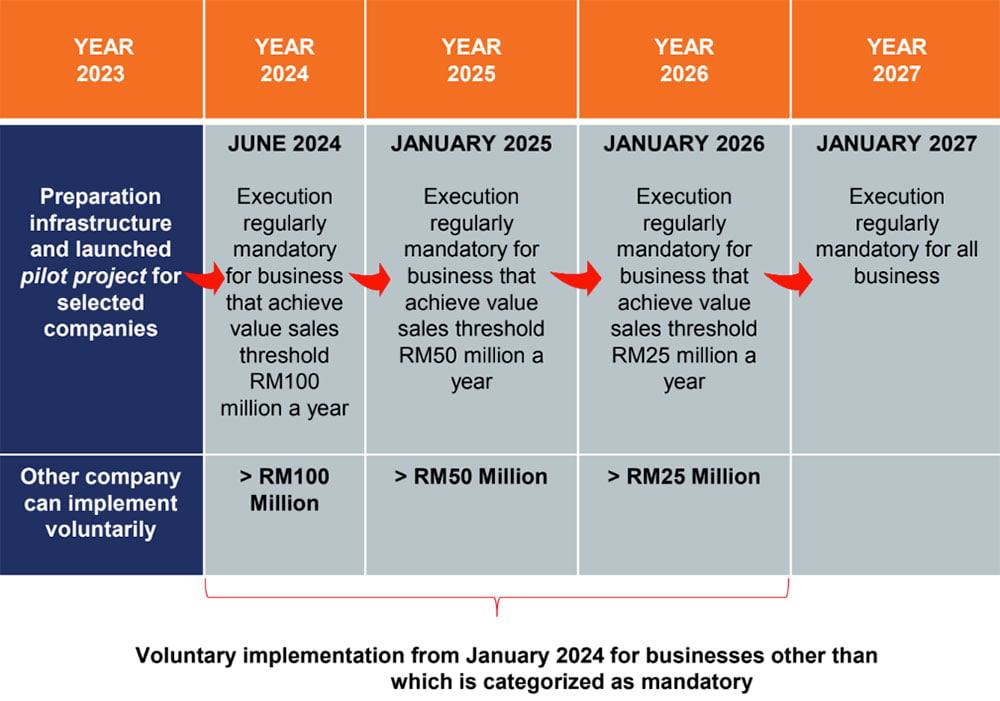

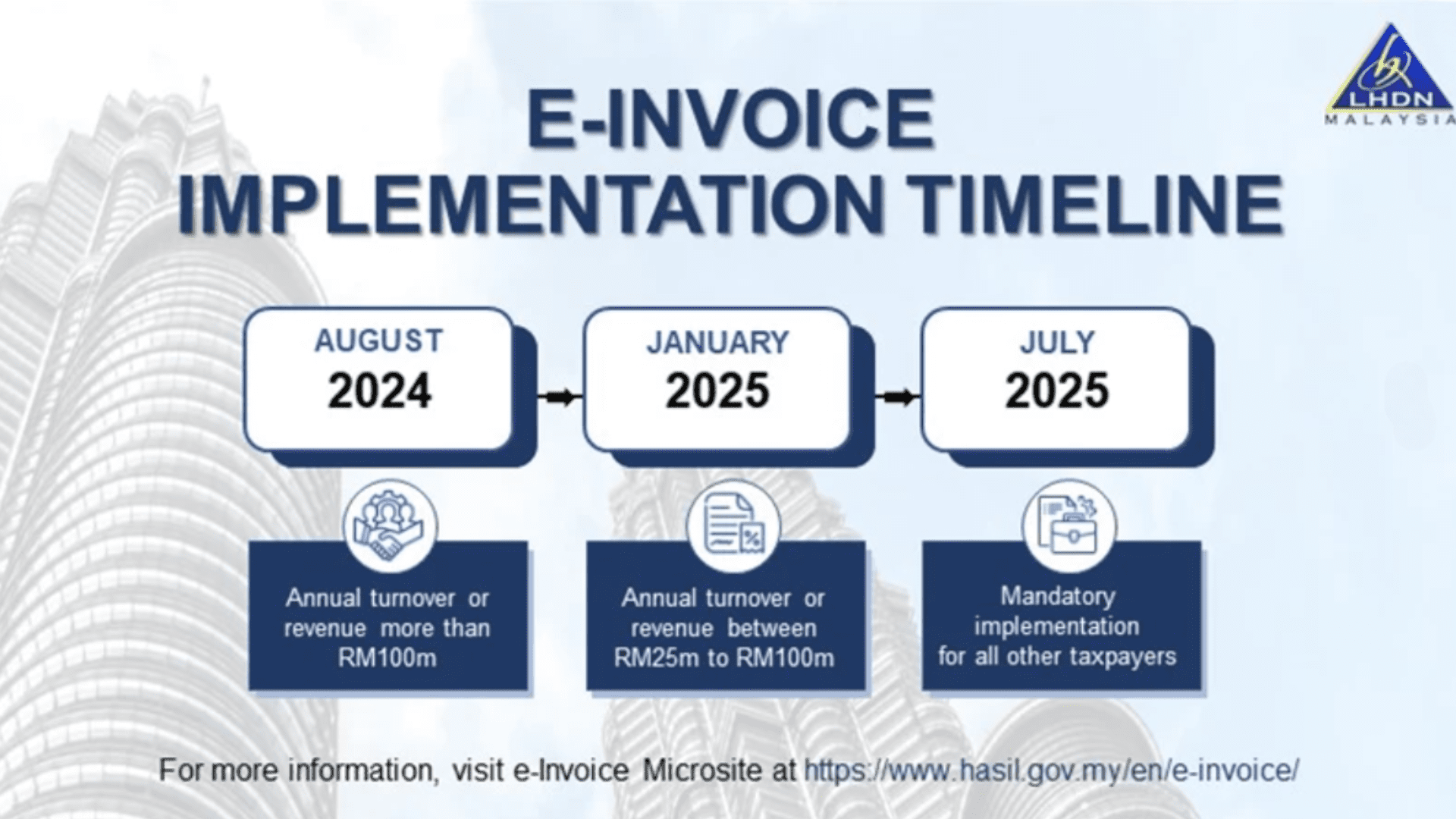

E Invoice Implementation Date Malaysia - The timeline includes implementation dates of: 1, 2024, for taxpayers with annual turnover or revenue. 10k+ visitors in the past month Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026.

The timeline includes implementation dates of: 1, 2024, for taxpayers with annual turnover or revenue. Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. 10k+ visitors in the past month

1, 2024, for taxpayers with annual turnover or revenue. Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. 10k+ visitors in the past month The timeline includes implementation dates of:

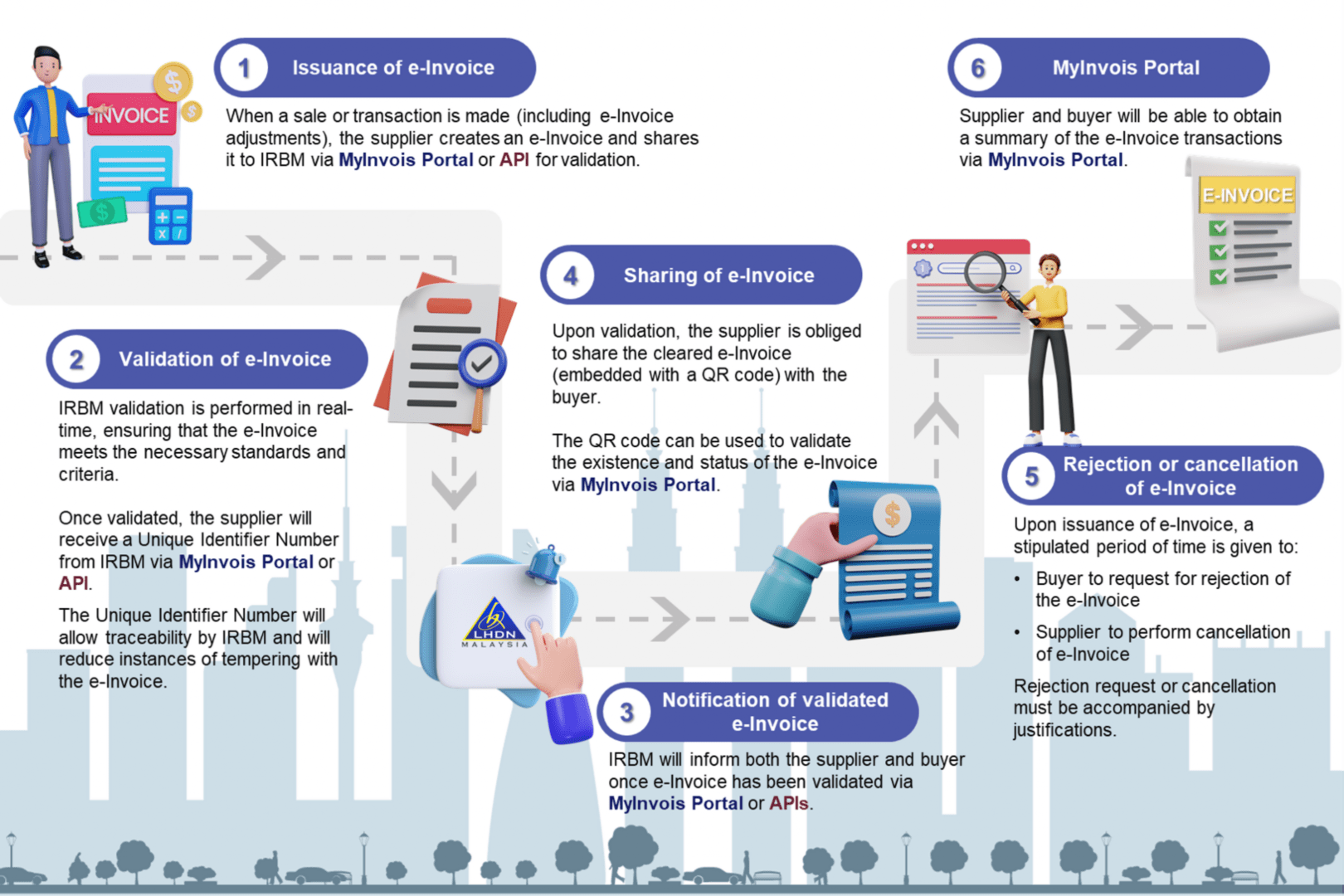

eInvois HASiL Info Lembaga Hasil Dalam Negeri Malaysia

Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. 1, 2024, for taxpayers with annual turnover or revenue. 10k+ visitors in the past month The timeline includes implementation dates of:

Implementation of EInvoicing Malaysia IVAOTR

10k+ visitors in the past month Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. The timeline includes implementation dates of: 1, 2024, for taxpayers with annual turnover or revenue.

2024 LHDN EInvoice Malaysia How it impact your business

The timeline includes implementation dates of: 1, 2024, for taxpayers with annual turnover or revenue. Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. 10k+ visitors in the past month

Adapting to EInvoicing A New Era for Malaysian Businesses SiteGiant

The timeline includes implementation dates of: 1, 2024, for taxpayers with annual turnover or revenue. 10k+ visitors in the past month Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026.

Navigating EInvoice Regulations IRB Malaysia's 2023 Guidelines

The timeline includes implementation dates of: 1, 2024, for taxpayers with annual turnover or revenue. Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. 10k+ visitors in the past month

Pelaksanaan eInvois di Malaysia Apa maksudnya

Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. 1, 2024, for taxpayers with annual turnover or revenue. The timeline includes implementation dates of: 10k+ visitors in the past month

Malaysia LHDN eInvoice Guidelines 50 QnA L & Co Accountants

Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. 10k+ visitors in the past month 1, 2024, for taxpayers with annual turnover or revenue. The timeline includes implementation dates of:

Mandatory eInvoicing System Starting From June 2024 ShineWing TY TEOH

1, 2024, for taxpayers with annual turnover or revenue. The timeline includes implementation dates of: 10k+ visitors in the past month Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026.

National EInvoicing Initiative My Software Solutions

1, 2024, for taxpayers with annual turnover or revenue. 10k+ visitors in the past month Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. The timeline includes implementation dates of:

1, 2024, For Taxpayers With Annual Turnover Or Revenue.

Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. The timeline includes implementation dates of: 10k+ visitors in the past month

.jpeg)