E Invoice Malaysia Implementation - This guide explains the phased implementation timeline, starting august 2024. Irbm is actively conducting a series of engagement sessions with industry players, tax practitioners, professional bodies and identified. #1 ai crm for salestrusted ai for sellers

Irbm is actively conducting a series of engagement sessions with industry players, tax practitioners, professional bodies and identified. This guide explains the phased implementation timeline, starting august 2024. #1 ai crm for salestrusted ai for sellers

This guide explains the phased implementation timeline, starting august 2024. Irbm is actively conducting a series of engagement sessions with industry players, tax practitioners, professional bodies and identified. #1 ai crm for salestrusted ai for sellers

Implementation of eInvoicing Malaysia Sage 300 Malaysia

#1 ai crm for salestrusted ai for sellers Irbm is actively conducting a series of engagement sessions with industry players, tax practitioners, professional bodies and identified. This guide explains the phased implementation timeline, starting august 2024.

Understanding Malaysia's EInvoicing Landscape A Comprehensive Guide

Irbm is actively conducting a series of engagement sessions with industry players, tax practitioners, professional bodies and identified. #1 ai crm for salestrusted ai for sellers This guide explains the phased implementation timeline, starting august 2024.

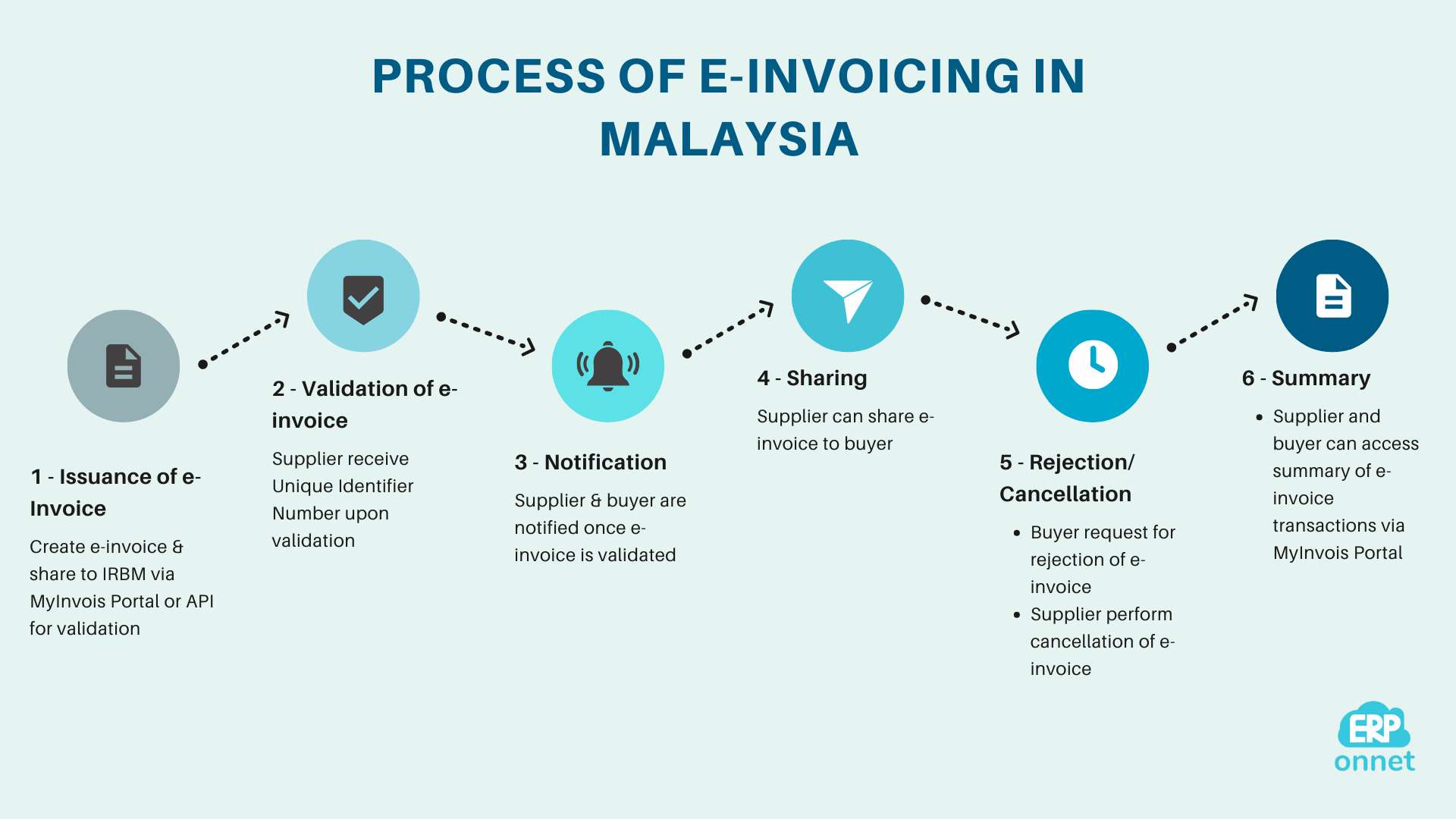

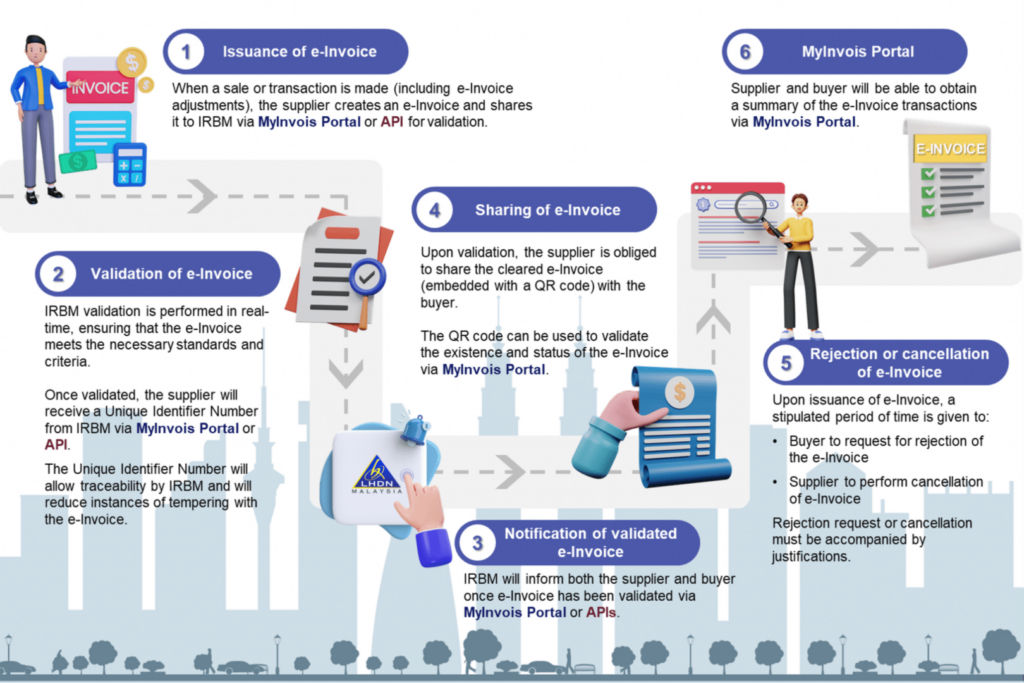

Introduction & Implementation of EInvoicing in Malaysia

This guide explains the phased implementation timeline, starting august 2024. Irbm is actively conducting a series of engagement sessions with industry players, tax practitioners, professional bodies and identified. #1 ai crm for salestrusted ai for sellers

Implementation of EInvoicing Malaysia IVAOTR

#1 ai crm for salestrusted ai for sellers This guide explains the phased implementation timeline, starting august 2024. Irbm is actively conducting a series of engagement sessions with industry players, tax practitioners, professional bodies and identified.

Malaysia E Invoicing 2024 Magda Roselle

This guide explains the phased implementation timeline, starting august 2024. #1 ai crm for salestrusted ai for sellers Irbm is actively conducting a series of engagement sessions with industry players, tax practitioners, professional bodies and identified.

EInvoicing in Malaysia System Overview and Implementation Process

#1 ai crm for salestrusted ai for sellers This guide explains the phased implementation timeline, starting august 2024. Irbm is actively conducting a series of engagement sessions with industry players, tax practitioners, professional bodies and identified.

The Implementation of EInvoicing in Malaysia A Digital Leap Forward

Irbm is actively conducting a series of engagement sessions with industry players, tax practitioners, professional bodies and identified. #1 ai crm for salestrusted ai for sellers This guide explains the phased implementation timeline, starting august 2024.

Malaysia LHDN eInvoice Guidelines 50 QnA L & Co Accountants

This guide explains the phased implementation timeline, starting august 2024. #1 ai crm for salestrusted ai for sellers Irbm is actively conducting a series of engagement sessions with industry players, tax practitioners, professional bodies and identified.

Adapting to EInvoicing A New Era for Malaysian Businesses SiteGiant

Irbm is actively conducting a series of engagement sessions with industry players, tax practitioners, professional bodies and identified. #1 ai crm for salestrusted ai for sellers This guide explains the phased implementation timeline, starting august 2024.

2024 LHDN EInvoicing Malaysia How it impact your business

#1 ai crm for salestrusted ai for sellers Irbm is actively conducting a series of engagement sessions with industry players, tax practitioners, professional bodies and identified. This guide explains the phased implementation timeline, starting august 2024.

#1 Ai Crm For Salestrusted Ai For Sellers

Irbm is actively conducting a series of engagement sessions with industry players, tax practitioners, professional bodies and identified. This guide explains the phased implementation timeline, starting august 2024.