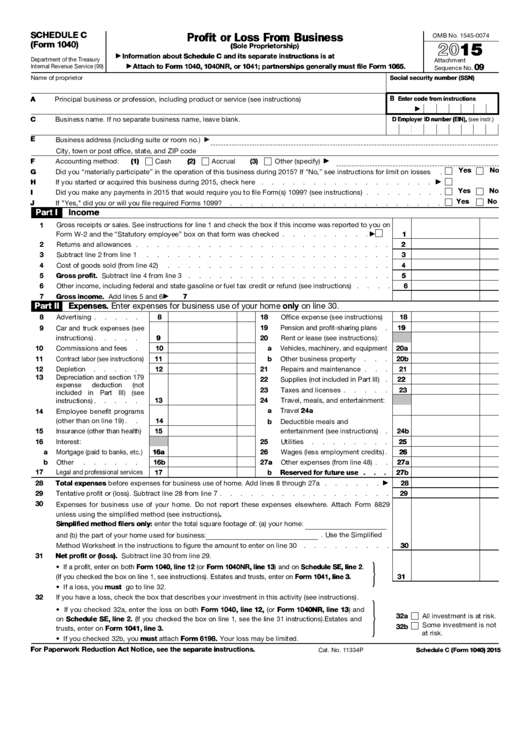

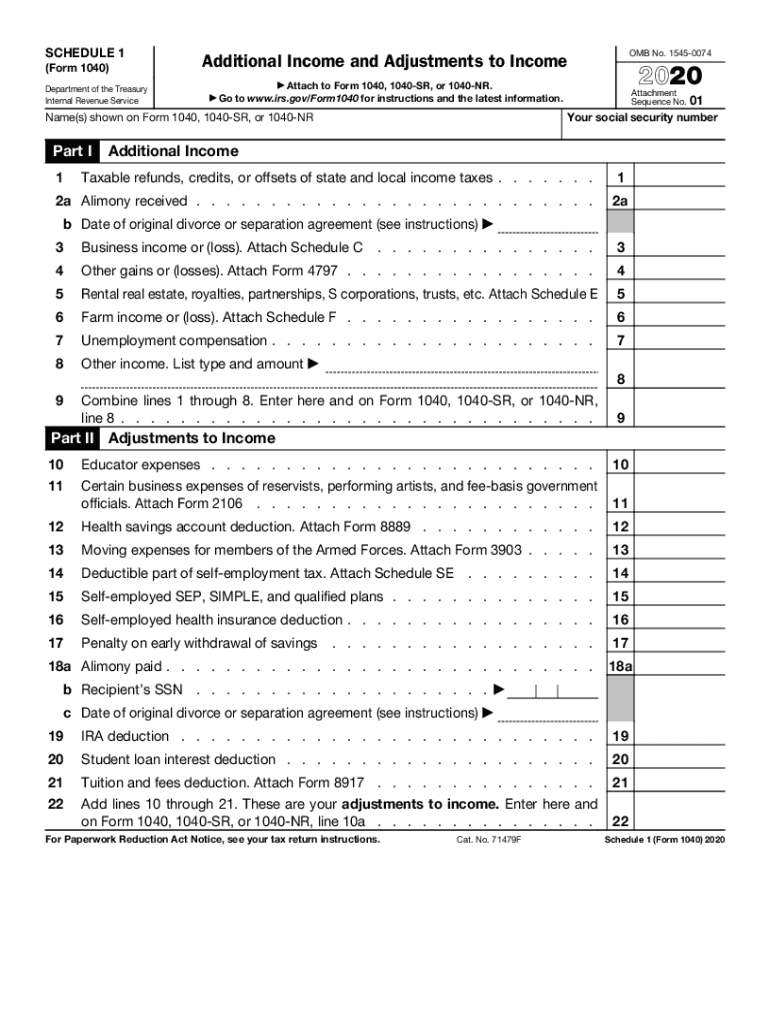

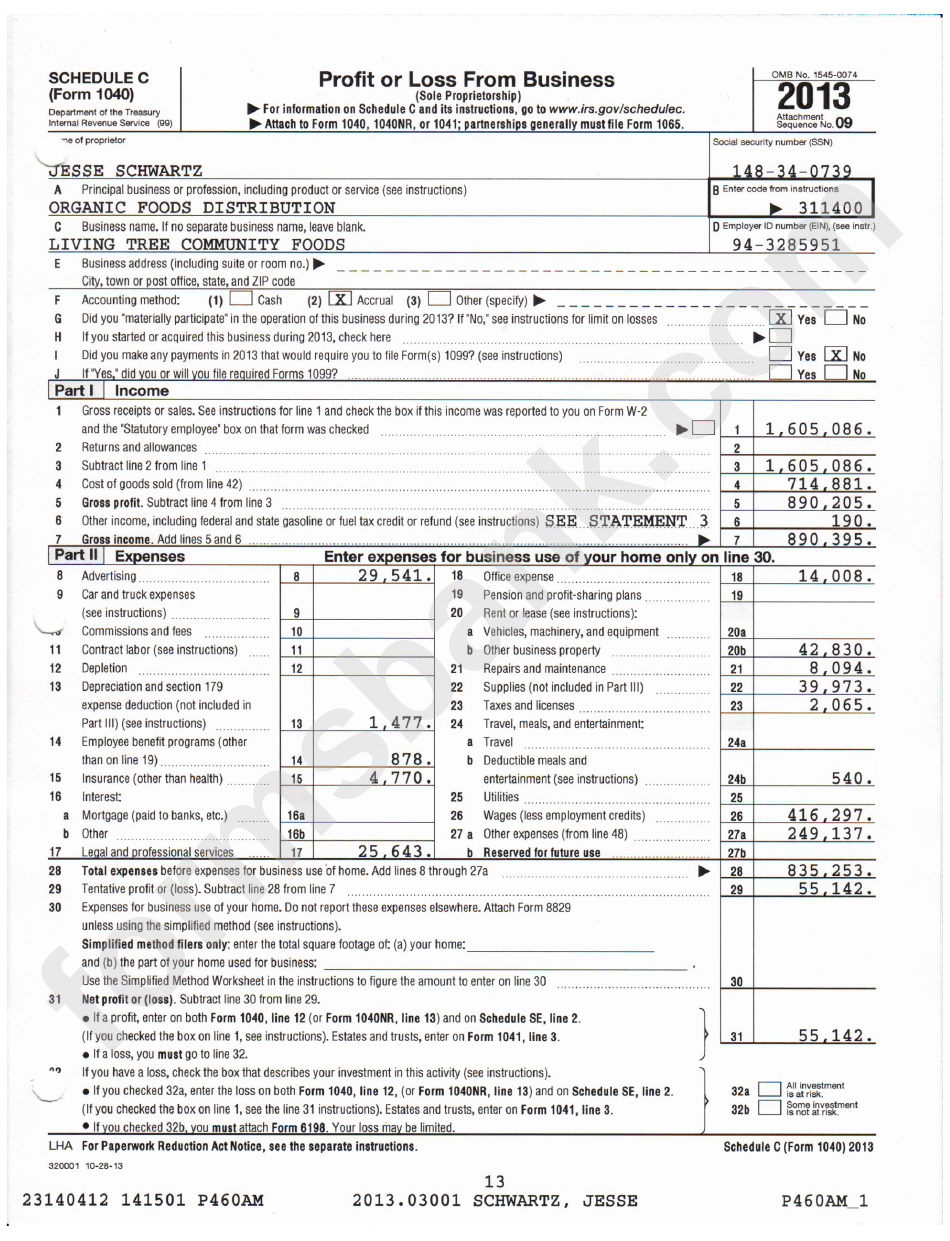

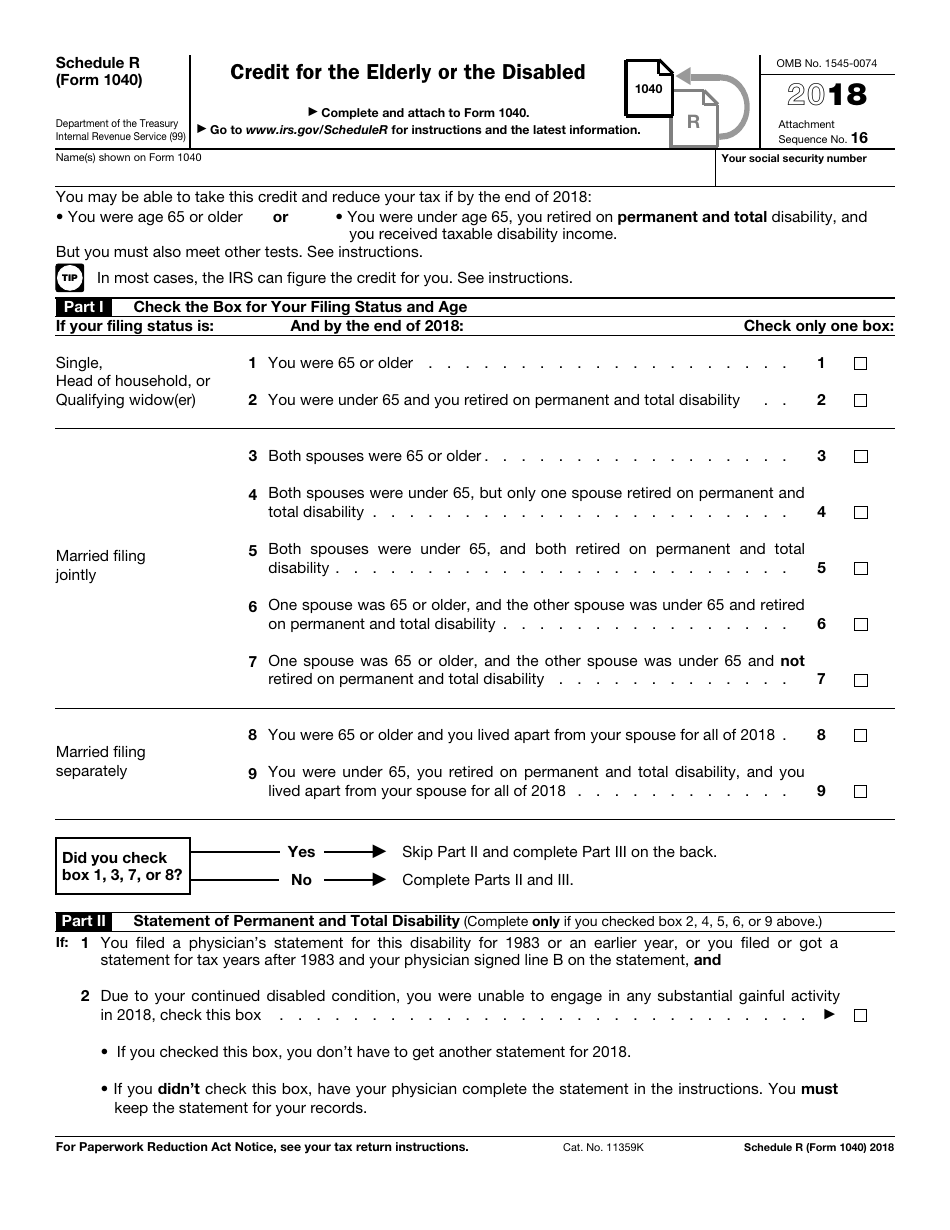

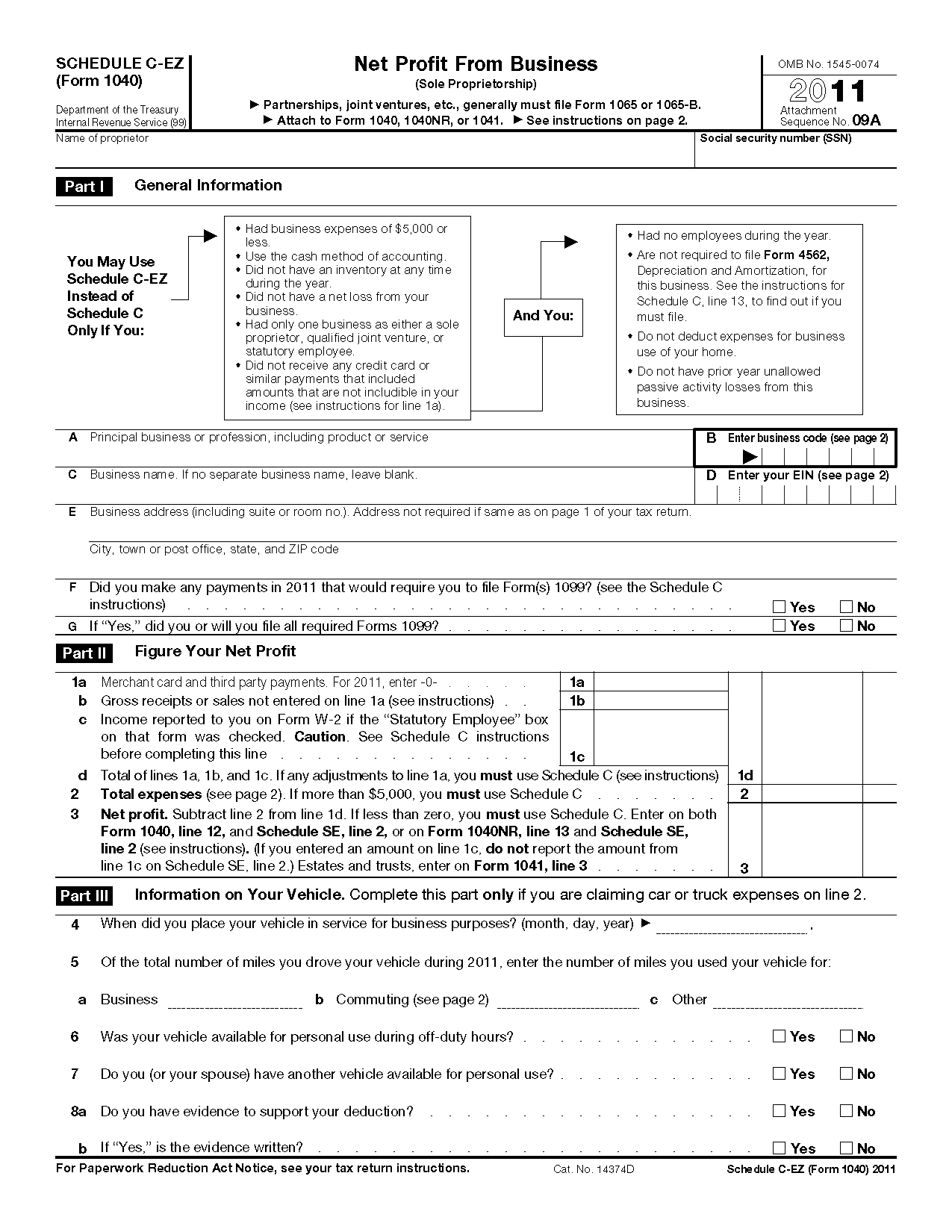

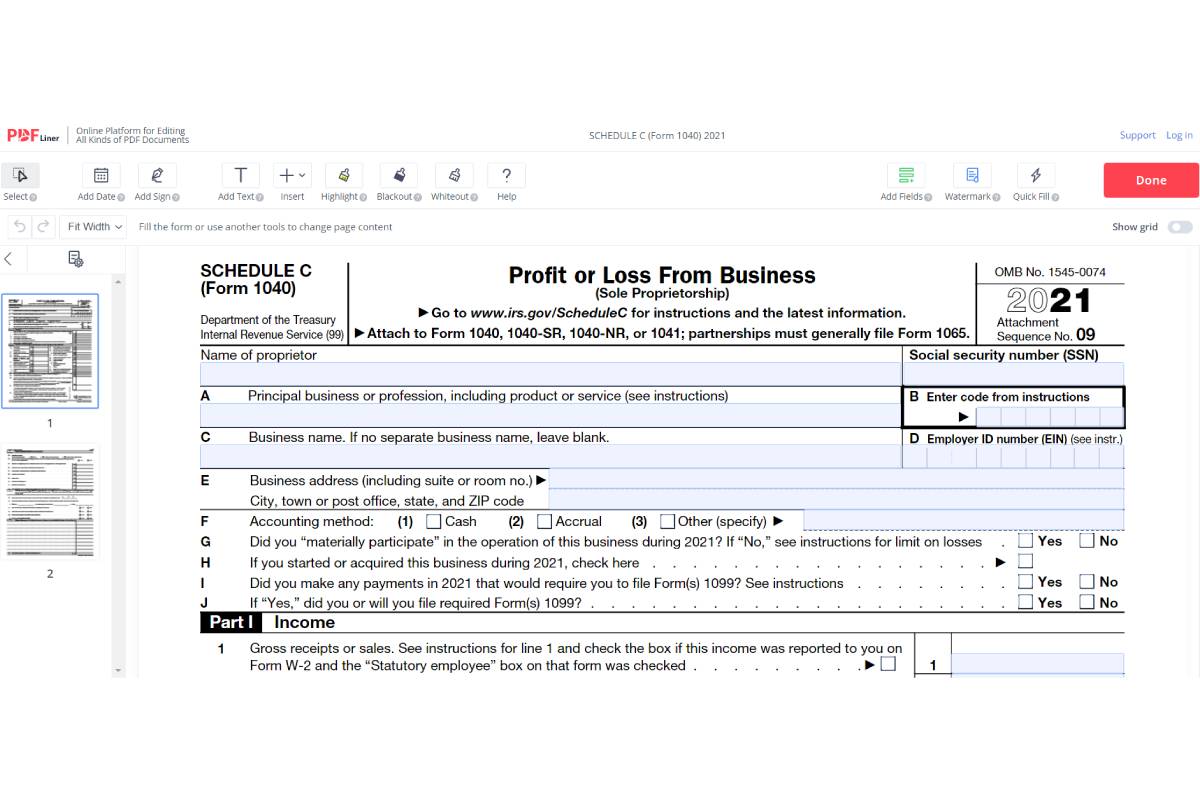

Schedule C Form Printable 2022 - For real estate transactions, be sure to. This form helps individuals calculate their total business income, deduct expenses, and determine their net profit or loss. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. If you disposed of any business assets in 2022, please enter date sold, sales price, and expenses of sale. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Accurate asset valuationconvenient for clients

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Accurate asset valuationconvenient for clients For real estate transactions, be sure to. This form helps individuals calculate their total business income, deduct expenses, and determine their net profit or loss. If you disposed of any business assets in 2022, please enter date sold, sales price, and expenses of sale.

Accurate asset valuationconvenient for clients Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. This form helps individuals calculate their total business income, deduct expenses, and determine their net profit or loss. If you disposed of any business assets in 2022, please enter date sold, sales price, and expenses of sale. For real estate transactions, be sure to.

Fillable Schedule C Irs Form 1040 Printable Pdf Download

For real estate transactions, be sure to. If you disposed of any business assets in 2022, please enter date sold, sales price, and expenses of sale. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Information about schedule c (form 1040), profit or loss from.

Schedule C Instructions for SelfEmployed to File Form 1040

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. For real estate transactions, be sure to. Accurate asset valuationconvenient for clients This form helps individuals calculate their total business income, deduct expenses, and determine their net profit or loss. If you disposed of any business assets.

Form 1040 Schedule C Generator ThePayStubs

Accurate asset valuationconvenient for clients Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. For real estate transactions, be sure to. This.

IRS Form 1040 Schedule C (2022) Profit or Loss From Business

For real estate transactions, be sure to. This form helps individuals calculate their total business income, deduct expenses, and determine their net profit or loss. If you disposed of any business assets in 2022, please enter date sold, sales price, and expenses of sale. Accurate asset valuationconvenient for clients Information about schedule c (form 1040), profit or loss from business,.

What Is Schedule C of Form 1040?

If you disposed of any business assets in 2022, please enter date sold, sales price, and expenses of sale. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Accurate asset valuationconvenient for clients For real estate transactions, be sure to. This form helps individuals calculate.

Schedule C (Form 1040) Fill and sign online with Lumin

Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. For real estate transactions, be sure to. This form helps individuals calculate their.

1040 Schedule C 2022 Fillable PDF Fillable Form 2025

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Accurate asset valuationconvenient for clients Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. For real estate transactions, be sure to. If.

Irs Form 1040 Schedule C 2025 Michael Harris

For real estate transactions, be sure to. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. This form helps individuals calculate their total business income, deduct expenses, and determine their net profit or loss. If you disposed of any business assets in 2022, please enter.

Form 1040 Schedule C Sample Profit Or Loss From Busin vrogue.co

Accurate asset valuationconvenient for clients For real estate transactions, be sure to. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. If.

Fillable Schedule C Irs Form 1040 Printable Pdf Download

For real estate transactions, be sure to. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. This form helps individuals calculate their total business income, deduct expenses, and determine their net profit or loss. Accurate asset valuationconvenient for clients If you disposed of any business.

Accurate Asset Valuationconvenient For Clients

If you disposed of any business assets in 2022, please enter date sold, sales price, and expenses of sale. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. For real estate transactions, be sure to.

:max_bytes(150000):strip_icc()/ScreenShot2022-12-14at2.10.22PM-ed1958c9bbb642398aec3cacd721b244.png)