Hp 10Bii+ Financial Calculator Cash Flow - Your business can benefit from using the hp 10bii to create detailed cash flow projections. By entering expected revenues and expenses, you. If you have an initial cash outflow of $40,000, followed by monthly cash inflows of $4,700, $7,000, $7,000, and $23,000, what is the irr/. • store the amount of the next cash flow and press [cfj] (if the amount entered occurs more than once consecutively, enter the number of times is. Welcome to prime dayfast shipping In this section we will take a look at how to use the hp 10bii+ to calculate the present and future values of uneven cash flow streams.

Welcome to prime dayfast shipping In this section we will take a look at how to use the hp 10bii+ to calculate the present and future values of uneven cash flow streams. • store the amount of the next cash flow and press [cfj] (if the amount entered occurs more than once consecutively, enter the number of times is. By entering expected revenues and expenses, you. Your business can benefit from using the hp 10bii to create detailed cash flow projections. If you have an initial cash outflow of $40,000, followed by monthly cash inflows of $4,700, $7,000, $7,000, and $23,000, what is the irr/.

By entering expected revenues and expenses, you. In this section we will take a look at how to use the hp 10bii+ to calculate the present and future values of uneven cash flow streams. Your business can benefit from using the hp 10bii to create detailed cash flow projections. Welcome to prime dayfast shipping • store the amount of the next cash flow and press [cfj] (if the amount entered occurs more than once consecutively, enter the number of times is. If you have an initial cash outflow of $40,000, followed by monthly cash inflows of $4,700, $7,000, $7,000, and $23,000, what is the irr/.

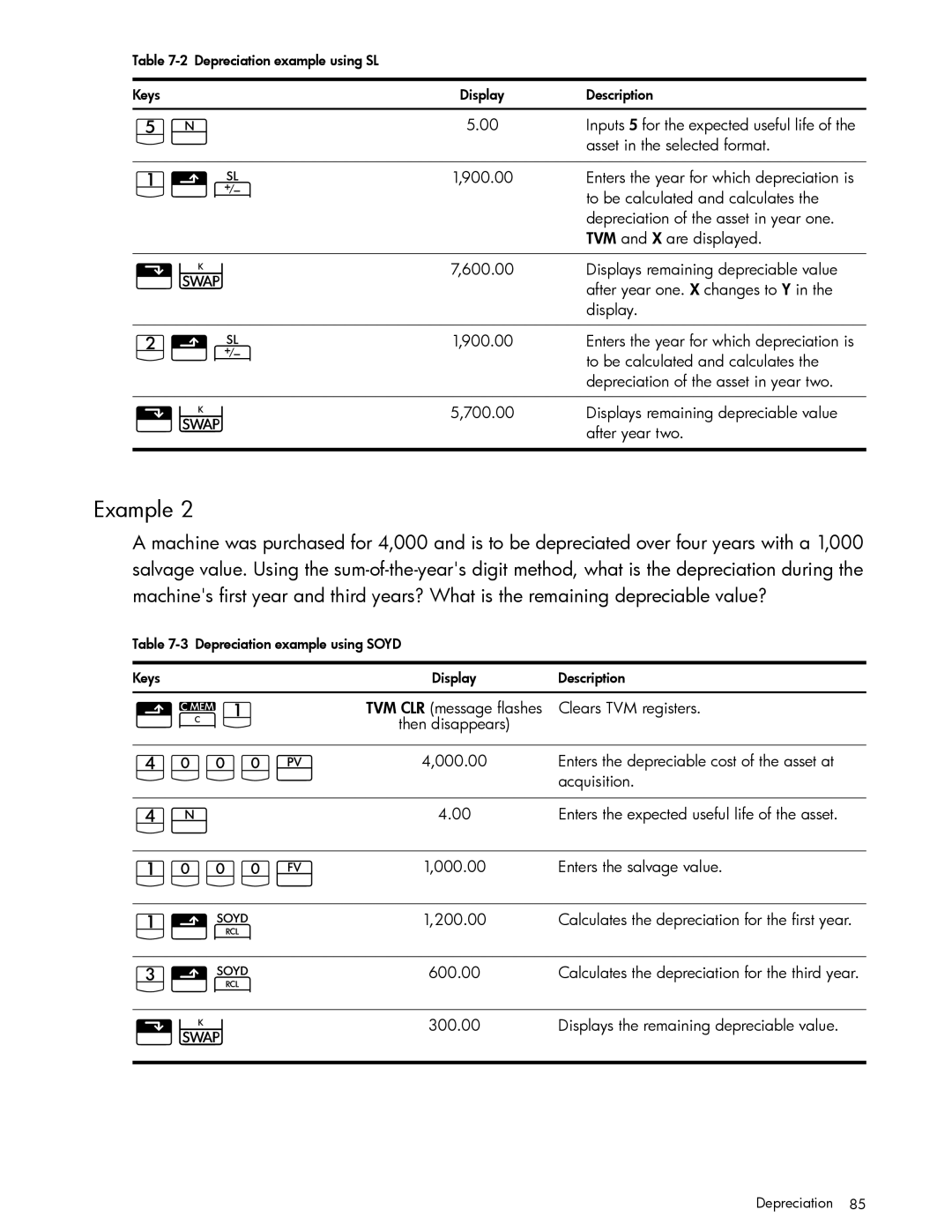

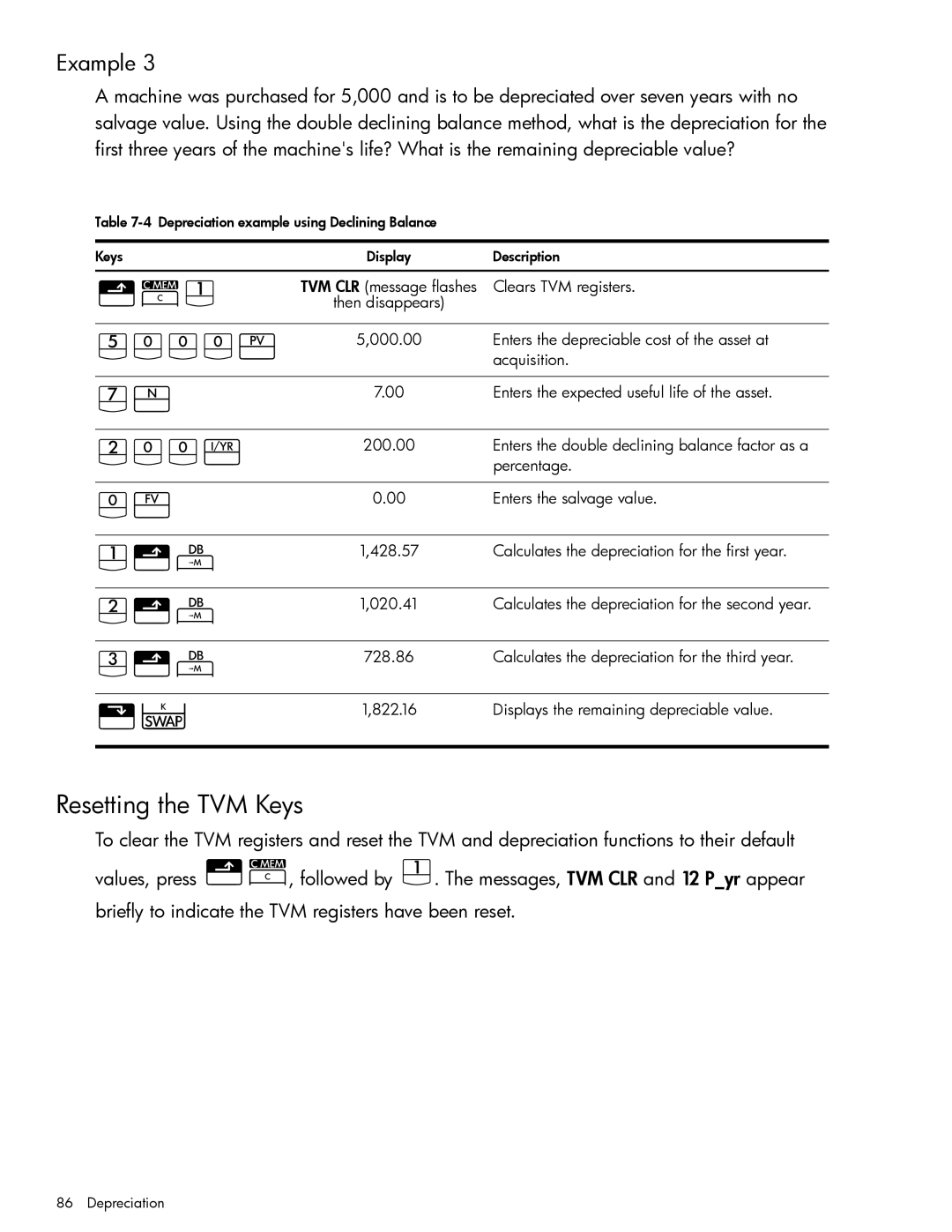

Cash Flow Calculations HP 10bII+ Financial manual

Your business can benefit from using the hp 10bii to create detailed cash flow projections. • store the amount of the next cash flow and press [cfj] (if the amount entered occurs more than once consecutively, enter the number of times is. By entering expected revenues and expenses, you. If you have an initial cash outflow of $40,000, followed by.

Cash Flow Calculations HP 10bII+ Financial manual

In this section we will take a look at how to use the hp 10bii+ to calculate the present and future values of uneven cash flow streams. Welcome to prime dayfast shipping • store the amount of the next cash flow and press [cfj] (if the amount entered occurs more than once consecutively, enter the number of times is. By.

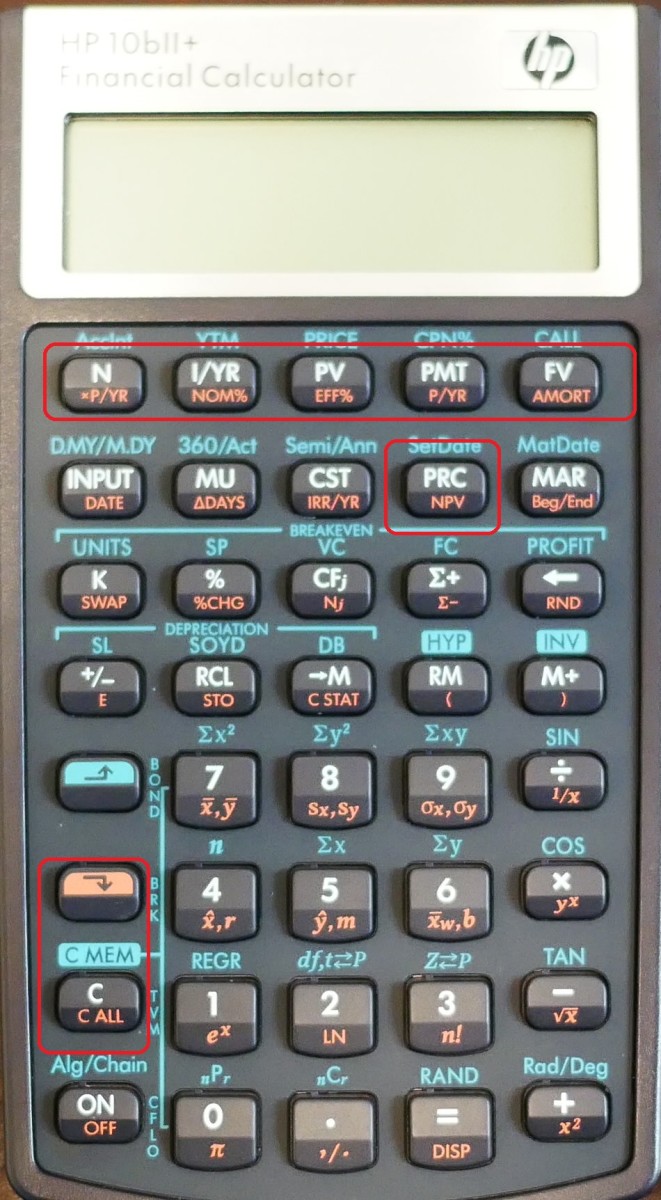

HP 10bII Financial Calculator

In this section we will take a look at how to use the hp 10bii+ to calculate the present and future values of uneven cash flow streams. If you have an initial cash outflow of $40,000, followed by monthly cash inflows of $4,700, $7,000, $7,000, and $23,000, what is the irr/. By entering expected revenues and expenses, you. Your business.

Financial Management Theory and Practice 14e ppt download

• store the amount of the next cash flow and press [cfj] (if the amount entered occurs more than once consecutively, enter the number of times is. Your business can benefit from using the hp 10bii to create detailed cash flow projections. In this section we will take a look at how to use the hp 10bii+ to calculate the.

10bII Financial Calculator 12Digit LCD 10bII Financial Calculator, 12

Your business can benefit from using the hp 10bii to create detailed cash flow projections. By entering expected revenues and expenses, you. Welcome to prime dayfast shipping If you have an initial cash outflow of $40,000, followed by monthly cash inflows of $4,700, $7,000, $7,000, and $23,000, what is the irr/. • store the amount of the next cash flow.

Using an HP 10bII Calculator to Find NPV and NFV With Uneven Cash Flows

• store the amount of the next cash flow and press [cfj] (if the amount entered occurs more than once consecutively, enter the number of times is. In this section we will take a look at how to use the hp 10bii+ to calculate the present and future values of uneven cash flow streams. Welcome to prime dayfast shipping If.

Financial Management Theory and Practice 14e ppt download

By entering expected revenues and expenses, you. If you have an initial cash outflow of $40,000, followed by monthly cash inflows of $4,700, $7,000, $7,000, and $23,000, what is the irr/. In this section we will take a look at how to use the hp 10bii+ to calculate the present and future values of uneven cash flow streams. Your business.

10bii Financial Calculator for Windows Pc & Mac Free Download (2023

In this section we will take a look at how to use the hp 10bii+ to calculate the present and future values of uneven cash flow streams. Welcome to prime dayfast shipping By entering expected revenues and expenses, you. Your business can benefit from using the hp 10bii to create detailed cash flow projections. If you have an initial cash.

Using an HP 10bII Calculator to Find NPV and NFV With Uneven Cash Flows

If you have an initial cash outflow of $40,000, followed by monthly cash inflows of $4,700, $7,000, $7,000, and $23,000, what is the irr/. Your business can benefit from using the hp 10bii to create detailed cash flow projections. By entering expected revenues and expenses, you. In this section we will take a look at how to use the hp.

NPV or net present value in HP 10bii financial calculator HP 10bii

If you have an initial cash outflow of $40,000, followed by monthly cash inflows of $4,700, $7,000, $7,000, and $23,000, what is the irr/. In this section we will take a look at how to use the hp 10bii+ to calculate the present and future values of uneven cash flow streams. • store the amount of the next cash flow.

Welcome To Prime Dayfast Shipping

• store the amount of the next cash flow and press [cfj] (if the amount entered occurs more than once consecutively, enter the number of times is. By entering expected revenues and expenses, you. In this section we will take a look at how to use the hp 10bii+ to calculate the present and future values of uneven cash flow streams. If you have an initial cash outflow of $40,000, followed by monthly cash inflows of $4,700, $7,000, $7,000, and $23,000, what is the irr/.

.jpg)