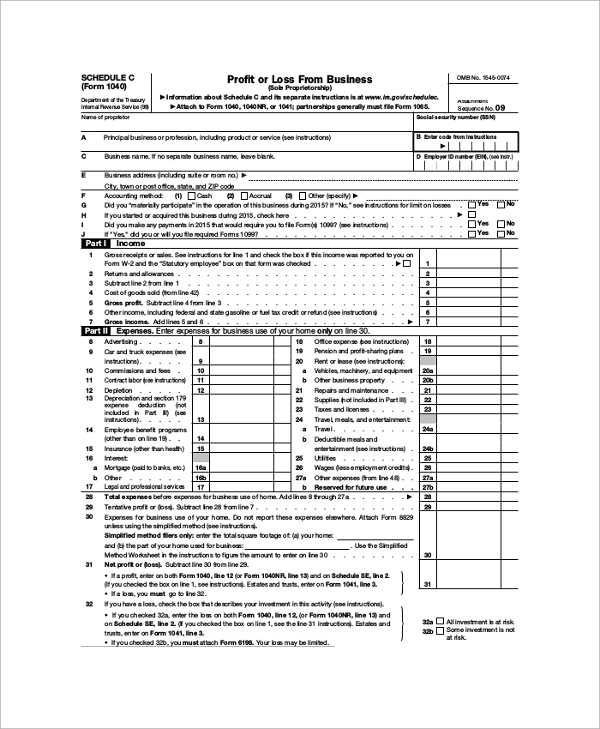

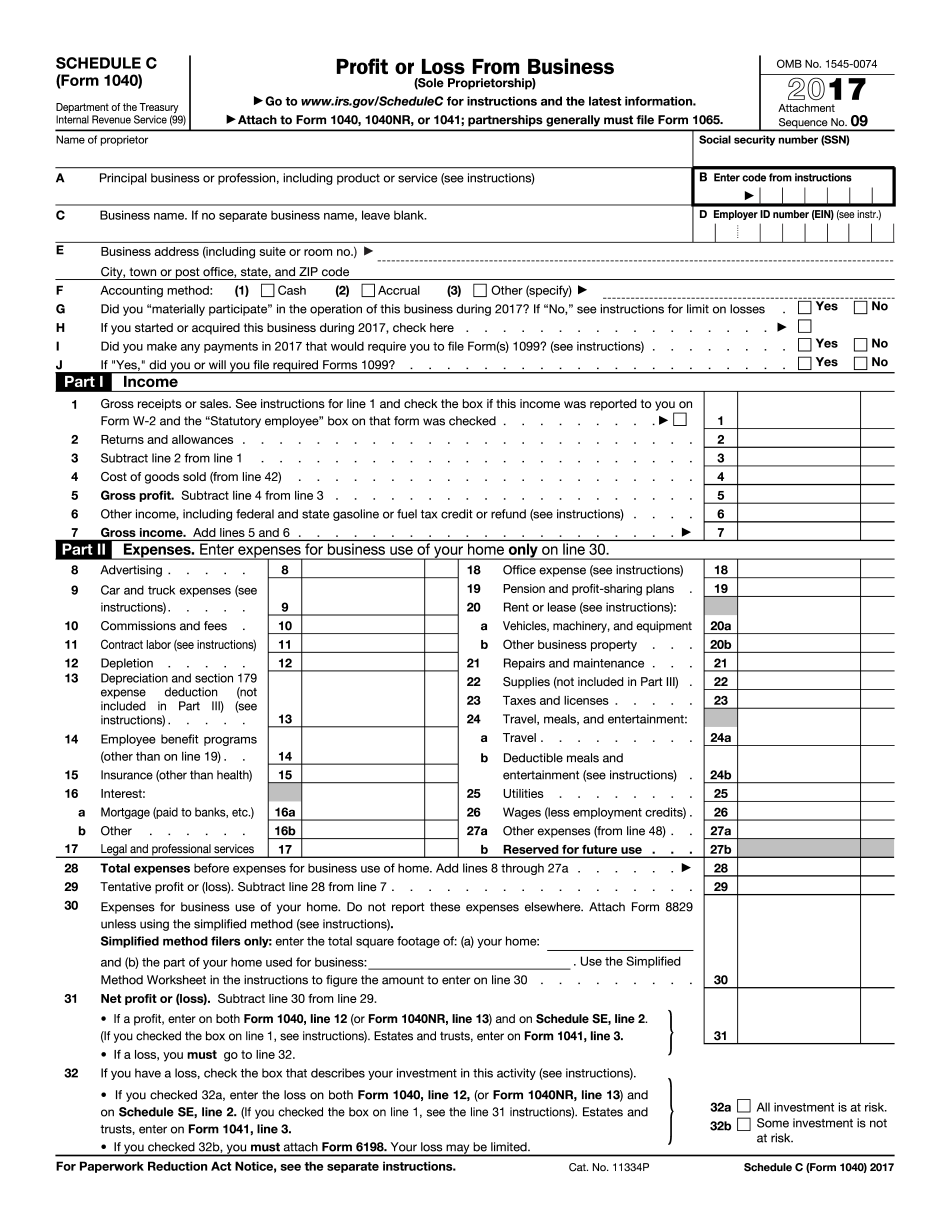

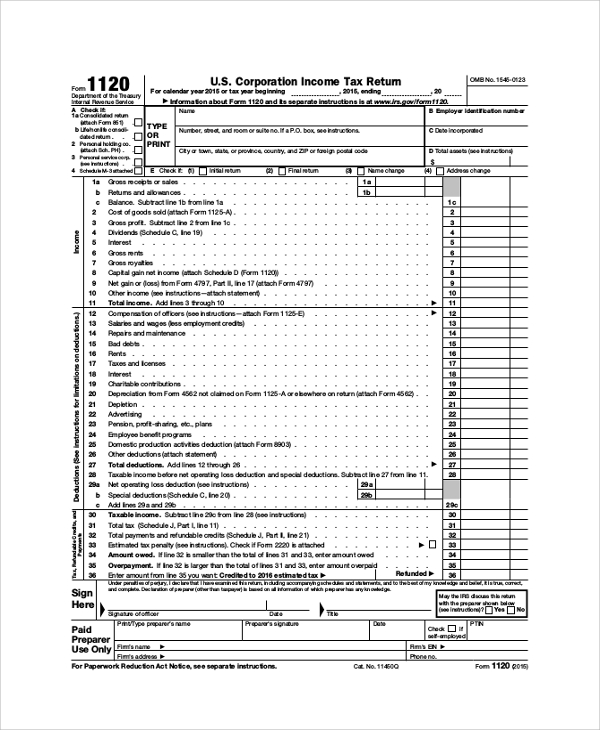

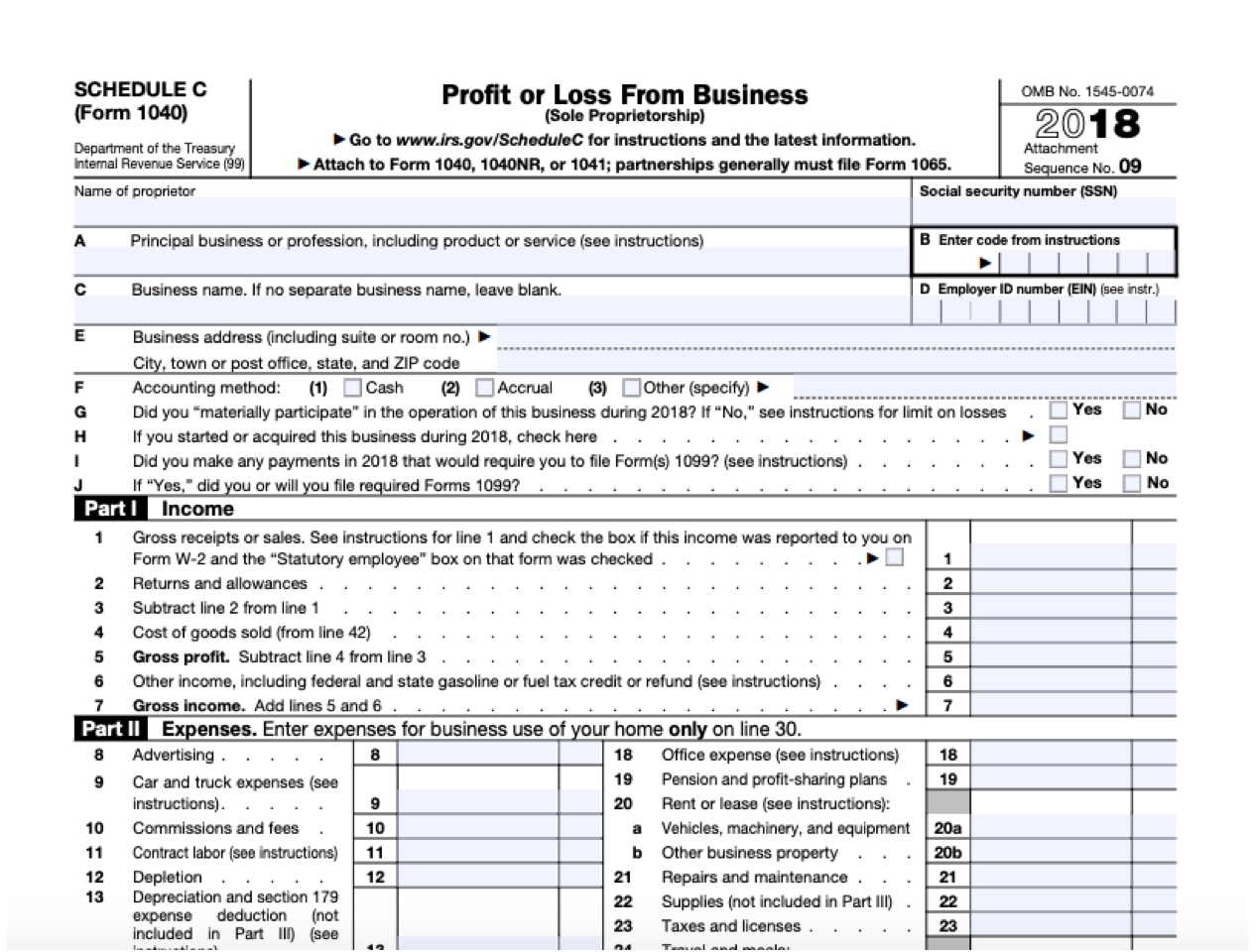

Schedule C 2024 Printable Form - Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040). • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. (if you checked the box on. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. Find the current and previous. Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal.

(if you checked the box on. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040). • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Find the current and previous. Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal.

(if you checked the box on. Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040). Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Find the current and previous. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal.

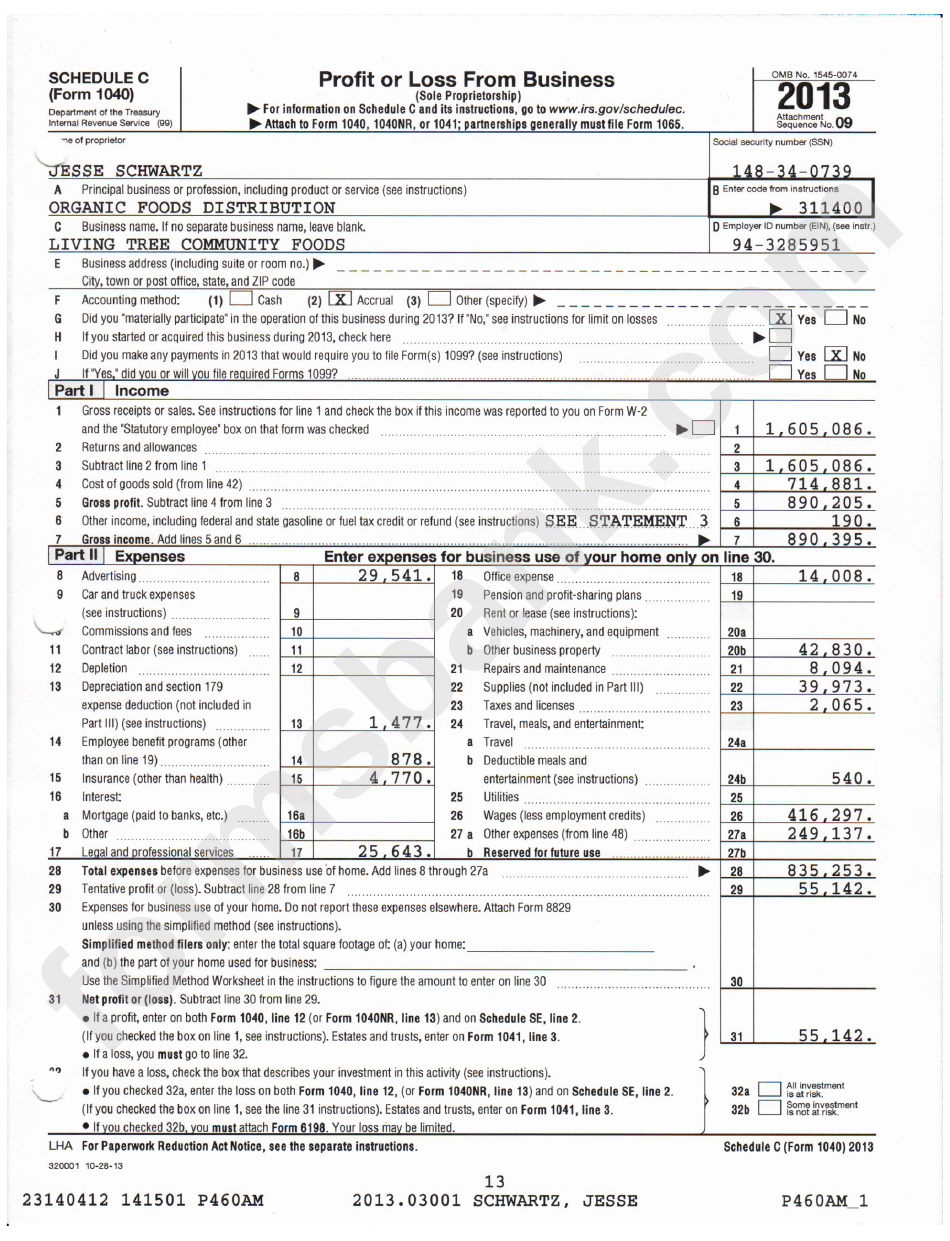

Download Fillable Schedule C Form

(if you checked the box on. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Download or print the 2024 federal (profit or loss from.

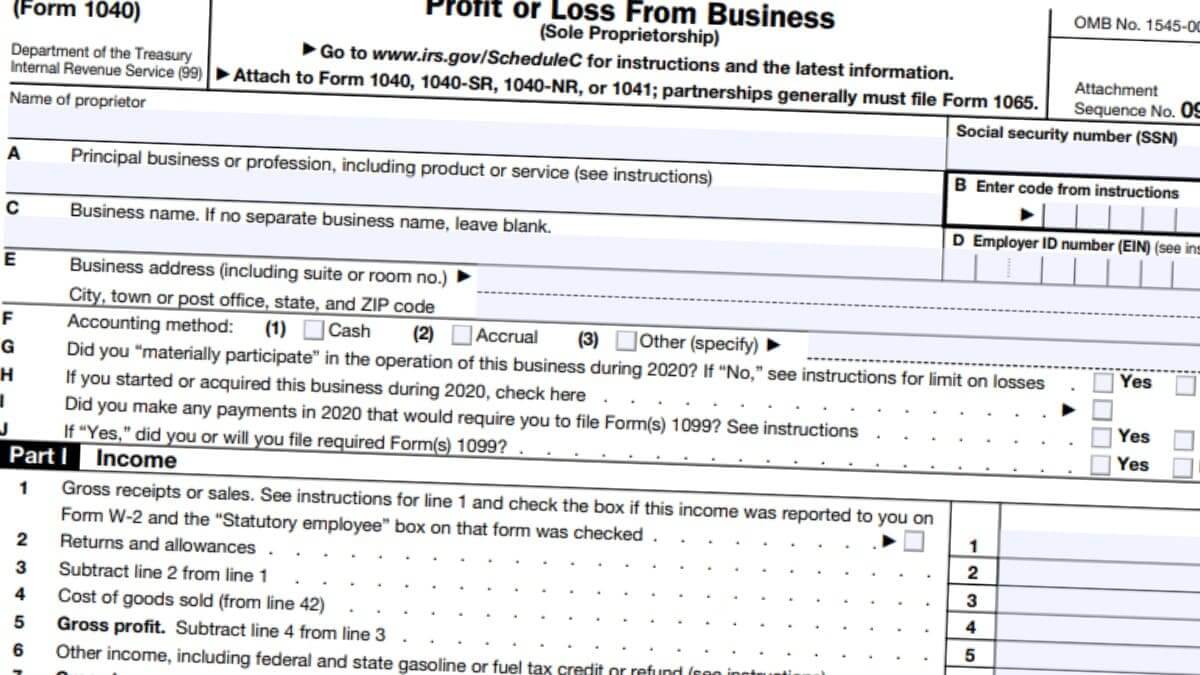

IRS Schedule C (Form 1040) Instructions 2024 Guide Excel Capital

Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040). Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal. Find the current and previous. Use schedule c to report income or loss from a business or profession in which.

2024 Irs Schedule C 2024 Calendar Template Excel

Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040). The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. Find the current and previous. Use schedule c to report income or loss from a business or profession.

2024 1040 Schedule C Ez Bobbi Chrissy

Find the current and previous. (if you checked the box on. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal. Report income or.

Free Printable Schedule C Tax Form

Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040). • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Find the current and previous. Use schedule c to report income or loss from a business or profession in which.

Download Fillable Schedule C Form

Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040). Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal. (if you checked the box on. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is.

Irs Fillable Forms 2024 Schedule C Penny Blondell

Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040). Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal..

Schedule C Tax Form Printable

Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040). The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of.

Schedule C 2024 Herta Giralda

The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal. Report income or loss from a business or profession as a sole proprietor using.

IRS Schedule C (Form 1040) Instructions 2024 Guide Excel Capital

• if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax.

Download Or Print The 2024 Federal (Profit Or Loss From Business (Sole Proprietorship)) (2024) And Other Income Tax Forms From The Federal.

(if you checked the box on. Find the current and previous. Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040). • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2.

Use Schedule C To Report Income Or Loss From A Business Or Profession In Which You Were The Sole Proprietor.

The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole.