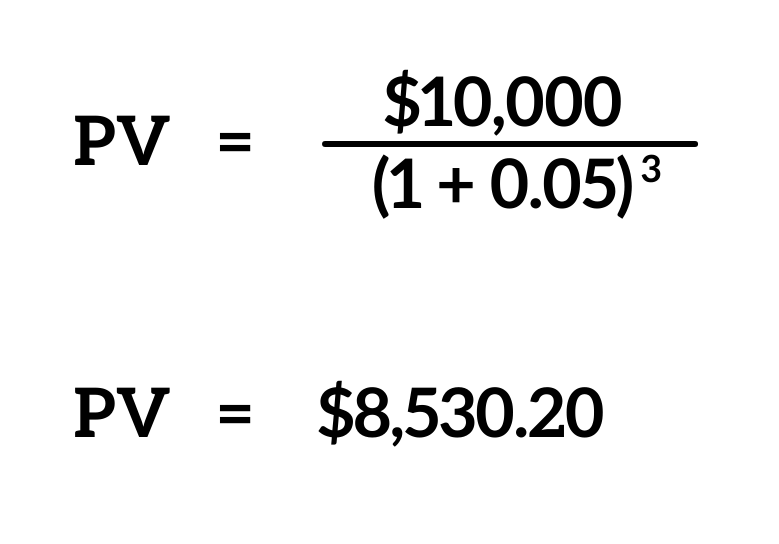

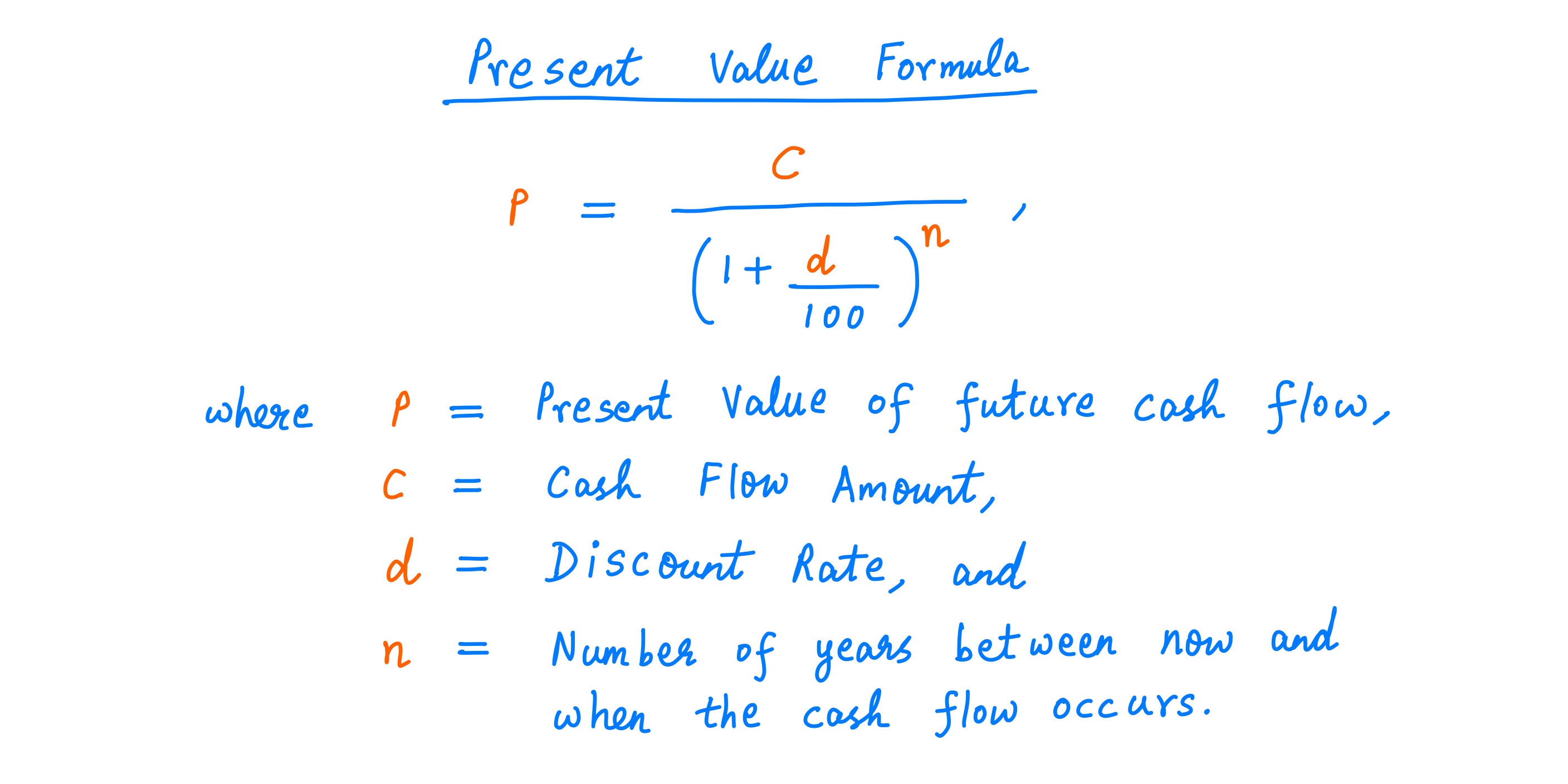

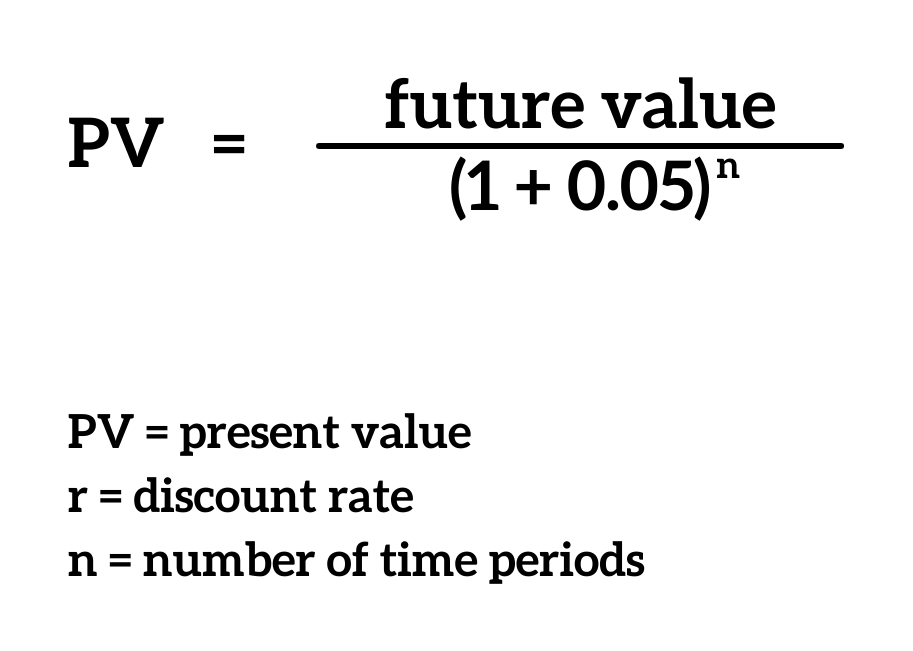

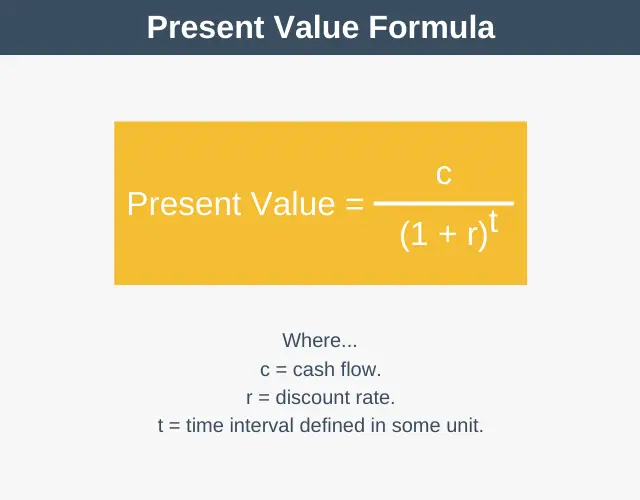

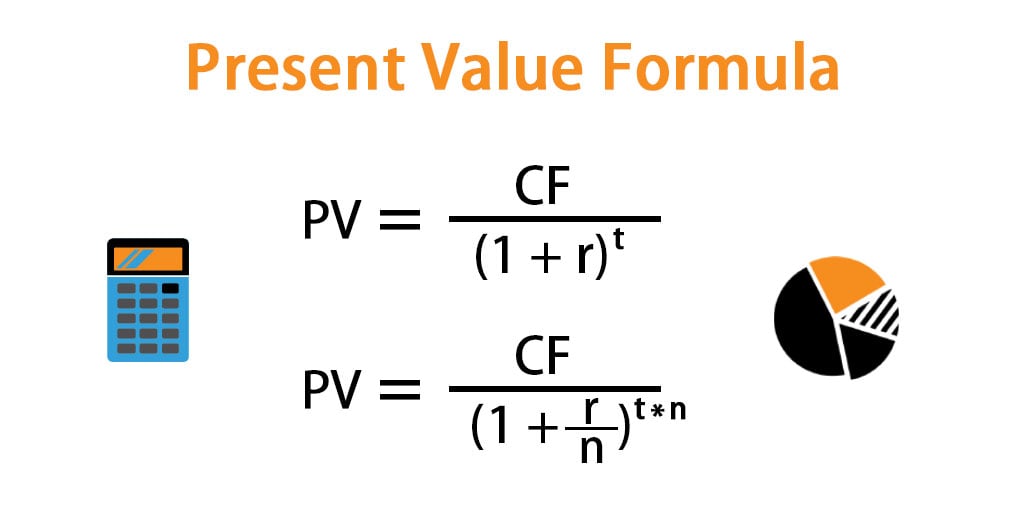

Pv Of Future Cash Flows Formula - At the heart of present value calculations lies a fundamental mathematical formula that translates future cash flows into. The formula used to calculate the present value (pv) divides the future value of a future cash flow by one plus the discount rate. Pv = $10,000 / (1 + 0.05)^5 = $7,835.26. Using the present value formula, the pv of this future cash flow can be calculated as:

Using the present value formula, the pv of this future cash flow can be calculated as: The formula used to calculate the present value (pv) divides the future value of a future cash flow by one plus the discount rate. Pv = $10,000 / (1 + 0.05)^5 = $7,835.26. At the heart of present value calculations lies a fundamental mathematical formula that translates future cash flows into.

Pv = $10,000 / (1 + 0.05)^5 = $7,835.26. At the heart of present value calculations lies a fundamental mathematical formula that translates future cash flows into. The formula used to calculate the present value (pv) divides the future value of a future cash flow by one plus the discount rate. Using the present value formula, the pv of this future cash flow can be calculated as:

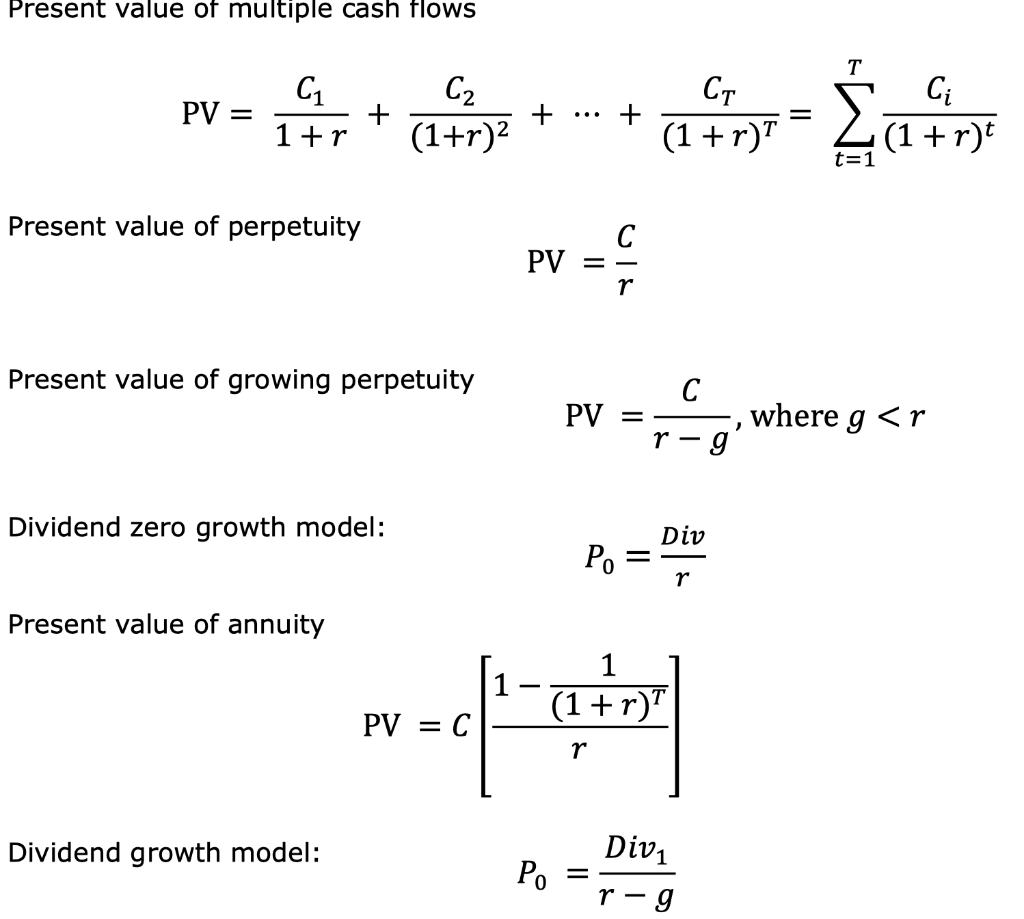

Solved Present value of multiple cash flows CT PV = C1 1+r

The formula used to calculate the present value (pv) divides the future value of a future cash flow by one plus the discount rate. At the heart of present value calculations lies a fundamental mathematical formula that translates future cash flows into. Using the present value formula, the pv of this future cash flow can be calculated as: Pv =.

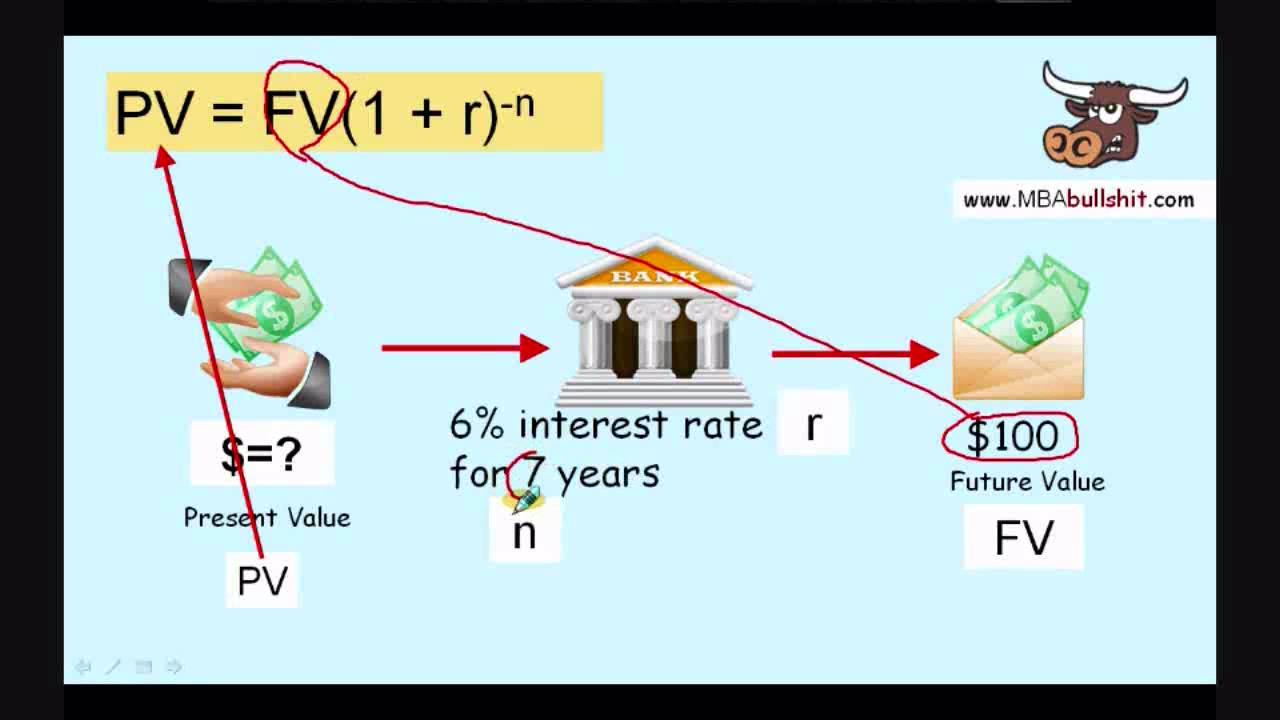

Fv Pv Formula

At the heart of present value calculations lies a fundamental mathematical formula that translates future cash flows into. Pv = $10,000 / (1 + 0.05)^5 = $7,835.26. The formula used to calculate the present value (pv) divides the future value of a future cash flow by one plus the discount rate. Using the present value formula, the pv of this.

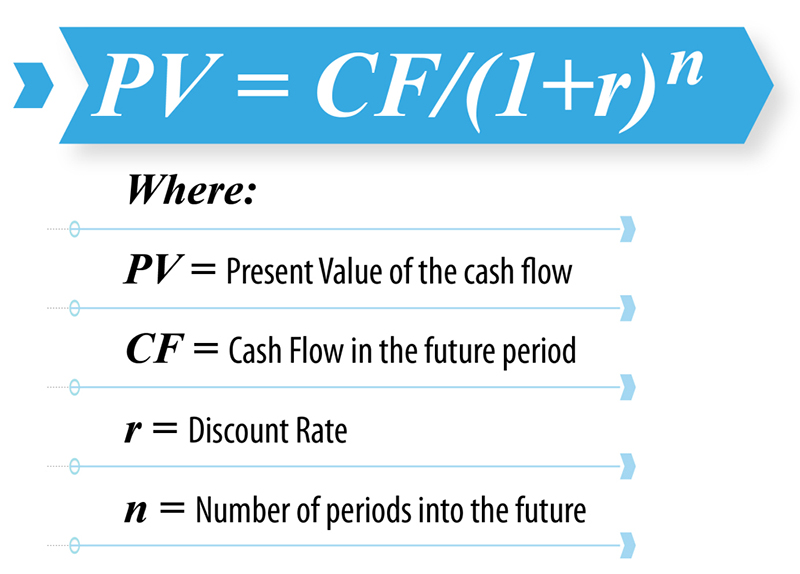

Present Value in Finance Calculations and Applications SuperMoney

The formula used to calculate the present value (pv) divides the future value of a future cash flow by one plus the discount rate. Pv = $10,000 / (1 + 0.05)^5 = $7,835.26. At the heart of present value calculations lies a fundamental mathematical formula that translates future cash flows into. Using the present value formula, the pv of this.

Discounted Cash Flow Analysis Formula, Use, Types & Benefits IBCA

Pv = $10,000 / (1 + 0.05)^5 = $7,835.26. Using the present value formula, the pv of this future cash flow can be calculated as: At the heart of present value calculations lies a fundamental mathematical formula that translates future cash flows into. The formula used to calculate the present value (pv) divides the future value of a future cash.

Present Value Formula

The formula used to calculate the present value (pv) divides the future value of a future cash flow by one plus the discount rate. Using the present value formula, the pv of this future cash flow can be calculated as: At the heart of present value calculations lies a fundamental mathematical formula that translates future cash flows into. Pv =.

Present Value Pv Formula And Calculation Riset

Using the present value formula, the pv of this future cash flow can be calculated as: Pv = $10,000 / (1 + 0.05)^5 = $7,835.26. The formula used to calculate the present value (pv) divides the future value of a future cash flow by one plus the discount rate. At the heart of present value calculations lies a fundamental mathematical.

Present Value in Finance Calculations and Applications SuperMoney

Using the present value formula, the pv of this future cash flow can be calculated as: The formula used to calculate the present value (pv) divides the future value of a future cash flow by one plus the discount rate. Pv = $10,000 / (1 + 0.05)^5 = $7,835.26. At the heart of present value calculations lies a fundamental mathematical.

Present Value Excel Template

At the heart of present value calculations lies a fundamental mathematical formula that translates future cash flows into. The formula used to calculate the present value (pv) divides the future value of a future cash flow by one plus the discount rate. Using the present value formula, the pv of this future cash flow can be calculated as: Pv =.

Net Present Value Explained

Using the present value formula, the pv of this future cash flow can be calculated as: The formula used to calculate the present value (pv) divides the future value of a future cash flow by one plus the discount rate. Pv = $10,000 / (1 + 0.05)^5 = $7,835.26. At the heart of present value calculations lies a fundamental mathematical.

Present Value Formula for Continuous Compounding Kline Durged

Using the present value formula, the pv of this future cash flow can be calculated as: The formula used to calculate the present value (pv) divides the future value of a future cash flow by one plus the discount rate. Pv = $10,000 / (1 + 0.05)^5 = $7,835.26. At the heart of present value calculations lies a fundamental mathematical.

The Formula Used To Calculate The Present Value (Pv) Divides The Future Value Of A Future Cash Flow By One Plus The Discount Rate.

Using the present value formula, the pv of this future cash flow can be calculated as: At the heart of present value calculations lies a fundamental mathematical formula that translates future cash flows into. Pv = $10,000 / (1 + 0.05)^5 = $7,835.26.