Bills Due 2025 - The cbo projects that this change will. The 2025 real property tax rate for regular district 1: $0.805 per $100 in assessed value. The due dates are june 5 and december 5. 1968) on march 15, 2025, that runs through. On june 3, 2023, lawmakers suspended the debt limit through january 1, 2025. 1 on january 2, 2025, that limit was reinstated at $36.1. The president signed a continuing resolution (h.r. From 2025 to 2028, workers can deduct overtime compensation from their taxable income. A government shutdown temporarily halts certain government services when congress fails to enact appropriations bills on time.

The cbo projects that this change will. From 2025 to 2028, workers can deduct overtime compensation from their taxable income. A government shutdown temporarily halts certain government services when congress fails to enact appropriations bills on time. 1 on january 2, 2025, that limit was reinstated at $36.1. The president signed a continuing resolution (h.r. The 2025 real property tax rate for regular district 1: On june 3, 2023, lawmakers suspended the debt limit through january 1, 2025. 1968) on march 15, 2025, that runs through. The treasury department said friday it would likely run out of cash to pay the nation’s bills by august, setting a new, firmer. $0.805 per $100 in assessed value.

The president signed a continuing resolution (h.r. The cbo projects that this change will. 1 on january 2, 2025, that limit was reinstated at $36.1. The due dates are june 5 and december 5. On june 3, 2023, lawmakers suspended the debt limit through january 1, 2025. The treasury department said friday it would likely run out of cash to pay the nation’s bills by august, setting a new, firmer. From 2025 to 2028, workers can deduct overtime compensation from their taxable income. The 2025 real property tax rate for regular district 1: 9 rows updated 3/28/2025: $0.805 per $100 in assessed value.

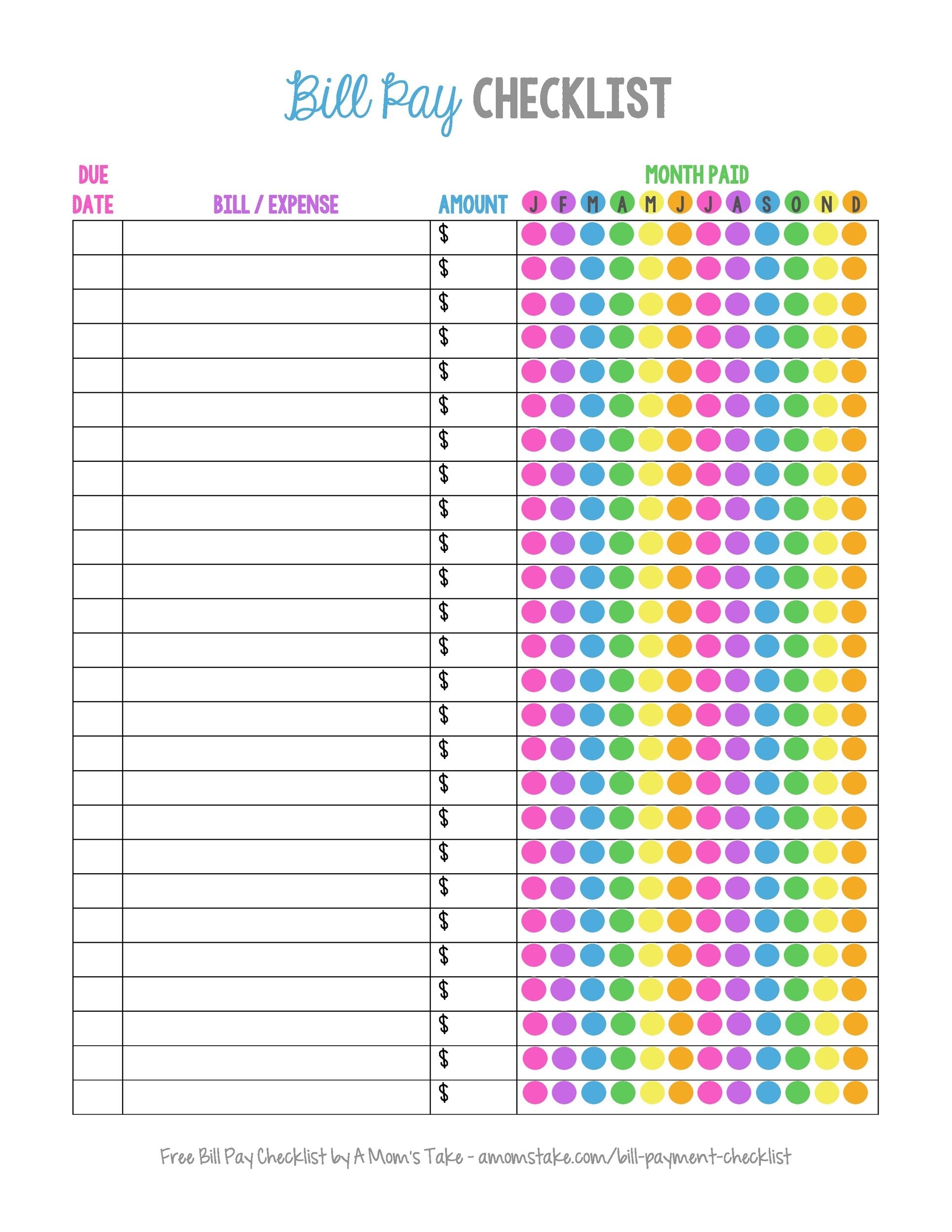

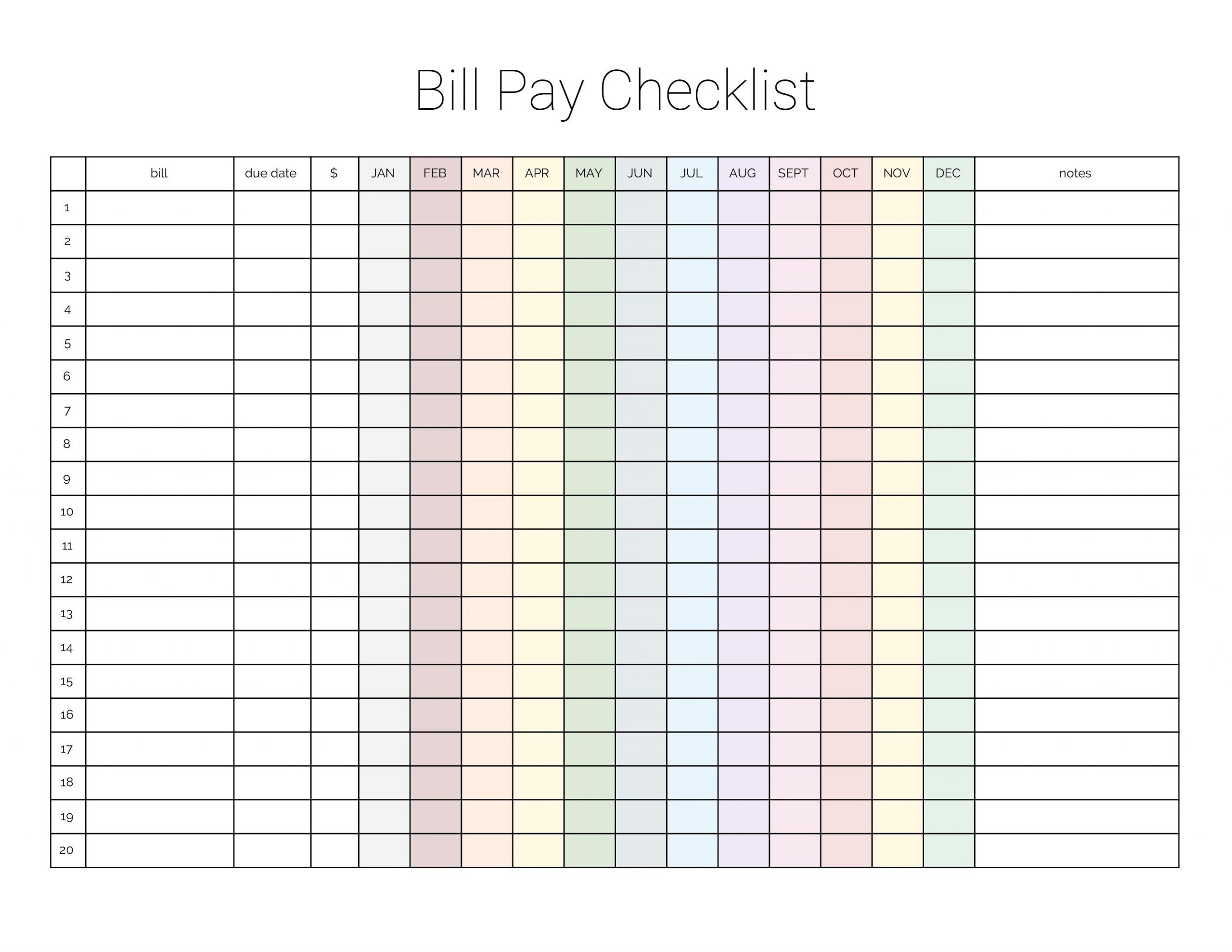

List Of Bills 2025 Serenity Grace

The due dates are june 5 and december 5. The president signed a continuing resolution (h.r. From 2025 to 2028, workers can deduct overtime compensation from their taxable income. The 2025 real property tax rate for regular district 1: The cbo projects that this change will.

Tax Bills due Jan. 1, 2025 Town of Manchester

1968) on march 15, 2025, that runs through. The treasury department said friday it would likely run out of cash to pay the nation’s bills by august, setting a new, firmer. On june 3, 2023, lawmakers suspended the debt limit through january 1, 2025. The president signed a continuing resolution (h.r. The due dates are june 5 and december 5.

List Of Bills 2025 Serenity Grace

1968) on march 15, 2025, that runs through. The 2025 real property tax rate for regular district 1: A government shutdown temporarily halts certain government services when congress fails to enact appropriations bills on time. The treasury department said friday it would likely run out of cash to pay the nation’s bills by august, setting a new, firmer. $0.805 per.

When Do Taxes Start 2025 Saki vanlinden

$0.805 per $100 in assessed value. A government shutdown temporarily halts certain government services when congress fails to enact appropriations bills on time. The treasury department said friday it would likely run out of cash to pay the nation’s bills by august, setting a new, firmer. From 2025 to 2028, workers can deduct overtime compensation from their taxable income. The.

Free Printable Bill Calendar 2025 John Patrick

From 2025 to 2028, workers can deduct overtime compensation from their taxable income. $0.805 per $100 in assessed value. On june 3, 2023, lawmakers suspended the debt limit through january 1, 2025. 1968) on march 15, 2025, that runs through. 1 on january 2, 2025, that limit was reinstated at $36.1.

Direct Impact of Inflation on Social Security Benefits in 2025

9 rows updated 3/28/2025: The due dates are june 5 and december 5. From 2025 to 2028, workers can deduct overtime compensation from their taxable income. The treasury department said friday it would likely run out of cash to pay the nation’s bills by august, setting a new, firmer. The president signed a continuing resolution (h.r.

New Tax Bill 2025 Key Highlights, Updates, and PDF Download

The due dates are june 5 and december 5. The cbo projects that this change will. 9 rows updated 3/28/2025: $0.805 per $100 in assessed value. From 2025 to 2028, workers can deduct overtime compensation from their taxable income.

What Is In The Spending Bill 2025 Ren vansmit

9 rows updated 3/28/2025: The president signed a continuing resolution (h.r. 1968) on march 15, 2025, that runs through. The cbo projects that this change will. $0.805 per $100 in assessed value.

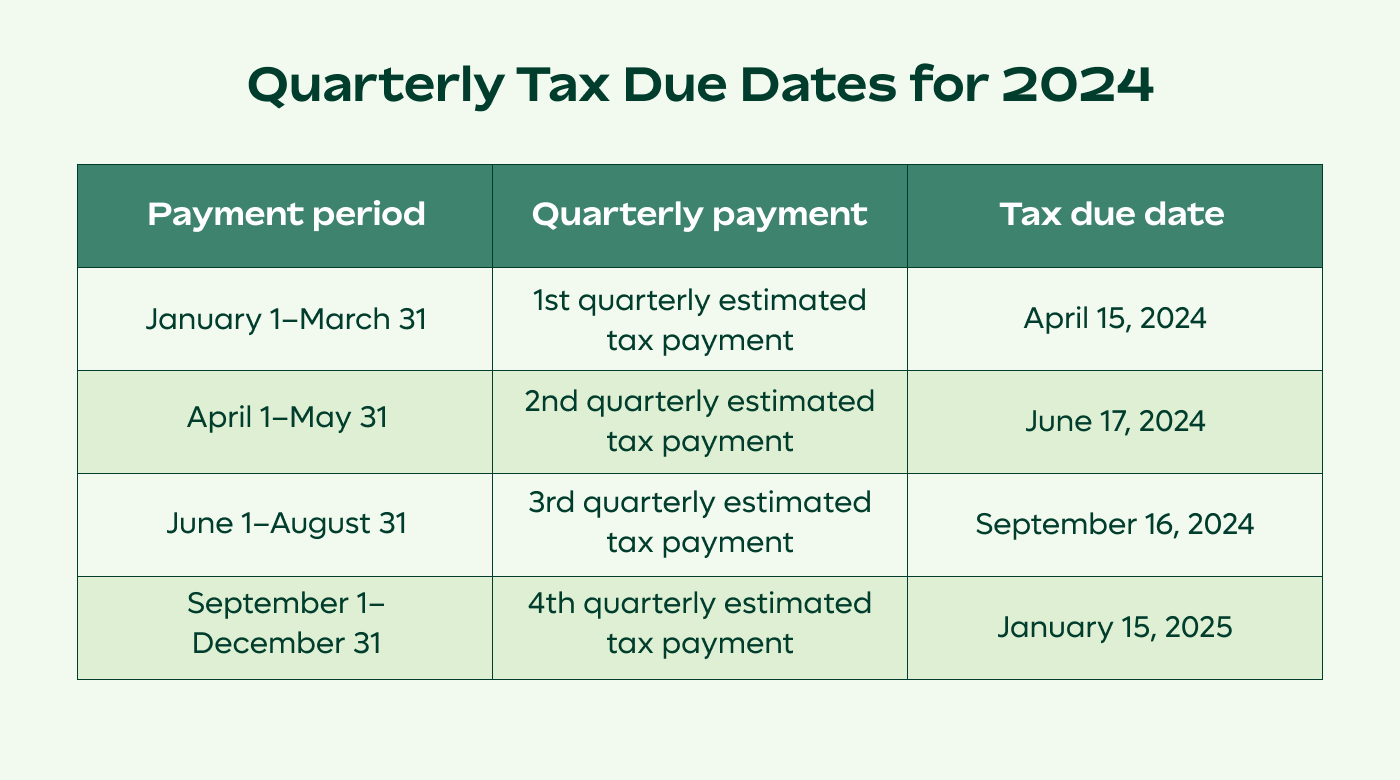

Est Tax Payment Dates 2025 Marj Stacie

The president signed a continuing resolution (h.r. The 2025 real property tax rate for regular district 1: $0.805 per $100 in assessed value. 9 rows updated 3/28/2025: The cbo projects that this change will.

Estimated Tax Payments 2025 Calendar Ryan Spooner

The 2025 real property tax rate for regular district 1: 9 rows updated 3/28/2025: 1 on january 2, 2025, that limit was reinstated at $36.1. On june 3, 2023, lawmakers suspended the debt limit through january 1, 2025. The president signed a continuing resolution (h.r.

The Due Dates Are June 5 And December 5.

The president signed a continuing resolution (h.r. 1968) on march 15, 2025, that runs through. 1 on january 2, 2025, that limit was reinstated at $36.1. $0.805 per $100 in assessed value.

The 2025 Real Property Tax Rate For Regular District 1:

The cbo projects that this change will. The treasury department said friday it would likely run out of cash to pay the nation’s bills by august, setting a new, firmer. On june 3, 2023, lawmakers suspended the debt limit through january 1, 2025. From 2025 to 2028, workers can deduct overtime compensation from their taxable income.

A Government Shutdown Temporarily Halts Certain Government Services When Congress Fails To Enact Appropriations Bills On Time.

9 rows updated 3/28/2025: