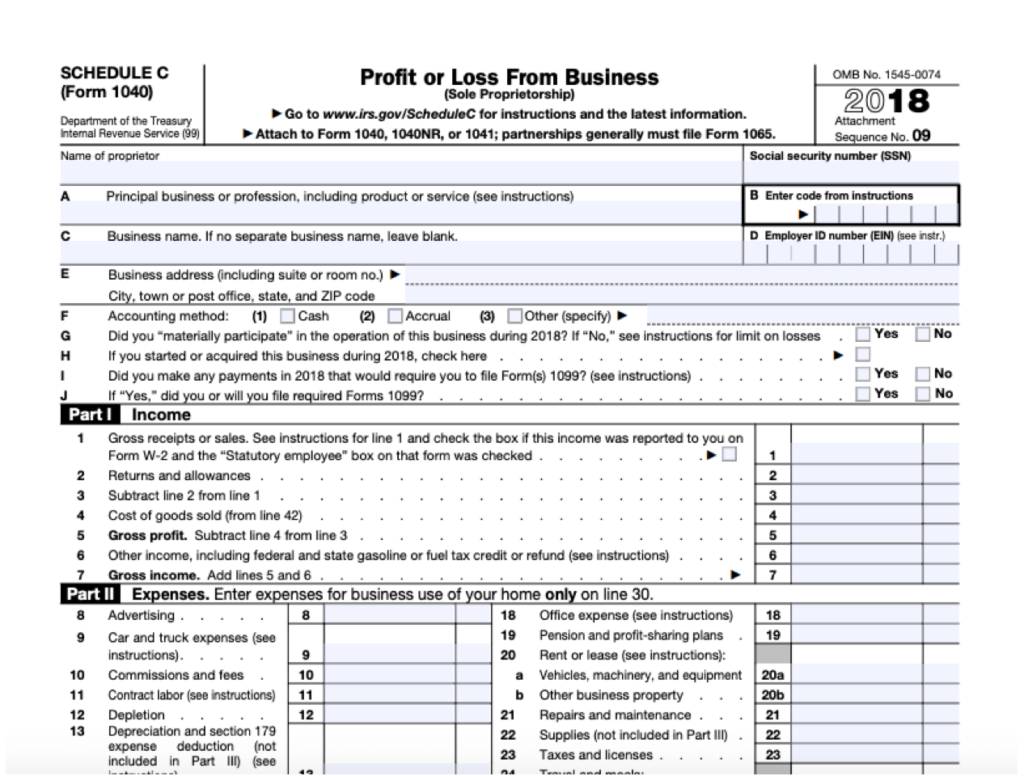

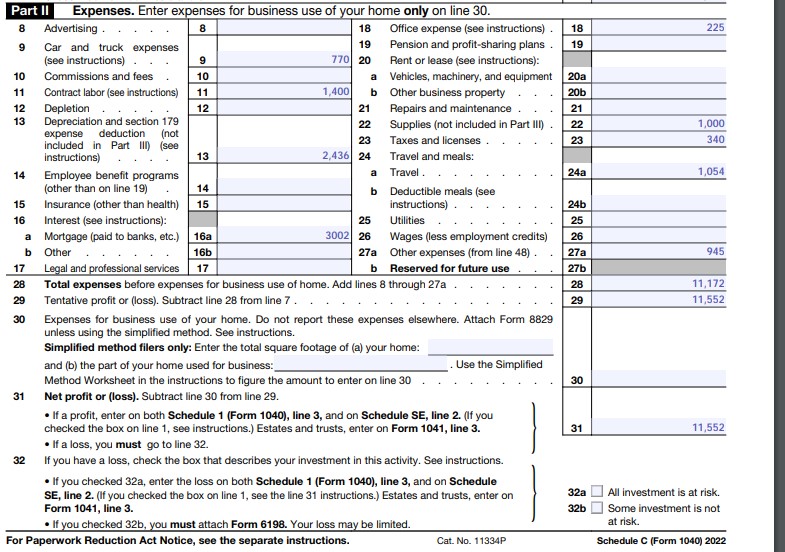

Instructions For 2024 Schedule C - Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. In this article, we’ll walk you through everything you need to know about the schedule c tax form, from what it is to how to. What is irs schedule c (form 1040)? (if you checked the box on. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor.

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. What is irs schedule c (form 1040)? (if you checked the box on. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. In this article, we’ll walk you through everything you need to know about the schedule c tax form, from what it is to how to.

What is irs schedule c (form 1040)? In this article, we’ll walk you through everything you need to know about the schedule c tax form, from what it is to how to. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. (if you checked the box on. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor.

Schedule C Instructions 2024 Instructions Ivett Letisha

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. (if you checked the box on. In this article, we’ll walk you through.

IRS Schedule C (Form 1040) Instructions 2024 Guide Excel Capital

(if you checked the box on. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. • if you checked 32a, enter the.

IRS Schedule C (Form 1040) Instructions 2024 Guide Excel Capital

Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. In this article, we’ll walk you through everything you need to know about the schedule c tax form, from what it is to how to. Information about schedule c (form 1040), profit or loss from business,.

2024 Instructions For Forms 2024C And 2024C C Corp Cathie Doralyn

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. (if you checked the box on. What is irs schedule c (form 1040)? • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Use schedule.

Instructions For Schedule C 2024 Retha Hyacinthia

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. • if you checked 32a, enter the loss on both schedule 1 (form.

2024 Instructions For Forms 2024C And 2024C Csc Kitti Lindsay

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. What is irs schedule c (form 1040)? • if you checked 32a, enter.

2024 Instructions Schedule C domino's pizza carte

Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. (if you checked the box on. What is irs schedule c (form 1040)? • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. In.

2024 Form 1040 Schedule C Instructions Meaning Lydia Rochell

What is irs schedule c (form 1040)? Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. (if you checked the box on..

2024 Schedule C Alia Louise

(if you checked the box on. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. In this article, we’ll walk you through everything you need to know about the schedule c tax form, from what it is to how to. • if you checked 32a, enter.

Schedule C Instructions 2024 Pdf Download Roxy Catarina

Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. (if you checked the box on. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. What is irs schedule c (form 1040)? Information.

Information About Schedule C (Form 1040), Profit Or Loss From Business, Used To Report Income Or Loss From A Business Operated Or Profession.

Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. (if you checked the box on. In this article, we’ll walk you through everything you need to know about the schedule c tax form, from what it is to how to. What is irs schedule c (form 1040)?

:max_bytes(150000):strip_icc()/ScheduleC-ProfitorLossfromBusiness-1-2b9fe42e669342c783bbaae69e570415.png)