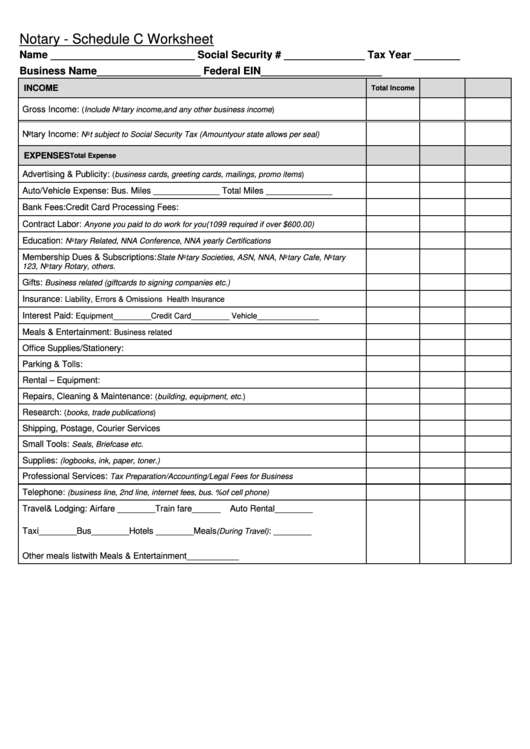

Schedule C Worksheet 2023 - I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. If claimed, business miles can be found on either line 44a of the schedule c, or on line 30 of form 4562. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. If no separate business name, leave blank. Go to www.irs.gov/schedulec for instructions and the latest information. Net profit or (loss) buildings and machinery sold outright (no trades):

I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. If claimed, business miles can be found on either line 44a of the schedule c, or on line 30 of form 4562. Net profit or (loss) buildings and machinery sold outright (no trades): Go to www.irs.gov/schedulec for instructions and the latest information. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. If no separate business name, leave blank.

If no separate business name, leave blank. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Net profit or (loss) buildings and machinery sold outright (no trades): Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. If claimed, business miles can be found on either line 44a of the schedule c, or on line 30 of form 4562. I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. Go to www.irs.gov/schedulec for instructions and the latest information.

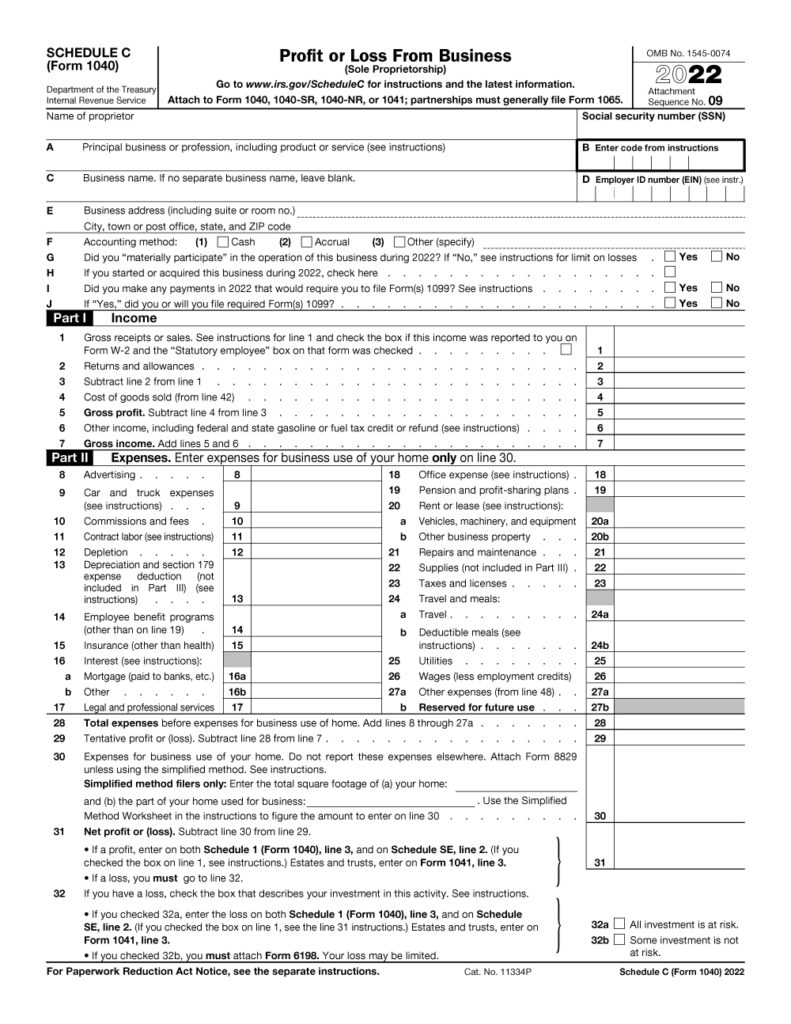

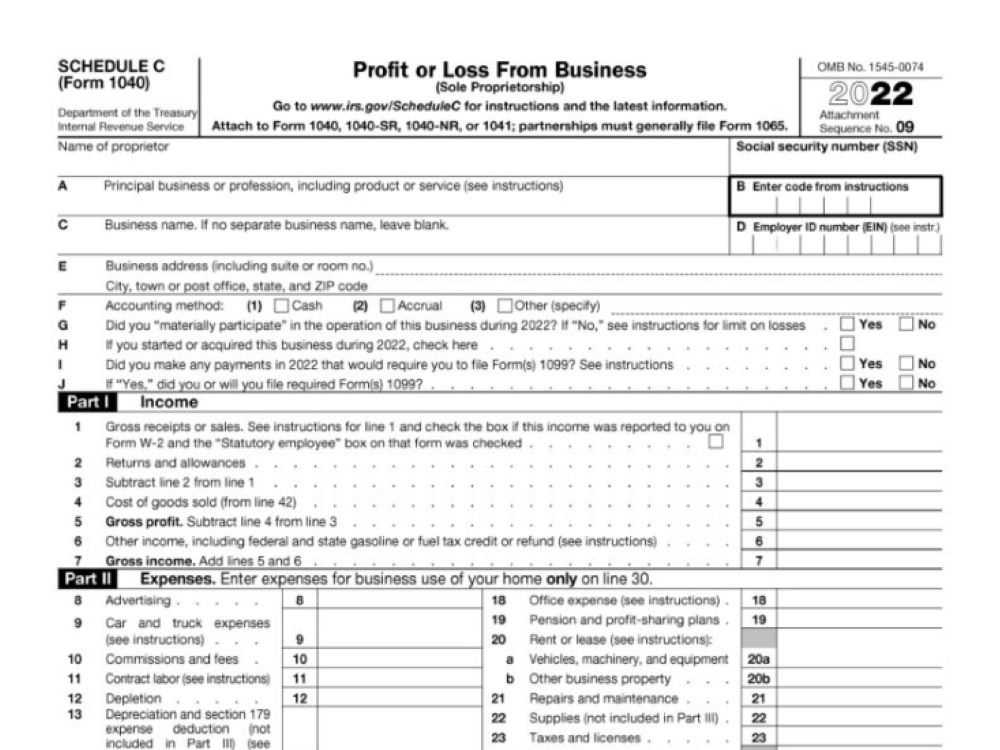

1040 schedule c 2022 form Fill out & sign online DocHub

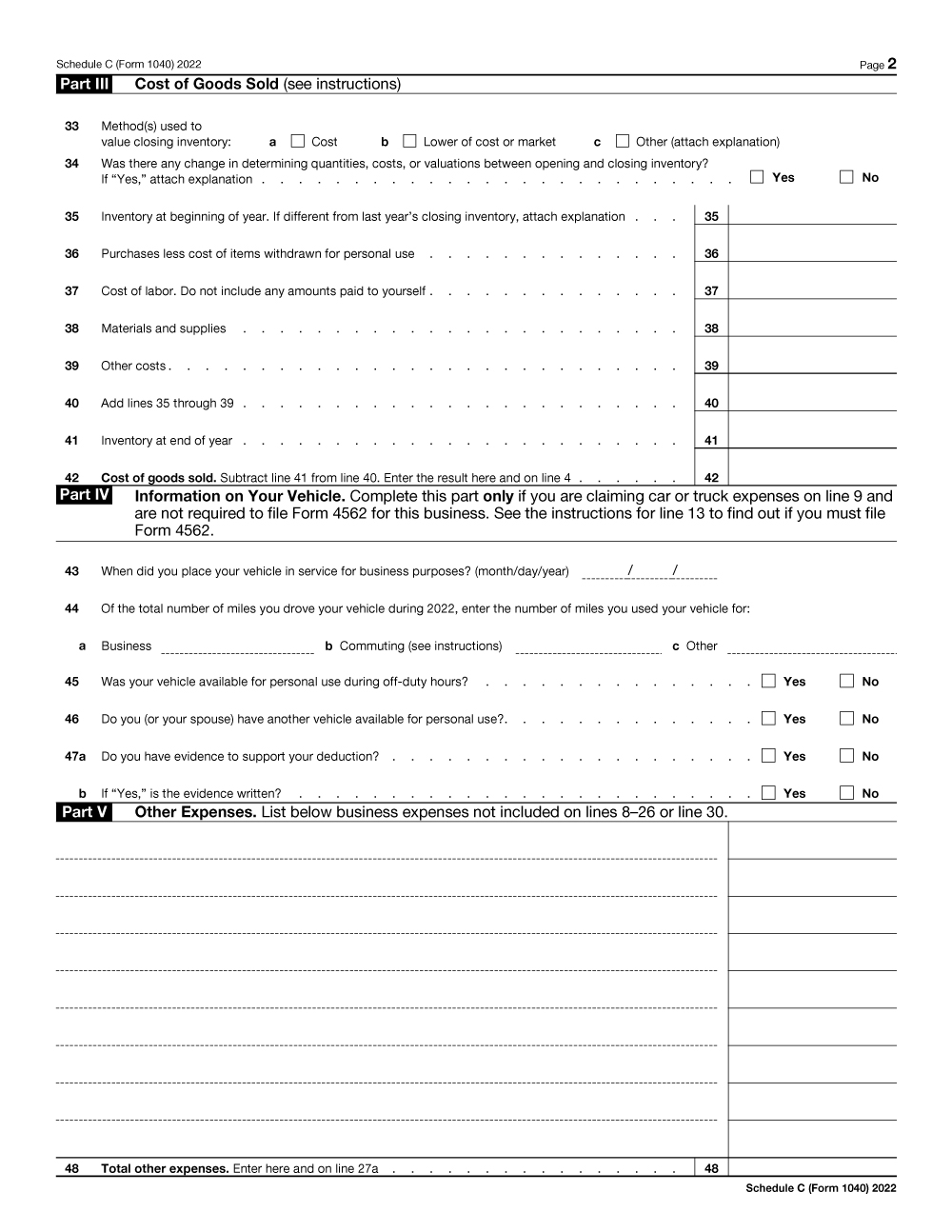

Net profit or (loss) buildings and machinery sold outright (no trades): Go to www.irs.gov/schedulec for instructions and the latest information. If no separate business name, leave blank. I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. If claimed, business miles can be found on either line 44a of the schedule c,.

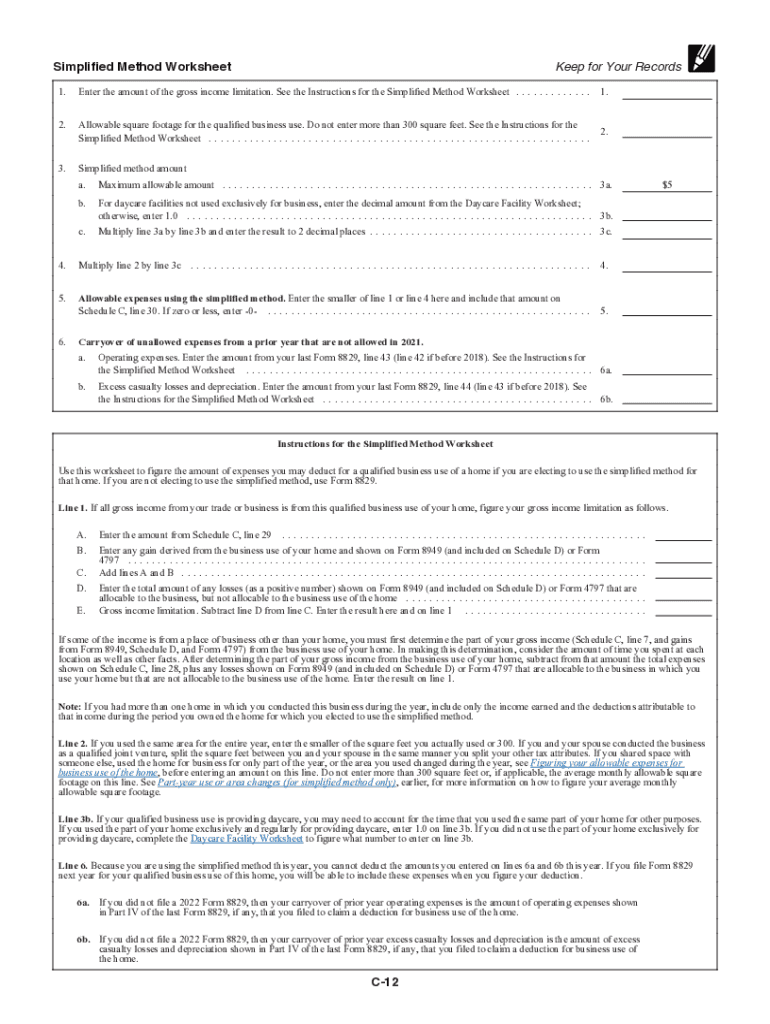

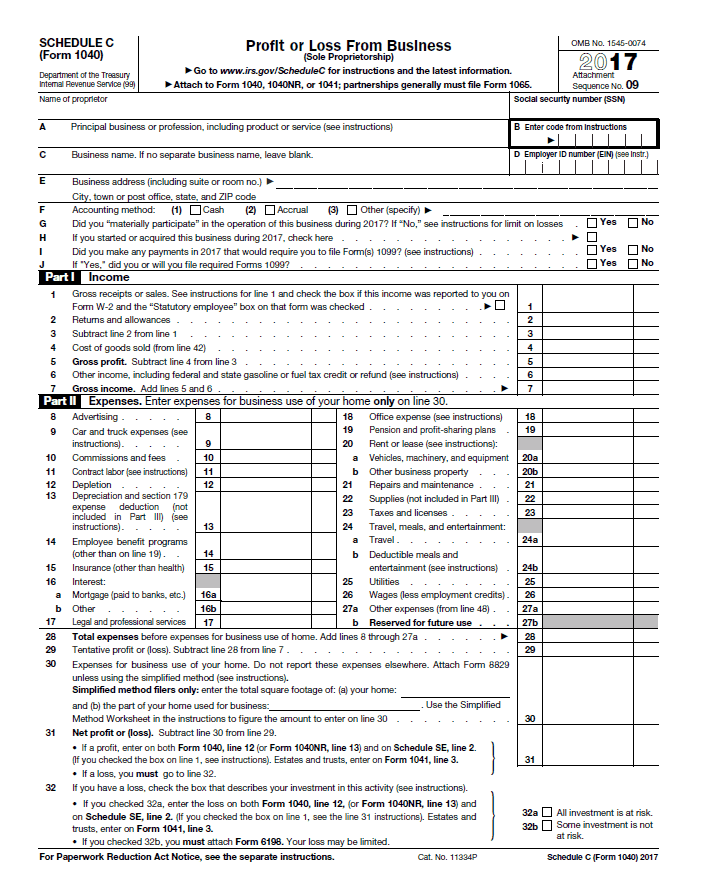

Schedule C Simplified Method Worksheet Printable Calendars AT A GLANCE

Go to www.irs.gov/schedulec for instructions and the latest information. If no separate business name, leave blank. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Net.

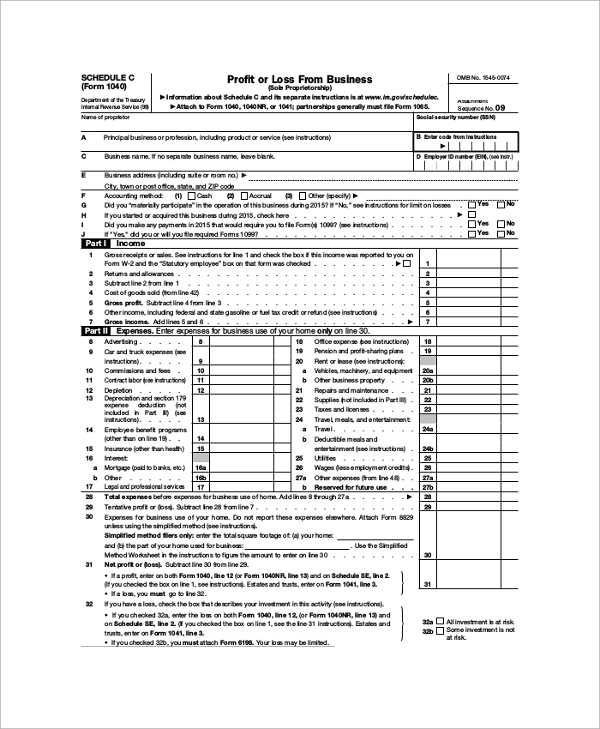

Schedule C Worksheet 2020

If claimed, business miles can be found on either line 44a of the schedule c, or on line 30 of form 4562. Net profit or (loss) buildings and machinery sold outright (no trades): Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Schedule c worksheet for.

Schedule C (Form 1040) 2023 Instructions

I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. Net profit or (loss) buildings and machinery sold outright (no trades): If claimed, business miles can be found on either line 44a of the schedule c, or on line 30 of form 4562. If no separate business name, leave blank. Go to.

Irs 1040 Schedule C 2025 Paxton Quincy

Go to www.irs.gov/schedulec for instructions and the latest information. If claimed, business miles can be found on either line 44a of the schedule c, or on line 30 of form 4562. Net profit or (loss) buildings and machinery sold outright (no trades): If no separate business name, leave blank. Schedule c worksheet for self employed businesses and/or independent contractors irs.

Schedule C Worksheet 2023 Printable Word Searches

If no separate business name, leave blank. Go to www.irs.gov/schedulec for instructions and the latest information. I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Net profit or.

Schedule C (Form 1040) 2023 Instructions

Net profit or (loss) buildings and machinery sold outright (no trades): I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. If no separate business name, leave blank. If claimed, business miles can be found on either line 44a of the schedule c, or on line 30 of form 4562. Information about.

Schedule C Simplified Method Worksheet

Net profit or (loss) buildings and machinery sold outright (no trades): If no separate business name, leave blank. I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. If claimed, business miles can be found on either line 44a of the schedule c, or on line 30 of form 4562. Schedule c.

A 1040 Schedule C Upwork

Net profit or (loss) buildings and machinery sold outright (no trades): If claimed, business miles can be found on either line 44a of the schedule c, or on line 30 of form 4562. Go to www.irs.gov/schedulec for instructions and the latest information. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from.

Schedule C Form 1040 How to Complete it? The Usual Stuff

If no separate business name, leave blank. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Go to www.irs.gov/schedulec for instructions and the latest information. If claimed, business miles can be found on either line 44a of the schedule c, or on line 30 of form 4562. I hereby.

Information About Schedule C (Form 1040), Profit Or Loss From Business, Used To Report Income Or Loss From A Business Operated Or Profession.

I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. If claimed, business miles can be found on either line 44a of the schedule c, or on line 30 of form 4562. If no separate business name, leave blank. Net profit or (loss) buildings and machinery sold outright (no trades):

Go To Www.irs.gov/Schedulec For Instructions And The Latest Information.

Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule.