Net Worth Calculation For Ind As - Ind as is mandatory based on net worth and listing for companies and financial sector entities. During the second phase, ind as became mandatory for specific companies: Net worth is calculated from audited standalone. Ind as are set of accounting standards notified by ministry of corporate affairs (mca), converged with international financial reporting standards. Four phases for convergence to ind as from current accounting standards have been notified by the ministy of corporate. Listed and unlisted companies with a net worth of rs.

Four phases for convergence to ind as from current accounting standards have been notified by the ministy of corporate. Ind as are set of accounting standards notified by ministry of corporate affairs (mca), converged with international financial reporting standards. During the second phase, ind as became mandatory for specific companies: Ind as is mandatory based on net worth and listing for companies and financial sector entities. Listed and unlisted companies with a net worth of rs. Net worth is calculated from audited standalone.

Four phases for convergence to ind as from current accounting standards have been notified by the ministy of corporate. Listed and unlisted companies with a net worth of rs. Net worth is calculated from audited standalone. During the second phase, ind as became mandatory for specific companies: Ind as is mandatory based on net worth and listing for companies and financial sector entities. Ind as are set of accounting standards notified by ministry of corporate affairs (mca), converged with international financial reporting standards.

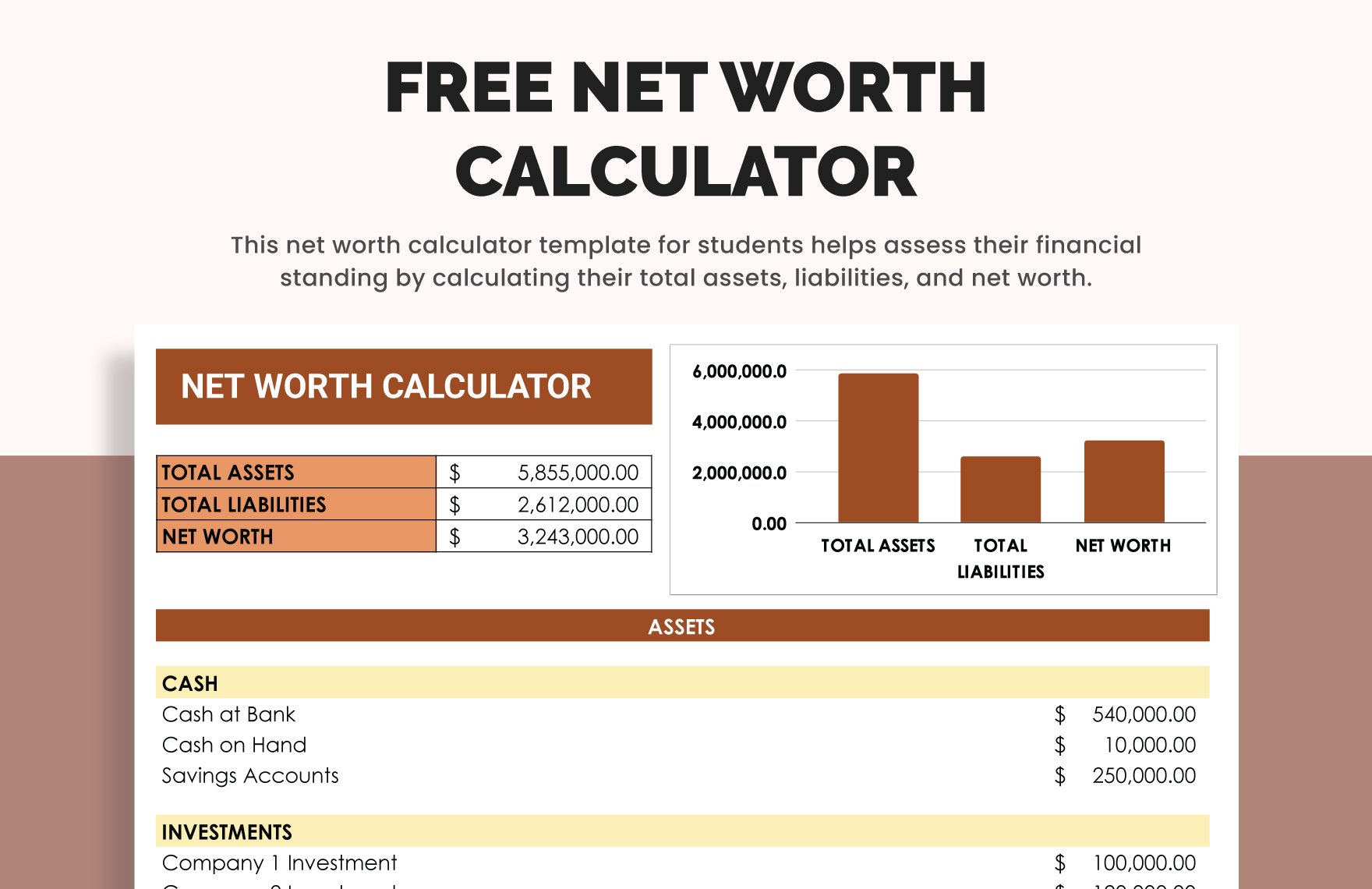

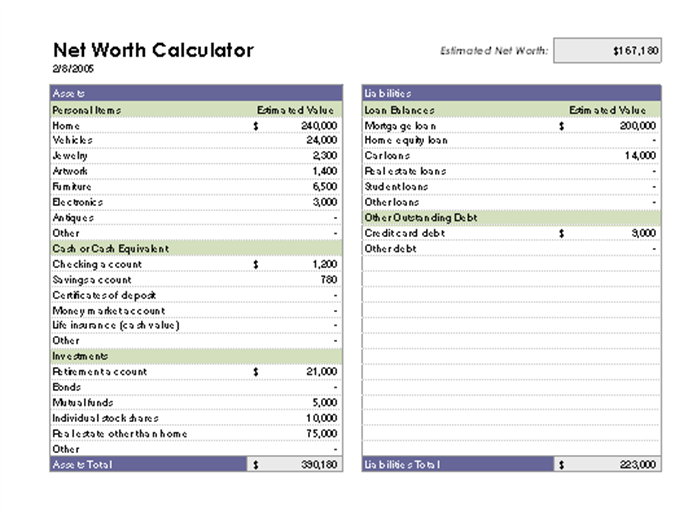

Net Worth Calculator in Excel, Google Sheets Download

Ind as are set of accounting standards notified by ministry of corporate affairs (mca), converged with international financial reporting standards. Four phases for convergence to ind as from current accounting standards have been notified by the ministy of corporate. During the second phase, ind as became mandatory for specific companies: Ind as is mandatory based on net worth and listing.

Net Worth Calculator Balance Sheet Assets and Liabilities Etsy

Listed and unlisted companies with a net worth of rs. During the second phase, ind as became mandatory for specific companies: Ind as are set of accounting standards notified by ministry of corporate affairs (mca), converged with international financial reporting standards. Net worth is calculated from audited standalone. Ind as is mandatory based on net worth and listing for companies.

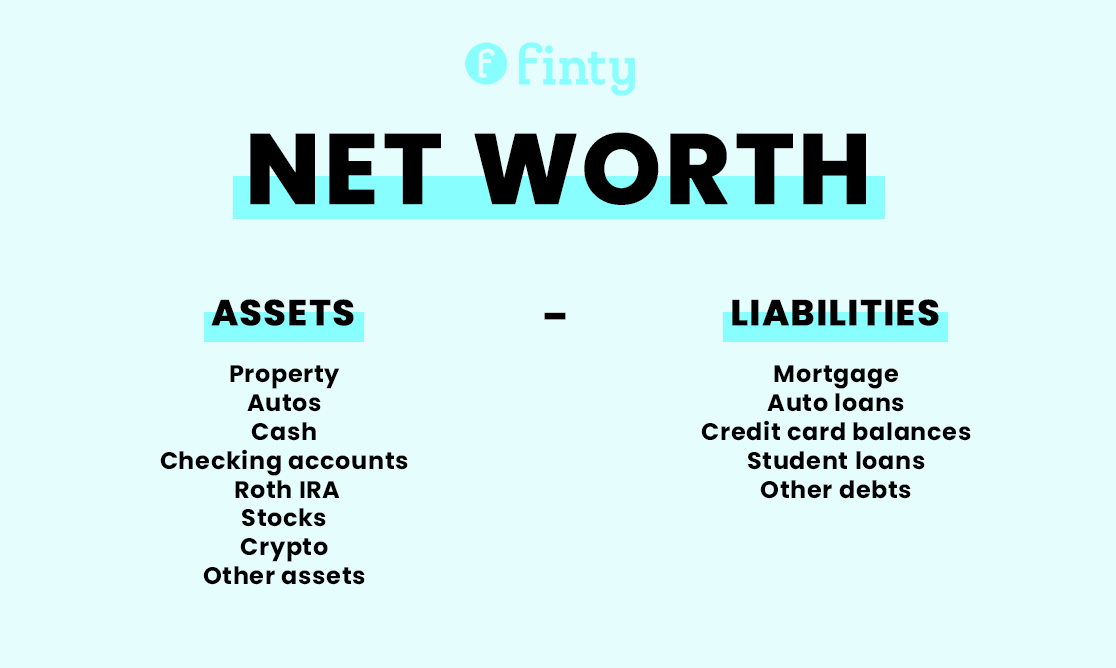

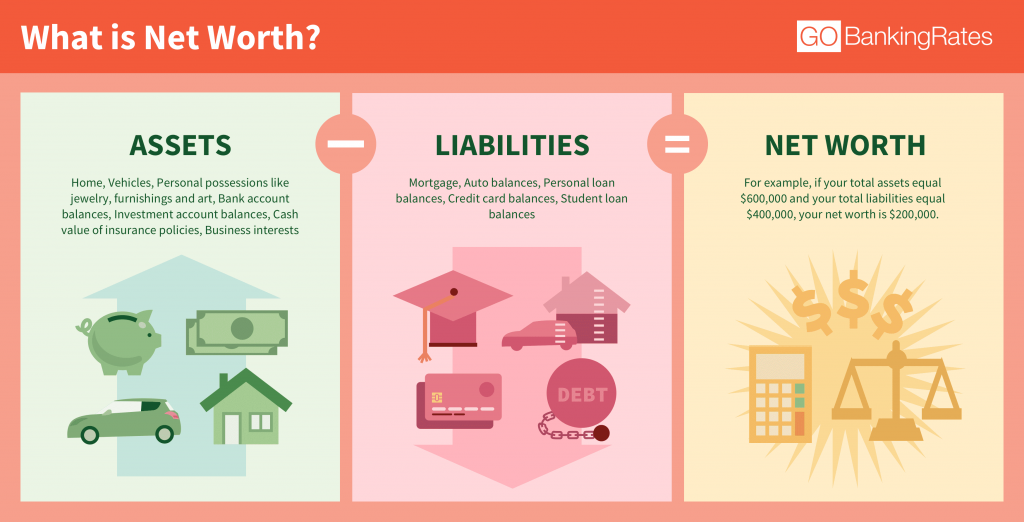

What is Net Worth? (And How to Calculate yours)

During the second phase, ind as became mandatory for specific companies: Four phases for convergence to ind as from current accounting standards have been notified by the ministy of corporate. Listed and unlisted companies with a net worth of rs. Net worth is calculated from audited standalone. Ind as is mandatory based on net worth and listing for companies and.

Net Worth Template Excel

Net worth is calculated from audited standalone. During the second phase, ind as became mandatory for specific companies: Listed and unlisted companies with a net worth of rs. Ind as is mandatory based on net worth and listing for companies and financial sector entities. Four phases for convergence to ind as from current accounting standards have been notified by the.

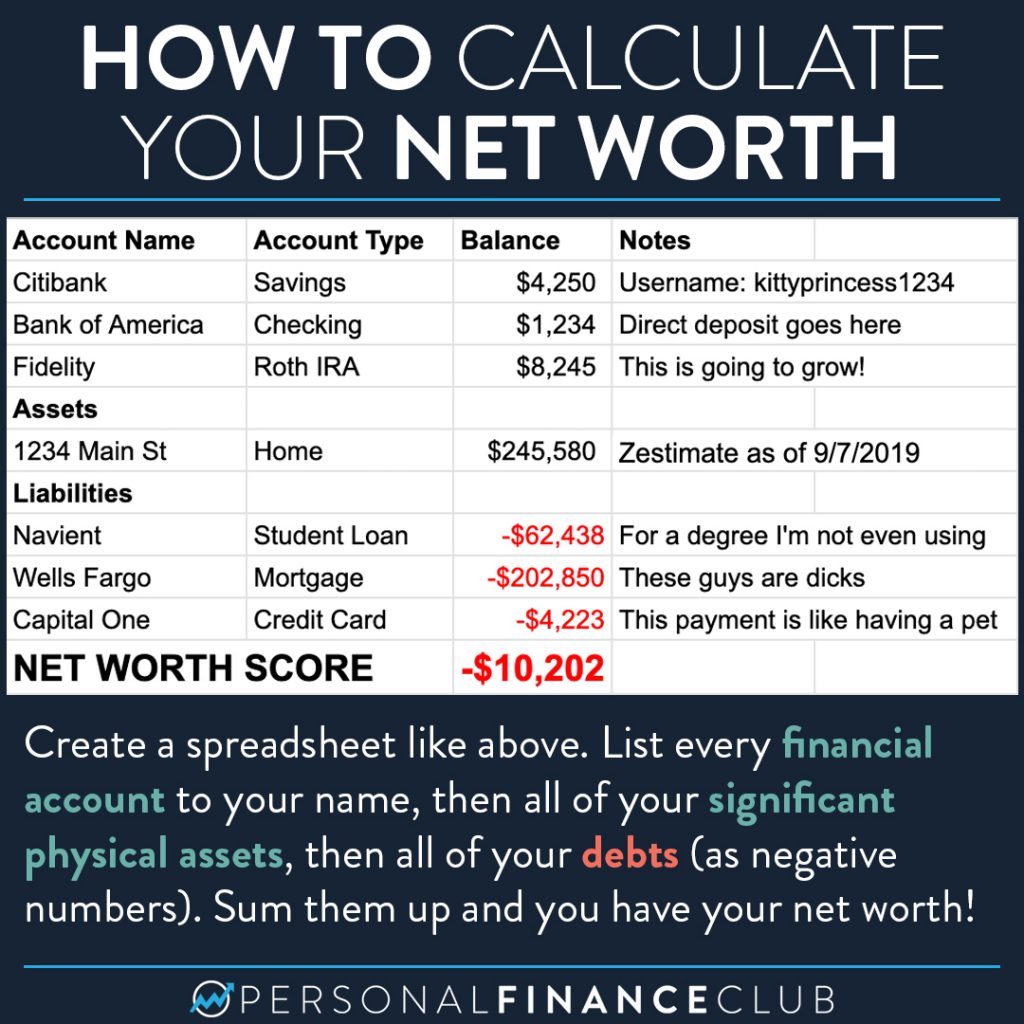

Calculating Your Net Worth Worksheet

Ind as is mandatory based on net worth and listing for companies and financial sector entities. Ind as are set of accounting standards notified by ministry of corporate affairs (mca), converged with international financial reporting standards. Four phases for convergence to ind as from current accounting standards have been notified by the ministy of corporate. Listed and unlisted companies with.

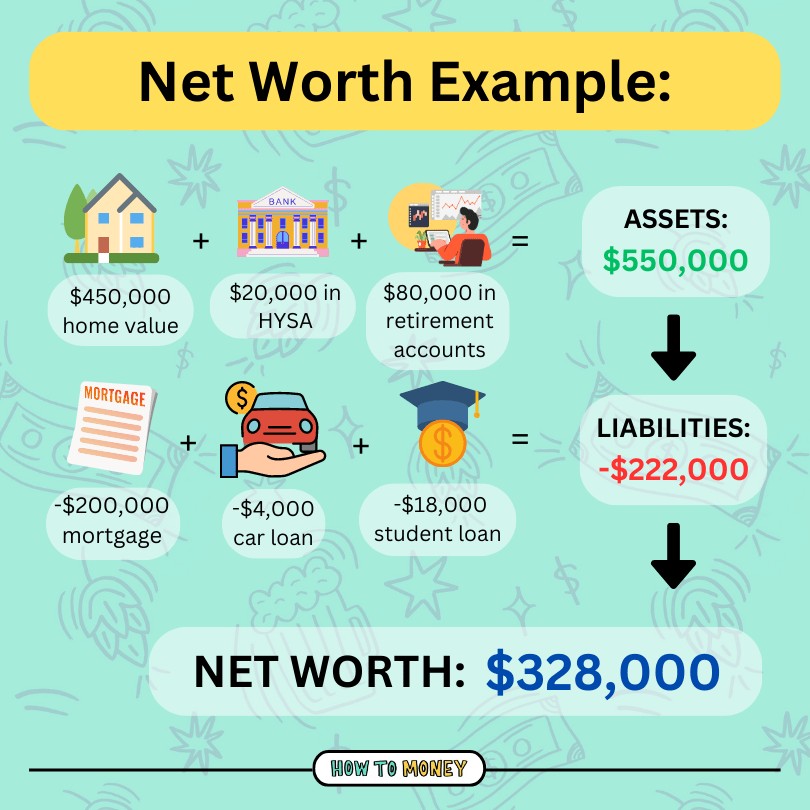

Net Worth Here’s Everything You Need To Know How to Money

Listed and unlisted companies with a net worth of rs. Ind as is mandatory based on net worth and listing for companies and financial sector entities. Ind as are set of accounting standards notified by ministry of corporate affairs (mca), converged with international financial reporting standards. Net worth is calculated from audited standalone. Four phases for convergence to ind as.

Net Worth Definition As Per Companies Act at Tawny Priscilla blog

Ind as are set of accounting standards notified by ministry of corporate affairs (mca), converged with international financial reporting standards. Ind as is mandatory based on net worth and listing for companies and financial sector entities. Net worth is calculated from audited standalone. During the second phase, ind as became mandatory for specific companies: Listed and unlisted companies with a.

Net Worth Calculator, Balance Sheet, Assets and Liabilities Excel

Ind as is mandatory based on net worth and listing for companies and financial sector entities. Four phases for convergence to ind as from current accounting standards have been notified by the ministy of corporate. During the second phase, ind as became mandatory for specific companies: Listed and unlisted companies with a net worth of rs. Ind as are set.

Net Worth Calculator Template

Net worth is calculated from audited standalone. Ind as are set of accounting standards notified by ministry of corporate affairs (mca), converged with international financial reporting standards. Four phases for convergence to ind as from current accounting standards have been notified by the ministy of corporate. Ind as is mandatory based on net worth and listing for companies and financial.

Tn Net Worth Calculation at Guillermo Brianna blog

Four phases for convergence to ind as from current accounting standards have been notified by the ministy of corporate. Listed and unlisted companies with a net worth of rs. Ind as is mandatory based on net worth and listing for companies and financial sector entities. Net worth is calculated from audited standalone. During the second phase, ind as became mandatory.

Listed And Unlisted Companies With A Net Worth Of Rs.

Net worth is calculated from audited standalone. Ind as are set of accounting standards notified by ministry of corporate affairs (mca), converged with international financial reporting standards. Ind as is mandatory based on net worth and listing for companies and financial sector entities. Four phases for convergence to ind as from current accounting standards have been notified by the ministy of corporate.