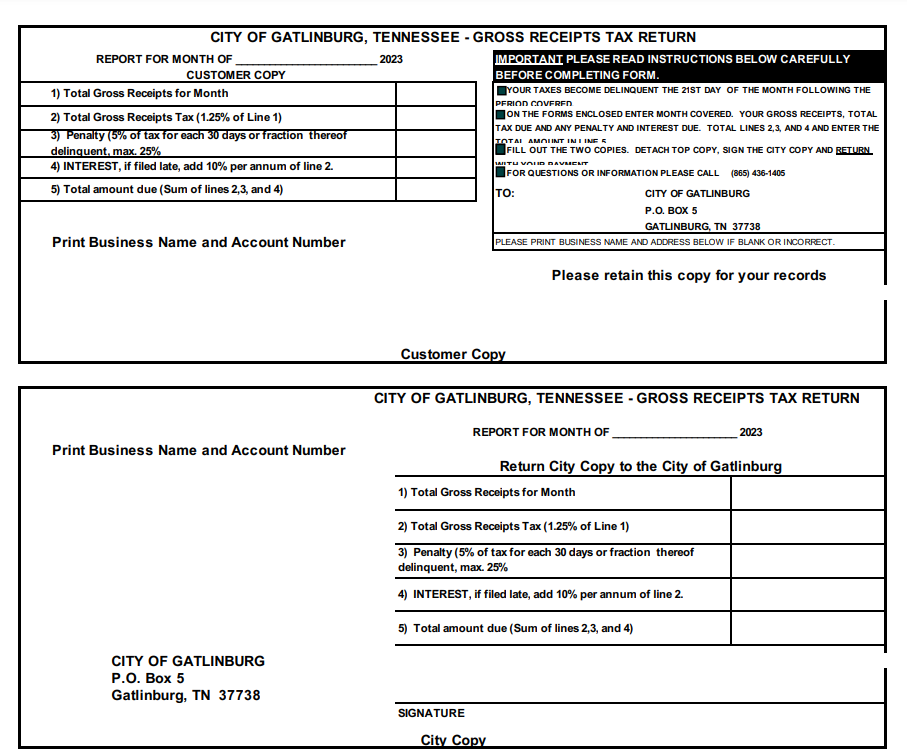

Gross Receipts 20222024 Form Fill Out and Sign Printable PDF

On the left, click on the type of form you need. Taxpayers incorporated or otherwise formed in tennessee must prorate the franchise tax on the initial return from the date formed or the date. Franchise tax property measure (schedule g) refunds on may 10, 2024, governor bill lee signed public chapter 950 (2024), which. On may 10, 2024, tennessee gov..

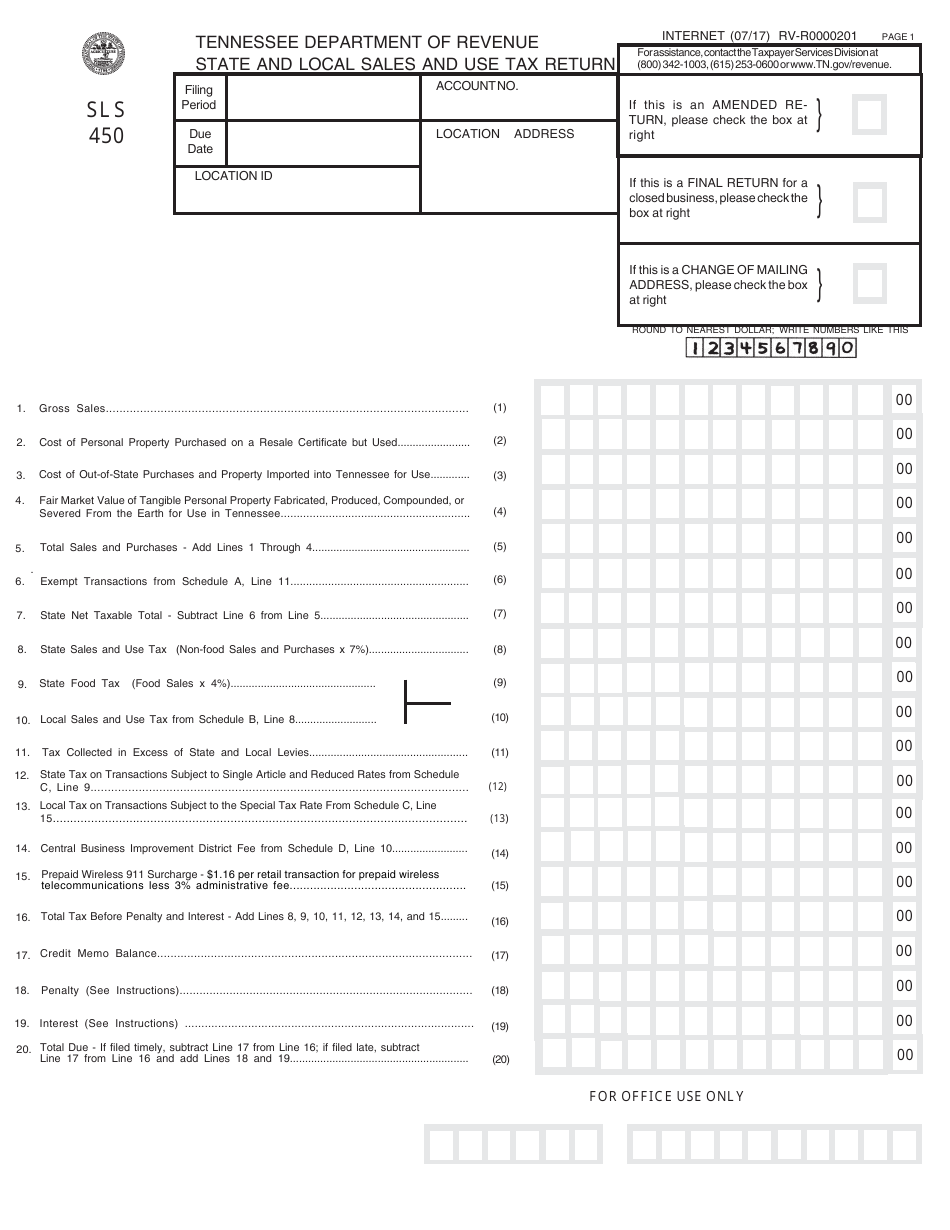

Tennessee Sales Tax 2024 Form Ketty Cariotta

You can find forms relevant to conducting business with the department of revenue here. On may 10, 2024, tennessee gov. On the left, click on the type of form you need. Franchise tax property measure (schedule g) refunds on may 10, 2024, governor bill lee signed public chapter 950 (2024), which. Taxpayers incorporated or otherwise formed in tennessee must prorate.

Tennessee Sales Tax 2024 Form Ketty Cariotta

Taxpayers incorporated or otherwise formed in tennessee must prorate the franchise tax on the initial return from the date formed or the date. You can find forms relevant to conducting business with the department of revenue here. On the left, click on the type of form you need. Bill lee approved legislation which eliminates the property measure for computing the.

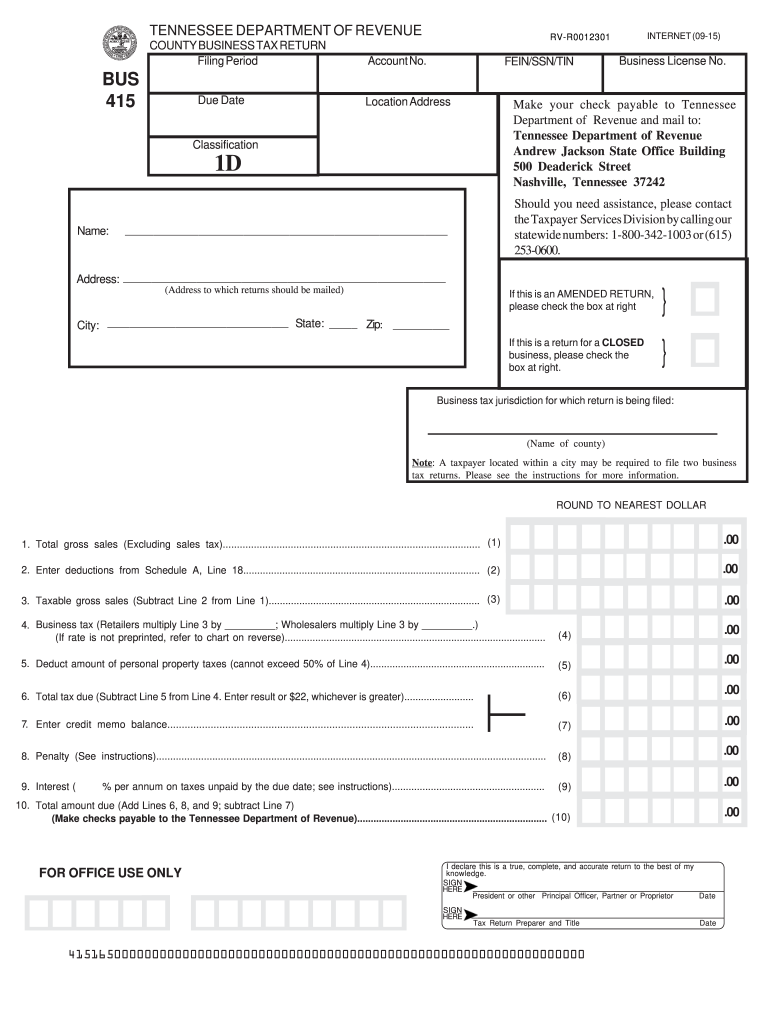

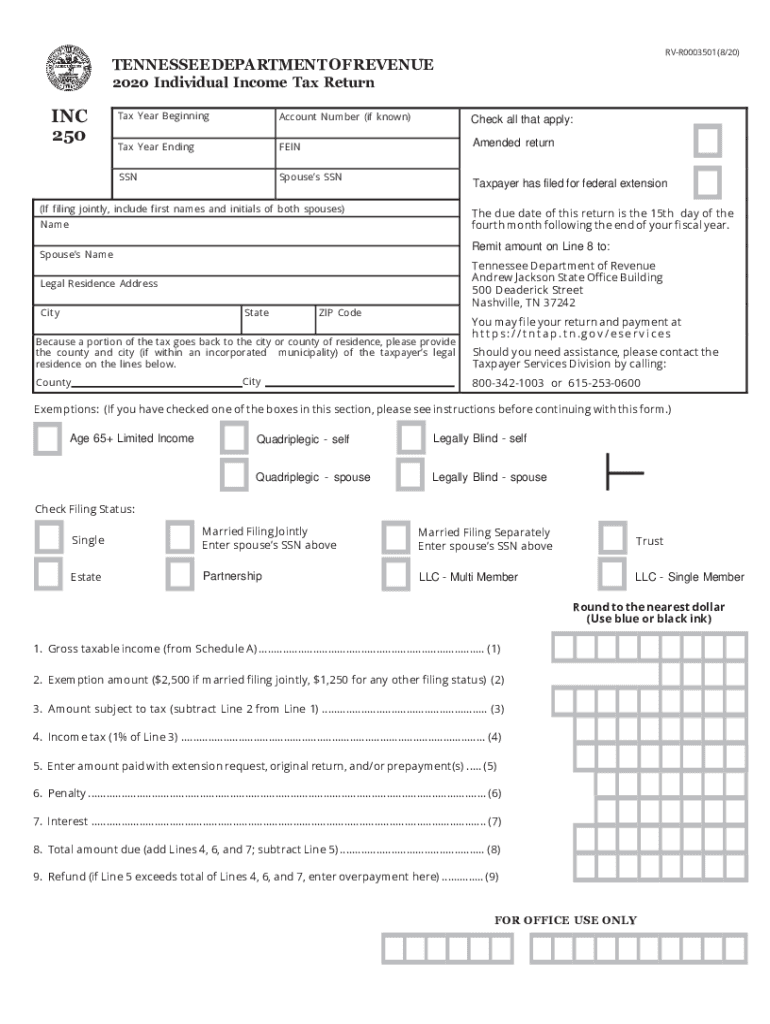

Tn Revenue Tax 20202025 Form Fill Out and Sign Printable PDF

You can find forms relevant to conducting business with the department of revenue here. Franchise tax property measure (schedule g) refunds on may 10, 2024, governor bill lee signed public chapter 950 (2024), which. Franchise and excise taxes may be reduced by a credit on industrial machinery and research and development equipment purchased during the. 2024 contributions to iras and.

When can I file my taxes for 2024? what's 1099K form? What to know in

On may 10, 2024, tennessee gov. You can find forms relevant to conducting business with the department of revenue here. Quarterly estimated tax payments normally due. Bill lee approved legislation which eliminates the property measure for computing the tennessee. 2024 contributions to iras and health savings accounts for eligible taxpayers.

Tennessee Tax Rates & Rankings Tax Foundation

You can find forms relevant to conducting business with the department of revenue here. Quarterly estimated tax payments normally due. On may 10, 2024, tennessee gov. On the left, click on the type of form you need. 2024 contributions to iras and health savings accounts for eligible taxpayers.

Tn fae 170 instructions Fill out & sign online DocHub

Taxpayers incorporated or otherwise formed in tennessee must prorate the franchise tax on the initial return from the date formed or the date. Franchise tax property measure (schedule g) refunds on may 10, 2024, governor bill lee signed public chapter 950 (2024), which. On may 10, 2024, tennessee gov. Quarterly estimated tax payments normally due. On the left, click on.

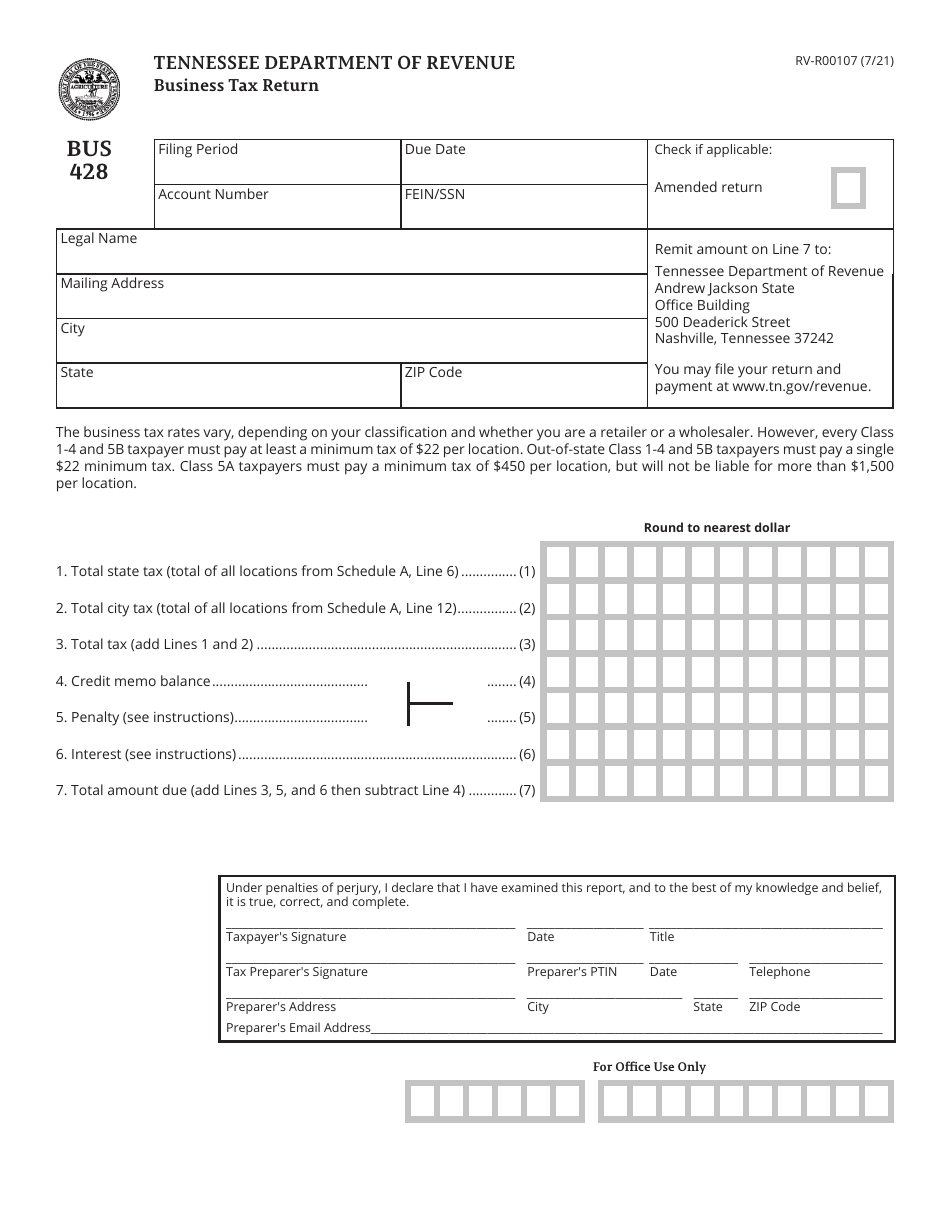

Form BUS428 (RVR00107) Download Printable PDF or Fill Online Business

Bill lee approved legislation which eliminates the property measure for computing the tennessee. Franchise tax property measure (schedule g) refunds on may 10, 2024, governor bill lee signed public chapter 950 (2024), which. On may 10, 2024, tennessee gov. You can find forms relevant to conducting business with the department of revenue here. Franchise and excise taxes may be reduced.

Tennessee Tax Rebate 2025 A Comprehensive Guide

You can find forms relevant to conducting business with the department of revenue here. On may 10, 2024, tennessee gov. Taxpayers incorporated or otherwise formed in tennessee must prorate the franchise tax on the initial return from the date formed or the date. Bill lee approved legislation which eliminates the property measure for computing the tennessee. 2024 contributions to iras.

Franchise Tax Property Measure (Schedule G) Refunds On May 10, 2024, Governor Bill Lee Signed Public Chapter 950 (2024), Which.

Taxpayers incorporated or otherwise formed in tennessee must prorate the franchise tax on the initial return from the date formed or the date. 2024 contributions to iras and health savings accounts for eligible taxpayers. On the left, click on the type of form you need. You can find forms relevant to conducting business with the department of revenue here.

Bill Lee Approved Legislation Which Eliminates The Property Measure For Computing The Tennessee.

Franchise and excise taxes may be reduced by a credit on industrial machinery and research and development equipment purchased during the. Quarterly estimated tax payments normally due. On may 10, 2024, tennessee gov.